The euro strengthened against the US dollar amid rumors that the European Central Bank may leave interest rates unchanged during this week's meeting. Good data on growth in industrial production and the decision of the German government to support companies that may suffer from the spread of coronavirus also provide good support for risky assets, including the euro, which returned to its local highs in the area of 1.1490 with the US dollar.

As mentioned above, the German government decided to return to the method already tried in 2008-2009, which consists of a package of measures aimed at supporting companies. First of all, we are talking about companies that have suffered from the spread of the coronavirus epidemic. As announced by German Chancellor Angela Merkel, assistance will be provided to those companies that, in times of crisis, transfer employees to a reduced working day instead of their full dismissal, or sending them on temporary leave at their own expense. The requirements that will be imposed on applicants applying for such subsidies have also been relaxed. The government promised to make full payments for employees who were paid social security contributions.

However, not all experts believe in the effectiveness of such measures. There is an opinion that such a package will be able to provide short-term support to companies and will only delay the economic shock from the coronavirus, especially since the deterioration of the economic situation is obvious, and the data for February do not show the whole problem that Germany found itself in after the virus spread.

Data was released today that indicated a sharp increase in industrial production in Germany in January this year and a recovery in the manufacturing sector, but this trend is unlikely to continue in February and March. According to the report, industrial production in Germany increased significantly in January this year and was much better than economists' forecasts. The German Bureau of Statistics Destatis said that total industrial production in January increased by 3.0% compared to the previous month, while economists had forecast it to grow by 1.8%. Compared to January 2019, production decreased by 1.3%. For December, the data was revised for the better. Initially, it was reported that industrial production fell by 3.5% in December, while the revised report shows a figure of -2.2%. Let me remind you that last Friday a report was released on orders in the industrial sector, which also grew by 5.5%.

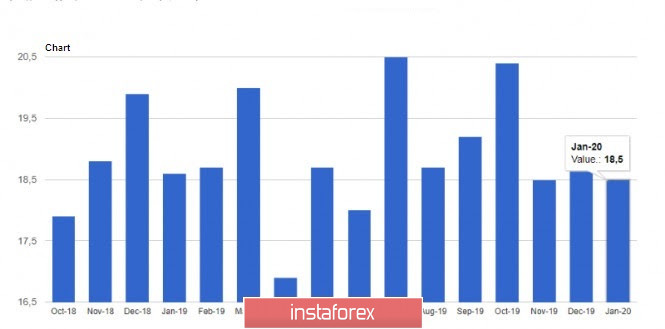

But the report on the foreign trade balance was not as positive as many expected. According to Destatis data, German exports remained unchanged in January 2020, while the growth of 0.9% was expected. Imports increased. Germany's trade surplus in January was 18.5 billion euros, while economists had forecast 18.0 billion euros. Imports increased by 0.5% compared to January. In figures, exports in January amounted to 106.5 billion euros and imports - 92.7 billion euros.

The euphoria for the euro could end quickly if Germany's recession turns out to be deeper than expected. Many economic agencies are already revising their forecasts, even though the data is positive. The country's GDP is expected to decrease by 0.2% in the 1st quarter of this year and by 0.6% in the 2nd quarter. Previously, many experts predicted zero growth or a reduction to a maximum of 0.1%. And if the manufacturing sector has long been dismantling cuts, then problems are expected in the service sector, which will be severely affected by the coronavirus epidemic.

This Thursday, the European Central Bank will hold a meeting where the ECB's key rate is expected to be lowered by 10 basis points, but the deposit rate may be kept at -0.50%. If the key rate remains unchanged, and this option is currently being considered by some experts, in any case, the Central Bank will announce a target allocation of liquidity to support small and medium-sized businesses, as well as resort to changing the terms of the asset purchase program.

As for the current technical picture of the EURUSD pair, the outlines of a side-channel in which the euro may get stuck are already visible. The upper border of this channel passes at a maximum of 1.1460, while the lower one is clearly traced in the range of 1.1370. A breakthrough in these areas will determine the future direction of the euro. When growing, the highs of 1.1540 and 1.1605 can be considered as major resistances. While the lows of 1.1330 and 1.1280 will act as support for the correction of the trading instrument.