Hello, colleagues!

There are very strong price movements for the dollar/yen currency pair. In my opinion, there are two main reasons for the fall of the US dollar. First, it is an epidemic of coronavirus, which continues to "walk" almost all over the globe, and, no doubt, has a negative impact on the world economy.

Many of the world's leading central banks are already taking steps to support their economies, comparable to those that took place during the global financial and economic crisis of 2008-2009.

In fact, if COVID-19 continues its rapid spread and negative impact on the world economy, it is unlikely to avoid another economic crisis.

In this regard, the world's leading central banks have already moved to ultra-loose monetary policy. Ahead of the planet is the US Federal Reserve System (FRS), which last week, for the first time since the global financial and economic crisis of 2008-2009, lowered the main interest rate by 50 basis points. I think this is not the limit.

Thus, the US dollar paired with the Japanese yen came under double pressure. On the one hand, the yen has become very much in demand, with the continued spread of the coronavirus as a safe asset. Investors go to safe havens and do not intend to take risks in the current situation. On the other hand, due to the spread of the coronavirus, the Fed is taking steps to support its own economy and has moved to significantly ease its monetary policy.

However, it is worth adding that US President Donald Trump intends to hold a press conference where measures to counteract the coronavirus for the American economy will be outlined. US Treasury Secretary Steven Mnuchin echoes President Trump, who said that this week there will be a meeting with the leaders of America's leading banks to discuss measures to prevent the negative impact of the coronavirus on the US economy.

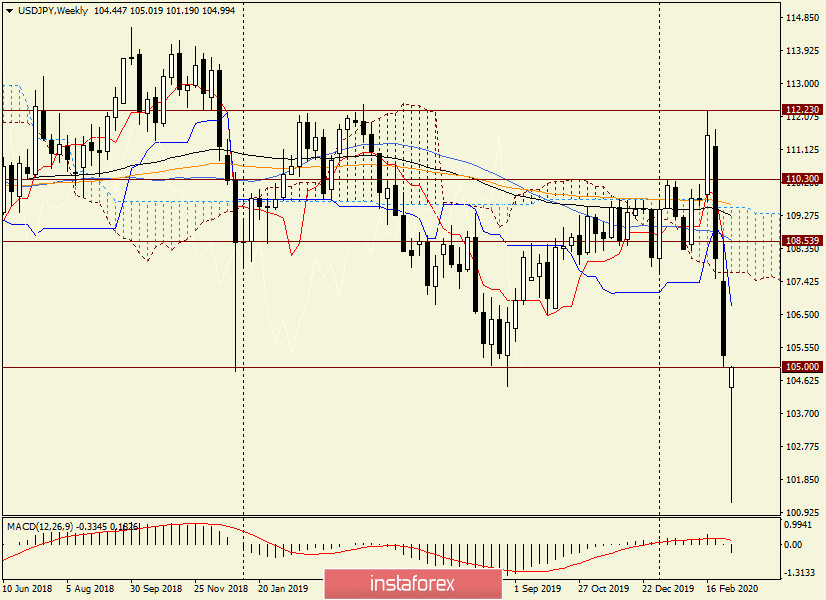

Weekly

Expectations of the White House press conference and Mnuchin's comments provided support for the US currency, and after falling to 101.19, the US dollar began to recover its losses against the Japanese yen.

At the time of writing, we see that there is a huge shadow at the bottom, and now the pair is trading above the opening price of 104.45.

I believe that much of the USD/JPY price dynamics will be clarified after the White House press conference. If the rhetoric is convincing and reassures investors, the US currency will continue to recover the huge losses incurred against the Japanese yen.

Otherwise, the pair will go back to the downward trend, where the most important level remains 105.00. In case of consolidation below this mark, and closing of weekly trading below, we can expect the continuation of a strong downward trend.

If the current candle is executed in the form of a reversal, which is at the end of the review, the USD/JPY pair will get all the prerequisites for continuing the recovery, where the nearest target will be the area of 106.70.

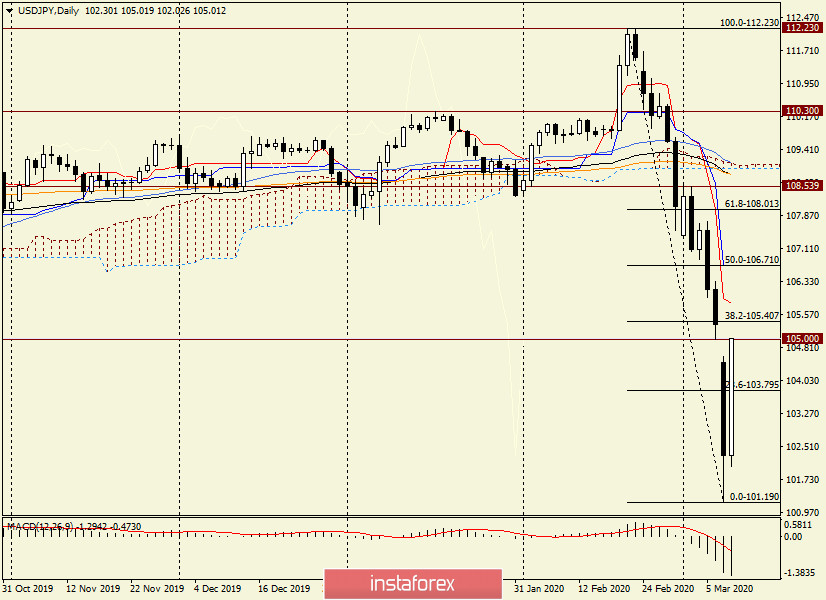

Daily

On the daily chart, the current upward scenario can be continued. In this scenario, the nearest possible growth targets will be the levels of the Fibonacci grid 38.2 and 50.0, stretched to a decrease of 112.23-101.19.

I dare to assume that the pair will continue to recover to the levels of 105.40 and (or) 106.70. The rest will depend on the rhetoric of the White House press conference. If market participants believe in the ability of the US administration to protect its economy from the effects of the coronavirus, the dollar will strengthen, and across a wide range of markets. Otherwise, the US currency will again be under selling pressure.

The main trading idea for the USD/JPY pair, in my personal opinion, is to buy, which is better to consider when reducing to the area of 104.20-104.00 or more aggressively, from the current prices of 104.90. Another option for opening long positions is to fix above 105.00 and roll back to this level, after which you can try buying.

Good luck!