Aggressive measures of the Bank of England clearly make it clear that the regulator does not intend to sit on the sidelines and wait for the situation to improve itself. Preventive measures are currently the most effective, which will avoid the global crisis of 2008.

Today, at an extraordinary meeting, the Bank of England decided to lower interest rates, which led to a sharp collapse of the British pound, which quickly regained its position. The actions of the government and the regulator are joint, and later today, the country's Finance Minister Rishi Sunak will present a draft budget that will be very much changed due to the spread of the coronavirus. By the way, more than 400 people have been infected in the UK.

Following a special meeting of the monetary policy committee, the Central Bank's management decided to reduce the key interest rate to 0.25% from 0.75%. The Bank of England also announced measures to combat the effects of the coronavirus. We are talking about creating a funding program designed to support lending to small businesses affected by the epidemic.

During his speech, Bank of England Governor Mark Carney said that the economic shock may be significant and sharp, but it will be temporary, and if necessary, there is space for applying additional monetary policy tools. Carney also hinted that quantitative easing remains part of the toolkit, and all measures taken today are coordinated with the presentation of the budget.

Now about the speech by the future head of the Bank of England, Andrew Bailey, who took part in making all the decisions. Bailey said that the destabilization of the British economy will be temporary, and the measures taken will allow banks to avoid obstacles in providing loans, which will help them survive in the conditions of destabilization of markets. Bailey also pointed out that the analysis of monetary and financial policy needs to be even clearer and more thorough. As for the stimulus capacity, the Bank of England still has about half of the existing capacity at its disposal.

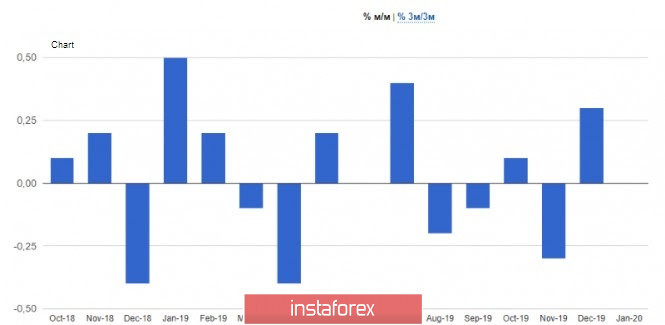

Data on UK industrial production, after a sharp decline in interest rates, no longer had such a clear impact on the market. According to the report, production decreased in January this year by 0.1% and fell by 2.9% compared to the same period in 2019. Production was forecast to grow by 0.3% and decrease by 2.5% per annum. Surprisingly, the deficit of foreign trade in UK goods in January this year was 3.7 billion pounds with a forecast of 7 billion pounds, and the positive balance of UK trade with countries outside the EU in January was at the level of 2.2 billion pounds.

As for the UK economy, it showed no growth in January compared to December 2019 and grew by only 0.6% compared to January last year, indicating real problems, which are added to the uncertainty over the EU-UK trade negotiations.

As for the technical picture of the GBPUSD pair, it seems that the pound enjoys good support due to the stimulus measures resorted to by the UK authorities. As long as trading is above the level of 1.2870, we can expect the upward correction of the trading instrument to continue to the area of the highs of 1.3020 and 1.3080. If the area of 1.2870 is breached, which is where the major players took advantage of the moment and opened long positions after the Bank of England's decision to lower interest rates, then the pressure on the pound will return, which will lead to an update of the lows in the area of 1.2790 and 1.2730.

Do not forget that the European Central Bank will hold a meeting tomorrow, where it will also announce packages of measures aimed at mitigating the impact of the spread of coronavirus on the economy. I have discussed this in detail in my previous reviews. In short, deposit rates are likely to be reduced by 10 basis points, to -0.60%, and monthly net asset purchases will rise to 40 billion euros from 20 billion euros.