Economic calendar (Universal time)

EUR / USD

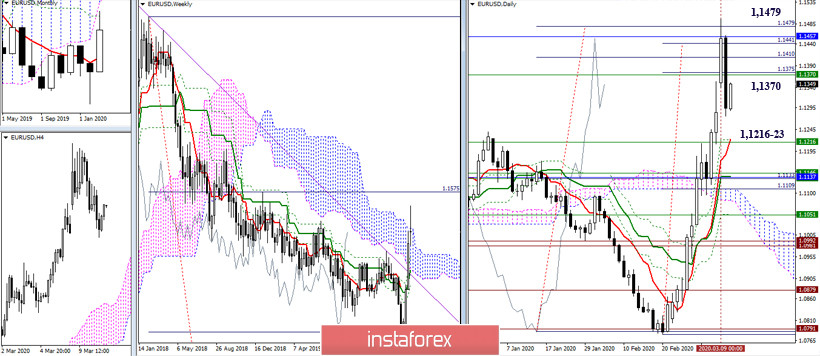

On the daily time frame, players to decline formed a candlestick reversal pattern "absorption" and now, it's the turn for a weekly time interval. The accumulation zone of the worked landmarks (1.1370–1.1479) continues to play the role of resistance and attraction. At the same time, the nearest support is concentrated today at 1.1223–1.1216 (daily Tenkan and Fibo Kijun + weekly Senkou Span B). Further prospects and preferences will be largely determined by how the balance of power is distributed in the current situation.

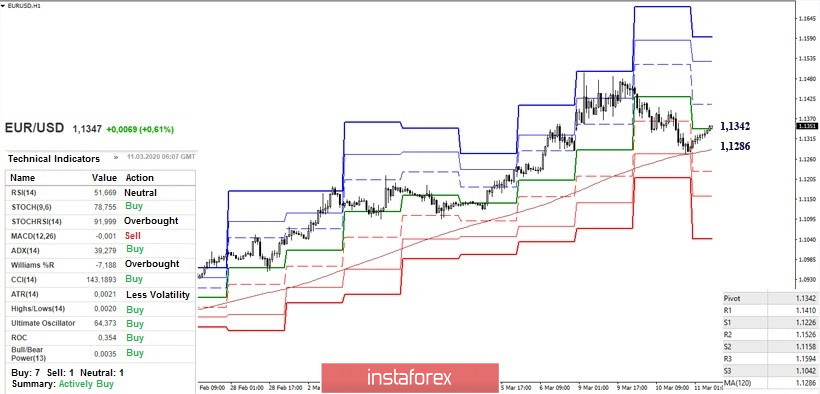

Meanwhile, a downward correction to the weekly long-term trend has been completed. Bears tested key support for the lower halves yesterday. The breakdown of the trend, fixing below and the reversal of the moving will allow us to talk about the further strengthening of the players to lower their advantages and prospects. If the central Pivot level (1.1342) returns to the side of the bulls, the classic Pivot levels R1 (1.1410) - R2 (1.1526) - R3 (1.1594) will act as resistance within the day. The breakdown of the support of the weekly long-term trend (1.1286) will open the way to the supports S1 (1.1226) - S2 (1.1158) - S3 (1.1042).

GBP / USD

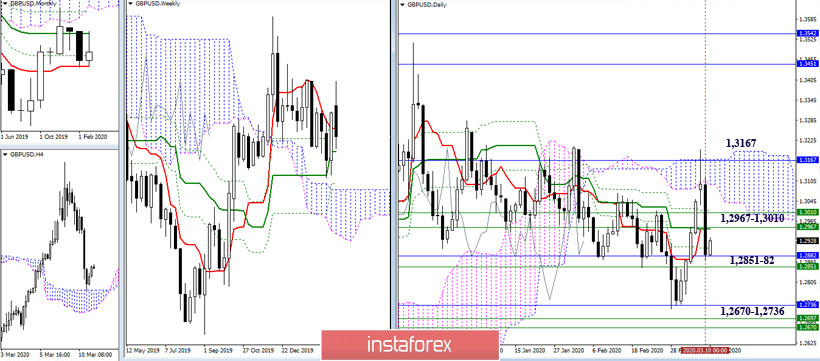

The players to decline showed not only activity yesterday, but also good performance. And thanks to which, they returned to important supports in the area of 1.2851–82 (weekly Kijun + monthly Fibo Kijun). A breakdown of the levels met can restore prospects for further strengthening of bearish sentiment, while the main support area in this direction is now the area of 1.2670–1.2736 (monthly Tenkan + weekly Fibo Kijun and Senkou Span B). If the pair slows down again and remains within the past consolidation zone, then uncertainty will still dominate, preserving work and movement within the existing borders.

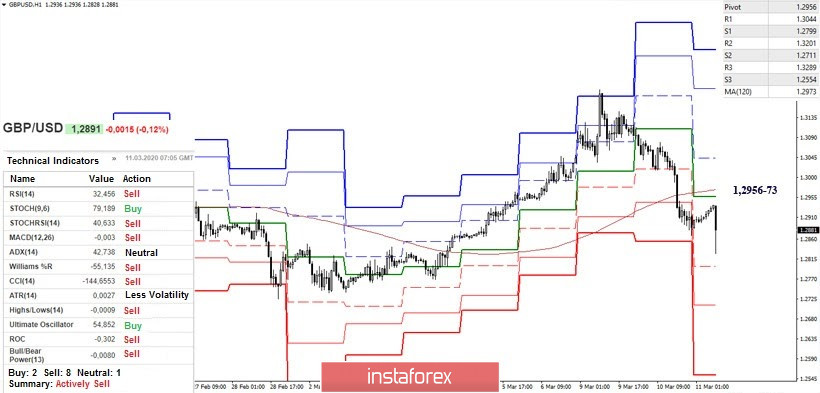

On H1, the downward trend players have an advantage, and as a result, we observe the development of a downward trend. The reference points within the day for the bears are the support of the classic Pivot levels 1.2799 -1.2711 - 1.2554. The key resistance of the lower halves today is joining forces within 1.2956 - 73 (central Pivot level + weekly long-term trend). At the same time, other resistances of classic Pivot levels are now at 1.3044 -1.3201 -1.3289.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)