Hello, colleagues!

The spread of the COVID-19 epidemic around the world is still the main topic for markets. In this regard, the comments of German Chancellor Angela Merkel and President of the European Central Bank (ECB) Christine Lagarde did not go unnoticed.

At her speech in Berlin yesterday, Angela Merkel suggested that between 60 and 70 percent could become infected with the coronavirus. Needless to say, the forecast is disappointing. Let me remind you that as of yesterday, according to the calculations of an authoritative news agency, the number of people infected with the coronavirus already exceeds 119,000, and the victims of the epidemic were 4,296 people.

According to Angela Merkel, the main task now is to buy time for the COVID-19 vaccine to be found. However, no one knows how long it will take, and the virus does not wait and continues to spread around the globe.

ECB chief Christine Lagarde has launched an initiative to allocate more funds to counter the coronavirus epidemic. Lagarde also considers it necessary to take stimulus measures for economic stability.

By the way, the ECB's decision on the interest rate will become known today, after which the head of this department will hold a traditional press conference.

Let me remind you that the European Central Bank has previously stated that they will not follow the Fed's path and will not change the parameters of their monetary policy. In other words, the main interest rate, which is at zero, will remain unchanged.

But how do we understand Christine Lagarde's comments that budget measures are needed to support the region's economy? Will the ECB follow the path of other leading world central banks that have already cut rates?

We will find out the answers to these and other questions today when the ECB decision becomes known and Christine Lagarde holds a press conference. For some reason, I remembered former ECB President Mario Draghi, whose press conferences usually gave rise to good price impulses.

I believe that the European regulator will have to make a decision on the adoption of incentive measures, this is required by the situation with the spread of the coronavirus and the threat of a new global economic crisis. In the meantime, let's see what the situation is on the daily chart of the euro/dollar currency pair.

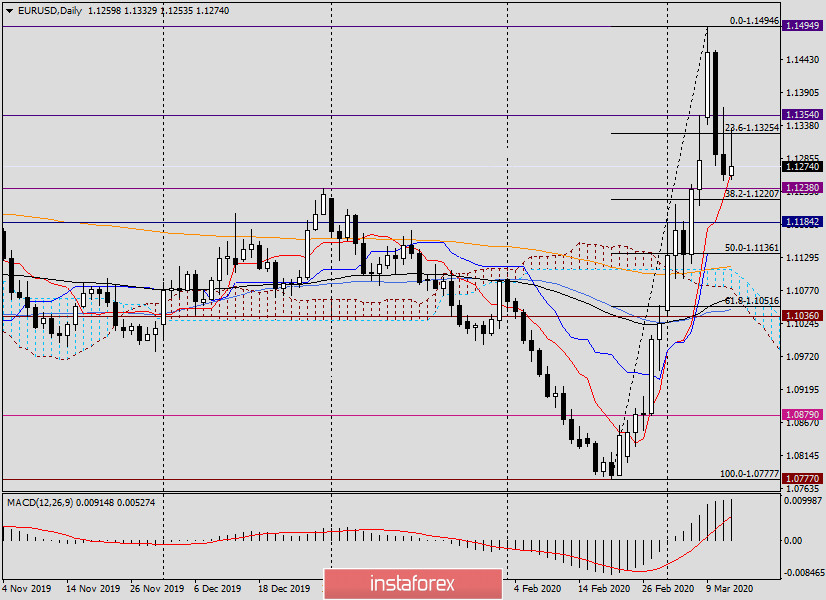

Daily

In yesterday's trading, the pair failed to overcome the mark of 1.1366, after which it declined and ended Wednesday's trading at 1.1260.

It is interesting, but today the situation is repeated, at least at the time of writing this article. The pair was already rising to 1.1330, but could not hold there and fell to 1.1263, leaving a long shadow at the top. Now the euro/dollar is trading near the Tenkan line of the Ichimoku indicator, which is trying in every possible way to support the quote.

It should be noted that today will be very important for the single European currency. At this point in time, the weekly candle clearly looks like a reversal, that is, a harbinger of a subsequent decline. I believe that the euro bulls today are almost the last chance to correct the situation. To do this, the market should positively perceive the ECB's decision on the rate and the comments of the head of the department, Christine Lagarde. Most likely, the European regulator will decide to ease monetary policy, which is more than natural in the current situation with threats of coronavirus to the world economy.

We can assume that the broken resistance level of 1.1238 will be the mark on which the further direction of EUR/USD will depend. If today's trading closes at 1.1238, there will be real prerequisites for a further decline to 1.1200, 1.155 and possibly lower.

If the reaction to the ECB is positive for the euro, we should expect a rise to the key level of 1.1300. If today's session ends above this mark, the euro bulls will have chances to turn the situation in their favor.

Due to the upcoming events and the incomprehensible reaction of market participants to them, I will refrain from specific trading recommendations today. And the technical picture for EUR/USD does not give clear signals about the further direction of the price.