Greetings, dear colleagues!

In this article, we will analyze the technical picture for the pound/dollar pair, as well as identify the most important events that will come from the UK and the US before the end of the week's trading. Let's start with macroeconomic statistics.

On Wednesday, the UK will provide reports on manufacturing, industrial production, and GDP data. Judging by the economic calendar, this is the only day that is quite rich in British statistics.

Data on the consumer price index will be received from the US, and reports on producer prices will be received the next day. More information about these and other events can be found in the economic calendar.

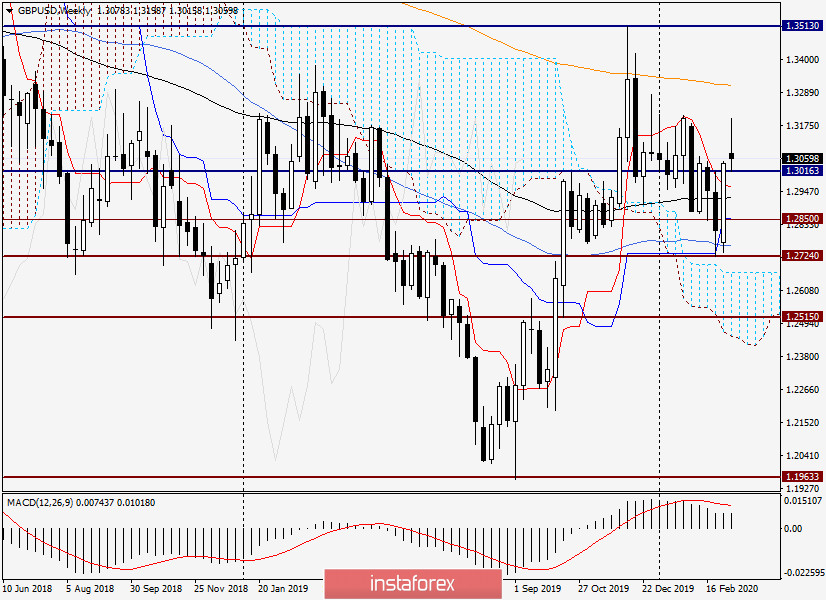

Now let's go to the technical analysis of GBP/USD, and start with the weekly timeframe.

Weekly

As you can see, the pair finished the last trading week with a strong growth, which resulted in a full bullish candle appearing on the weekly chart. Trading closed at 1.3043 on March 2-6. Given the important psychological and technical level of 1.3000, this is a pretty good result for the "Briton".

Now it is very curious whether the pound can continue to strengthen against the US dollar?

This week's trading for many currency pairs opened with price gaps, and not in favor of the US currency. The pound/dollar pair was no exception, which rose to 1.3199 on Monday but could not stay close to the significant level of 1.3200 and rolled back to the area of 1.3065, where it is trading at the time of writing this article.

In my opinion, the bulls on the pound have problems with the further rise of the quote. However, there is still enough time to change the situation before the end of the week. We can assume that Wednesday will be the most important day for the pair. At least this conclusion can be reached by looking at the events of March 11 in the economic calendar.

If the pair can return to 1.3200 and rise above this important mark, the next target will be a strong technical area of 1.3280-1.3320. It should be taken into account that the 200 exponential moving average is located at 1.3312, which has been hindering the northward movement since December last year.

If the current weekly candle will retain its current bearish shape, there will be a signal for sales. So far, on the weekly timeframe, nothing good is observed for players to increase the rate.

Daily

As a result of decent growth, the red resistance line of 1.3513-1.3207 was broken. In addition to this line, the pair went up through the simple moving average and the Kijun line of the Ichimoku indicator. But with the exit up from the Ichimoku cloud, there are problems. Yesterday's attempts to get out of the cloud were not successful, even despite the bullish gap. At the moment of completion of the article, the pair can not even enter the cloud, let alone exit it up.

Strong resistance can be indicated in the price zone of 1.3100-1.3115, and above near the level of 1.3200.

Support was found today at the former resistance level of 1.3016, which is technically quite justified. The fate of another marker is still unclear. At the end of the review, the pair is trading near 1.3068. If today's trading ends above this level, this will be a plus for the bulls in the pound.

Conclusion and recommendations:

Given the weakness of the US dollar caused by the Fed's decision to switch to a soft monetary policy, it is more likely that the US currency will continue to lose ground. Especially if the Fed cuts the rate again at the March meeting.

The technical picture at the moment does not give good points for opening positions. It would be nice to open purchases that I consider to be the main trading idea for GBP/USD after a pullback to the broken resistance level of 1.3016.

It's risky to buy right here and now. If they give a pullback to the area of 1.3000-1.2950, where the candlestick patterns characteristic of growth will appear, you can try buying. Alternatively, if the price moves into positive territory (above today's opening price), you can also buy carefully, with a small stop and goals.

In my opinion, it's a bit late for the sales. Although aggressive and risky, you can try to sell the pound at the current prices of 1.3054 with the nearest goals in the area of 1.3016-1.3000. It's not a bad idea to stay out of the market and wait for clearer signals to open positions.

Good luck!