The Bank of England today decided to prematurely join those central banks that eased monetary policy in response to the spread of the Chinese coronavirus. Members of the English regulator reduced the rate immediately by 50 basis points, as did their colleagues from the Fed. This is not to say that this decision was completely unexpected and shocking for market participants - recent events and comments by British officials (including representatives of the Bank of England) prepared the markets for such a scenario. The initial reaction of the pound also suggests that traders took this option into account in their forecasts. Moreover, now the British currency has received a certain immunity, given the previous rhetoric of Andrew Bailey.

Let me remind you that the successor of Mark Carney (Bailey will take up his duties this month) recently announced that the central bank could reduce the interest rate "approximately to 0.1%." The British currency initially slumped, reacting to such dovish forecasts - but subsequent official remarks offset the initial reaction. Bailey said that the regulator had virtually no room for political maneuvers, so you can't count on an aggressive reaction from the central bank. But according to the head of the regulator, the British government urgently needs to increase the role of fiscal policy.

Mark Carney expressed a similar position today, commenting on the decision to reduce the rate. He noted that the measures taken by the central bank should only complement incentive government programs. In addition, he also outlined the lower limit of the rate cut - according to him, the BoE could reduce it to the level of "just above 0%". This position is consistent with the position of Andrew Bailey, who set the "red line" at 0.10%. Carney's successor virtually ruled out the option of reducing to the negative area - in his opinion, negative interest rates will have a negative impact on the UK banking sector.

Thus, last week, Bailey announced the boundaries of possible actions on the part of the English regulator, and also actually warned the markets that the central bank was preparing to take appropriate countermeasures. This fact supported the pound at the moment when the dovish scenario began to come true. Moreover, the market should be ready for the next possible decision - when the BoE will reduce the rate by another 10 or 15 basis points.

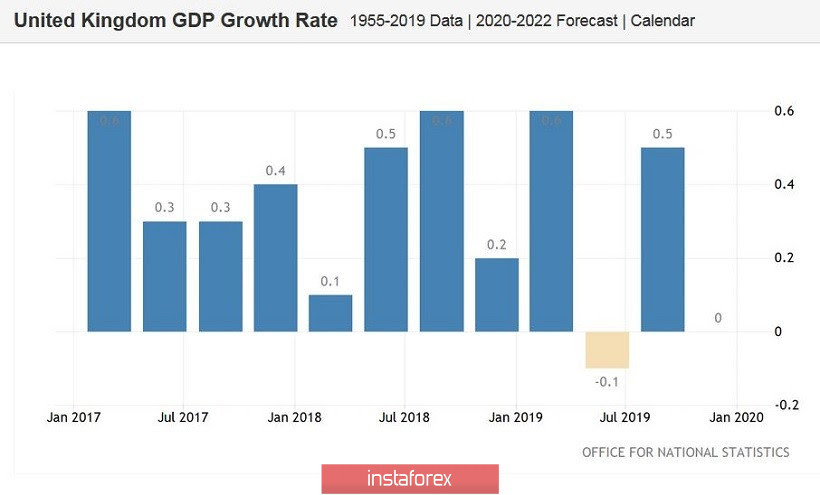

In other words, the pound held back a hit today, but paired with the dollar still could not enter the 30th figure. UK GDP growth data released today put pressure on the British currency. In January, this indicator reached zero (with a forecast of growth of up to 0.2%) on a monthly basis. The economy of Great Britain "froze in place" after a slight growth in December, when GDP grew by 0.3%. In quarterly terms, the key indicator also remained at zero, although experts expected a minimum increase of 0.1%.

Disappointed and indicators of industrial production. In both monthly and annual terms, the indicators appeared in the red zone, not reaching the forecast values (-0.1% and -2.9%, respectively). But the volume of production in the processing industry collapsed to -3.6% (on an annualized basis) - this is the weakest result in the past almost two years. And although experts expected a downward trend in the above indicators, real numbers turned out to be worse than pessimistic forecasts.

Despite such weak releases, the GBP/USD pair still shows character. This indicates the general weakness of the US currency. First, dollar bulls are disappointed with incentive measures proposed by the White House, around which political debate is still ongoing. The Trump administration and Congress cannot find a common denominator in this matter, and this fact puts additional pressure on the greenback.

Secondly, the dollar continues to be under pressure from panic. The number of confirmed cases of infection with a new coronavirus in the United States has reached a psychologically important thousandth, while the rate of spread of COVID-19 continues to increase. Many states have declared a state of emergency, and universities across the country are closing down or transferring students to online education. All this suggests that the Fed at the March meeting may again resort to aggressive measures to mitigate monetary policy. In particular, the US president, as well as some of his advisers, are urging the Fed to lower the rate to zero. Further spread of the epidemic will only increase the likelihood of this scenario.

It is for this reason that the pound today "held back the blow": while the BoE is limited in its actions, the Fed can afford more ambitious steps to soften monetary policy. This suggests that the GBP/USD pair retains the potential for its growth to the first resistance level, that is, to around 1.3070 (the lower boundary of the Kumo cloud on the daily chart).