Hello, colleagues!

Yesterday's trading for the main currency pair of the Forex market ended with a fairly decent decline. Even positive GDP reports for the 4th quarter did not help the single European currency. Despite the forecast value of 0.9%, the final data for the eurozone's GDP was 1%.

Markets are much more concerned about the topic of coronavirus and fears that the epidemic could cause a global economic crisis comparable to what it was in 2008-2009.

Judge for yourself, the tourist business is almost paralyzed and international airlines are missing a huge number of passengers. Football matches in Spain will be played without fans for at least two weeks. This also applies to international tournaments (the Champions League and the Europa League) whose revenues are not small. In general, the losses are very large-scale, but the coronavirus epidemic does not think to end.

In order to protect its economy from the impact of the coronavirus, US President Donald Trump was going to announce a special package of measures. However, according to some sources, the plan is not yet fully ready and needs to work out many nuances.

Nevertheless, investors were encouraged by the news of a special package of measures to combat the coronavirus. The growth was demonstrated by the stock and oil markets, and the US dollar received support, which yesterday strengthened across the entire spectrum of the market.

The main macroeconomic event of today will be the publication of the US consumer price index. This is an important indicator that affects the level of inflation in the country. Although in the current situation, if inflation increases and stabilizes near the target level of 2%, it is unlikely that monetary policy will tighten. This is all the fault of the coronavirus epidemic, which forces the world's leading central banks to conduct a soft monetary policy to prevent negative economic consequences.

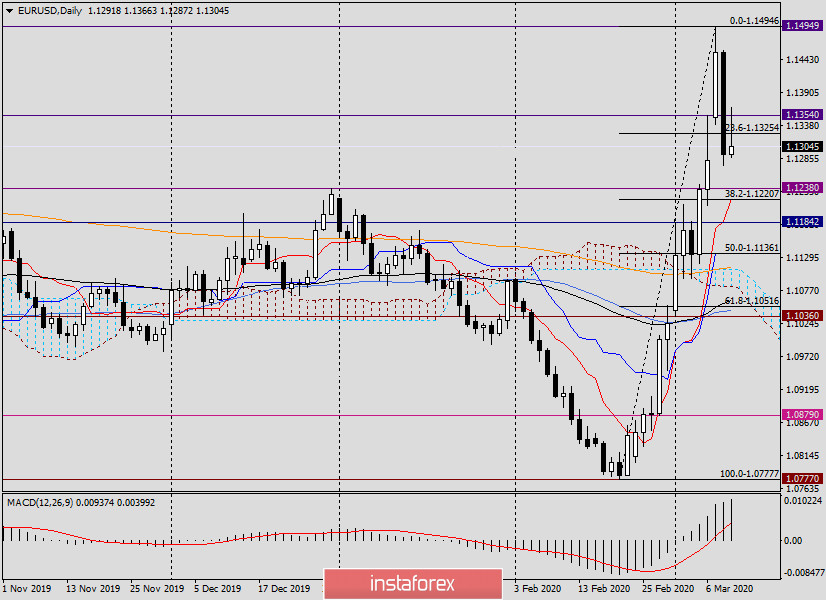

Daily

If we turn to the technical picture for the euro/dollar pair, yesterday's decline at this stage is perceived as a correction to the growth of 1.0777-1.1494.

At the auction on March 10, the pair fell slightly below the level of 23.6 from the indicated upward movement. Today, there are attempts to resume the rise and return trading above 23.6 Fibo, but this is still difficult.

After rising to the level of 1.1366, the pair met strong resistance there and fell back down and now is trading around 1.1320.

In general, it should be noted that the mark of 1.1360 is quite a strong technical level, which has repeatedly influenced the price movement of the euro/dollar pair. As we can see, the current situation is no exception.

If the quote cannot return to the area of 1.1366 and continue to grow, it is possible to reduce to the next pullback level of 38.2, next to which the broken resistance level of 1.1238, as well as the Tenkan line of the Ichimoku indicator.

In my opinion, it is possible to consider opening long positions here, and the confirmation will be the characteristic candlestick patterns on smaller time intervals.

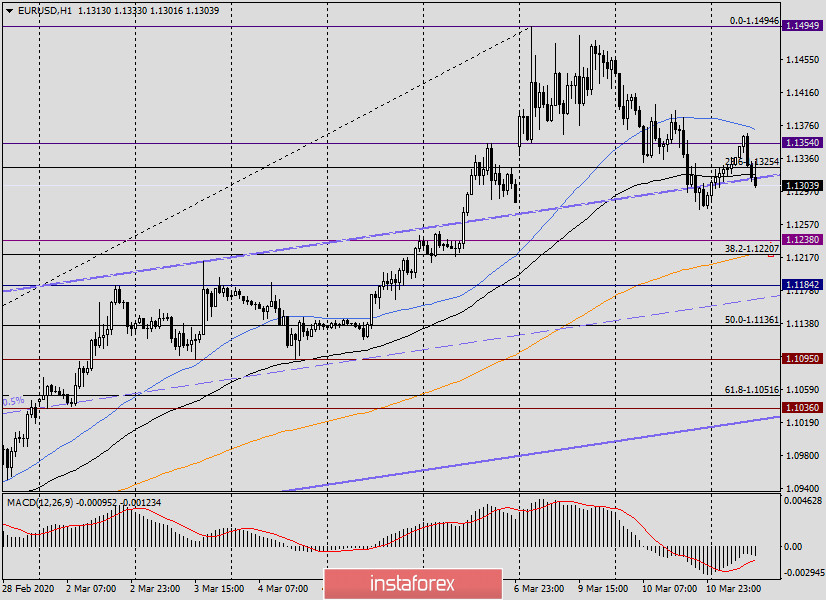

H1

This chart clearly shows that the pair has rolled back to the broken resistance line of the channel, which is still supporting the quote. The exponential moving average also keeps the pair from further falling. However, under the 89 EMA, one hourly candlestick has already closed, so it is not excluded that the price will drop to 1.1240-1.1220, where the broken resistance level is 1.1238, 38.2 Fibo from the growth of 1.0777-1.1494, as well as 200 exponential.

As already suggested above, at the moment, the decline in EUR/USD is corrective, so the main trading idea, in my opinion, is to buy after the decline in the area of 1.1240-1.1220. If the euro/dollar resumes growth from current prices, breaks through 50 MA and fixes higher, on the rollback to 1.1371 (50 MA), you can try to buy, but for now, it is better with small goals.

If a bearish candle or (candles) appears below 50 MA, you can try to sell it, but also short, with goals in the area of 1.1240/20. It is not yet known exactly what Trump's plan will be to protect the US economy from the coronavirus and how market participants will react to it. In this regard, the movement of the pair may not be completely predictable in any direction.

Good luck!