The day most awaited by speculators has arrived. In the next few hours, the important announcement will be made by Federal Reserve Chairman Jerome Powell. He will unveil monetary policy decisions which are expected to have a high impact on financial markets. The hawkish stance could strengthen the US dollar and we could see a fall of the euro to the level of 1.1474, the key support level of 0/8 of murray.

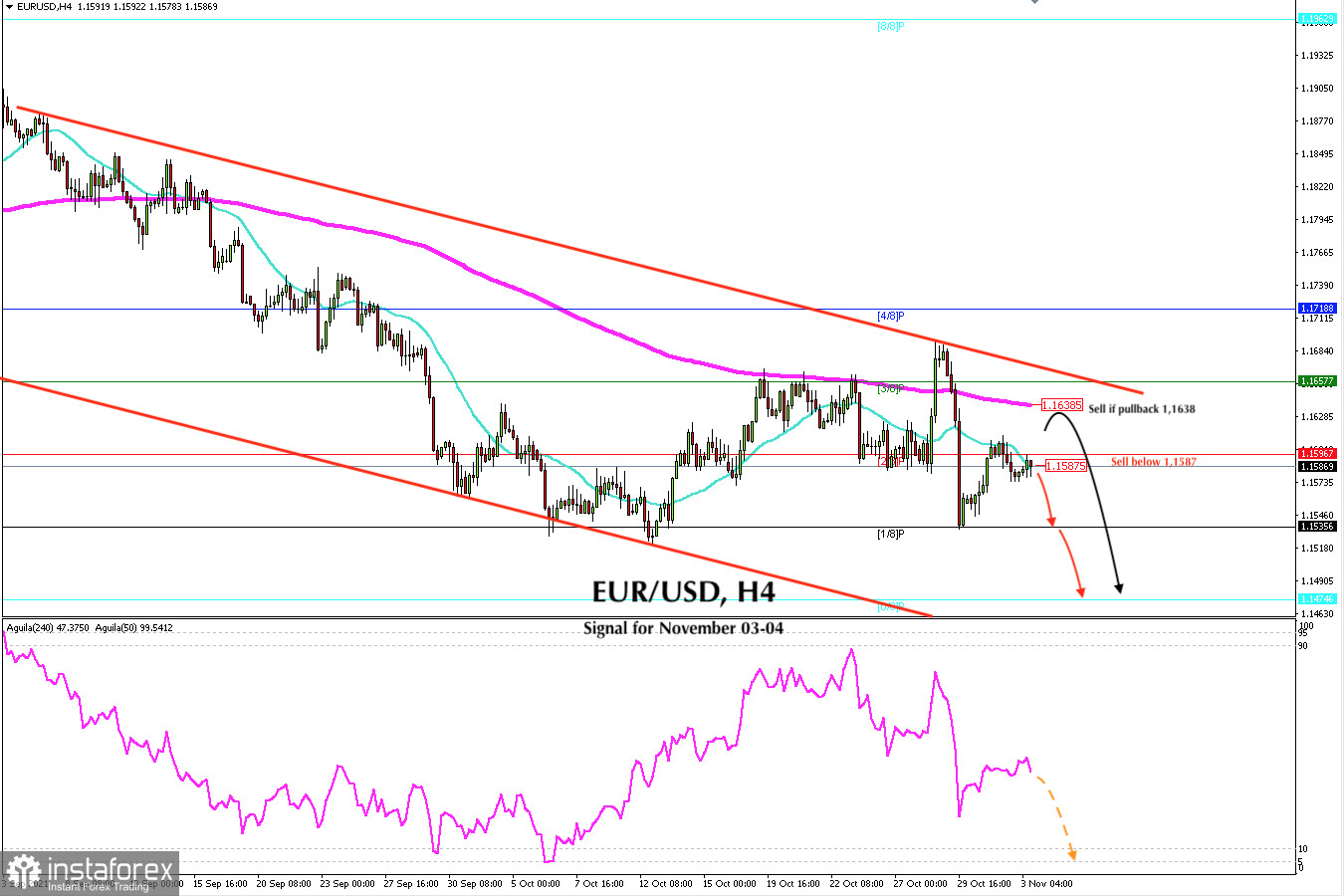

According to the 4-hour chart, EUR/USD is trading below the 200 EMA and below the 21 SMA. We can also see that the pair is trading within a downtrend channel. As long as it remains below these levels, the price could drop to 1.1531 and down to 1.1474, the price level of July 2020.

Given that investors are taking refuge in the dollar, EUR/USD is likely to extend its slide. The eagle indicator also shows a bearish signal. Therefore, our trading plan is to sell below 2/8 of Murray around 1.1596 with the target at 1.1535.

If the Euro makes a pullback towards the EMA of 200 at 1.1638 and towards the top of the downtrend channel and fails to break it, then it will be an opportunity to sell with targets at 1.1680 and 1.1536. If this support is broken, it could fall up to 1.1474 (0/8).

Market sentiment for today shows that there are 55.15% of traders who are selling EUR / USD. This is a neutral sign and we could expect a fall in the euro to the level of 1.1531. If this figure increases, it will be a positive signal and the euro could rise to 1.17.

On the other hand, if in the next hours after the Fed's announcement this figure decreases, we might see weakness of the euro and a return to the price level of July 2020 around 1.1470.

Support and Resistance Levels for November 03 - 04, 2021

Resistance (3) 1.1641

Resistance (2) 1.1627

Resistance (1) 1.1595

----------------------------

Support (1) 1.1564

Support (2) 1.1535

Support (3) 1.1498

***********************************************************

A trading tip for EUR/USD for November 03 - 04, 2021

Sell below 1.1587 (SMA 21) with take profit at 1.1531 (1/8) and 1,.474 (0/8), stop loss above 1.1625.