European dysfunction is "a major source of concern," said Peter Dixon, a global financial economist at Commerzbank AG in London. "It almost borders on the negligence of politics."

The European Central Bank has long been playing the role of primary rescuer. Within a decade, after the financial crisis, the central bank lowered short-term interest rates to zero in order to continue pumping money through European economies. It adopted an unorthodox bond purchase policy to lower long-term interest rates, ensuring that companies and households can get a loan to stimulate further expenses.

Many expect the European Central Bank to lower rates during its meeting on Thursday. That sentiment intensified on Monday when Saudi Arabia shocked the markets by sharply lowering oil prices and adding a general sense of confusion among investors.

But if the European Central Bank does cut rates, it will be mostly symbolic, an attempt to show that the authorities are aware of the extent of the problem.

When interest rates are zero or lower, their movement into the negative zone usually has little effect.

For Europe, as well as for the rest of the world, this crisis does not seem to lend itself to easy management, thanks to lower interest rates. Italy's wide quarantine violated production at factories, which are the main suppliers of spare parts for the automotive industry throughout Europe, which is the main threat to the economy of the continent. These factories will not suddenly come back to life if the Central Bank cuts borrowing costs. This will happen only when the threat to public health is reduced.

The most significant way in which policymakers can reduce economic damage is through fiscal policies that release public money, which can help small businesses cope with lost sales. Governments could encourage spending at a time when shopping malls, restaurants, concert halls, conference centers, and other places to interact with people are being shunned as transmission zones for the deadly virus.

On Monday, when Europe took over the influence of Italy's decision to isolate about 16 million people from the rest of civilization, senior European leaders called for targeted government spending.

Some hoped that the coronavirus (COVID-19) would be an incentive for expanding European solidarity, an incentive for collective action, which so often did not take place in other crises.

When the outbreak occurred in Italy last month, it was initially seen as a threat to the European industry and a potential shock to the global supply chain. The outbreak, which began in China, lead to industry closures and fears that factories around the world will soon face shortages of parts and electronics. These concerns were exacerbated in the outbreak in Italy raising the possibility that German car manufacturers will find it difficult to purchase parts made in Italian factories.

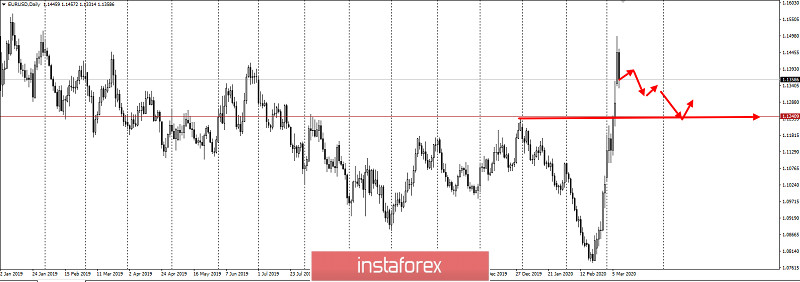

All this happens on the incredible growth of the euro against the dollar. Therefore, we recommend that you take a closer look at the corrective movement in the 1.13-1.2500 area, which has already begun that night:

Success in trading and control the risks!