Good day!

The continued spread of the coronavirus around the world forces leading central banks to take urgent measures to protect economic stability in their countries.

The lack of accurate data on the number of infected citizens is a problem for the Federal Reserve System (FRS). An emergency 50 basis point reduction in the refinancing rate was made by the Federal Reserve prior to the COVID-19 outbreak. Judging by the speed at which the coronavirus is spreading, the number of infected people in the United States and other countries will grow. If the situation develops in this way, the Fed and other leading central banks will have to continue to take measures for financial and economic stability. In this case, it is possible to expect the continuation of a reduction in interest rates and other stimulus measures.

It is reasonable to assume that at its March meeting, the Open Market Committee (FOMC) of the US Federal Reserve will again reduce the refinancing rate, but by 25 basis points.

Let's look at the charts of the USD/CAD currency pair and try to analyze what is happening.

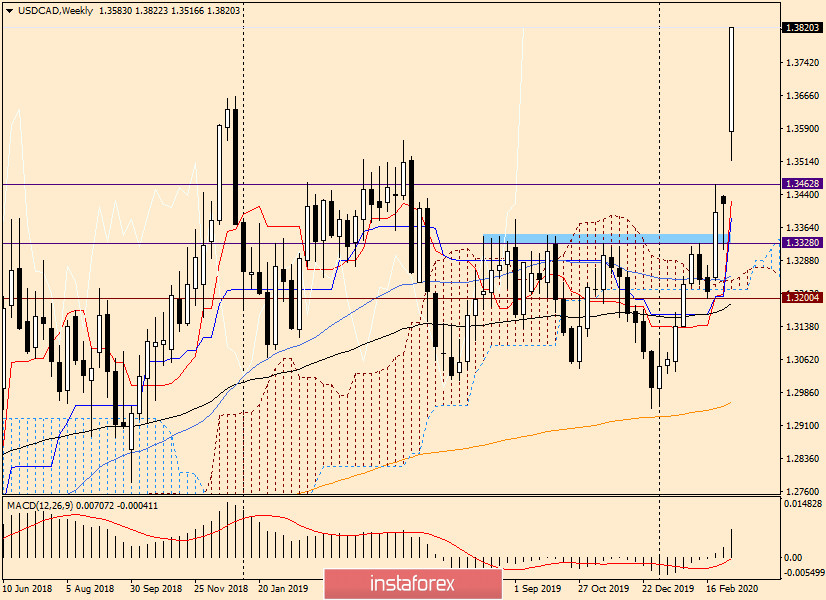

Weekly

As you can see, this week's trading for USD/CAD opened with a price gap up, and quite significant. The bullish gap was not completely closed, after which the pair rushed up.

In my opinion, important macroeconomic statistics from the US and Canada are not planned until the end of the current trading. This means that the pair will be influenced by reports about the coronavirus and measures announced by US President Donald Trump.

If market participants are disappointed with the presented plan of the White House or do not find specifics in it, the US dollar may be under significant selling pressure. In such a situation, bears can seize control of the market from their opponents and start winning back losses, which are impressive at the time of writing.

If the final bearish candle appears on the weekly chart, a strong signal will be received for a reversal in the south direction. Otherwise, the pair will continue to grow, which can be very impressive in its strength.

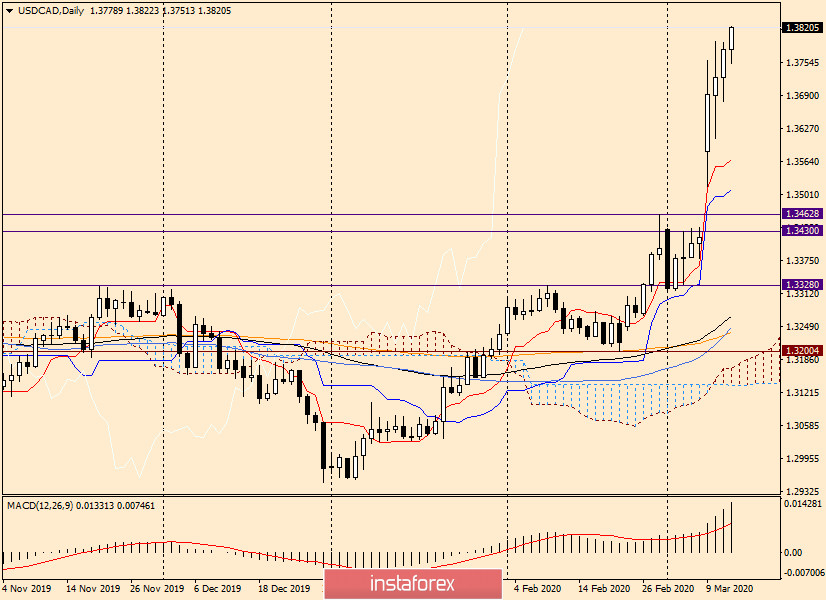

Daily

After the opening of trading on March 9 with a bullish gap, there was quite an intensive growth. However, in the area of a significant technical level of 1.3800, the upward momentum shows a tendency to fade.

If today's candlestick forms in the shape of a bearish reversal, you can try to sell. No matter how it happens, to buy at such prices, and even taking into account the not flooded gap, in my opinion, is extremely risky. Let's see what picture is observed on the lower timeframe.

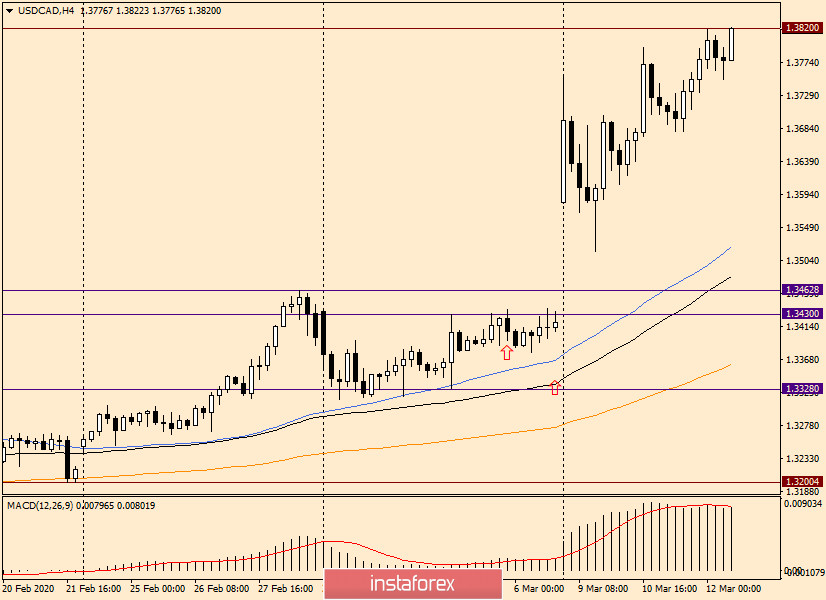

H4

As you can see, there are already some signals on the 4-hour chart about a likely pullback down. It is too early to call it a reversal, but the prerequisites for a usd / cad correction are already being seen.

If the current candle is made in the form of a bearish one, you can try neat sales with a stop above the last highs of 1.3820 and the nearest targets of 1.3745, 1.3700 and 1.3680. The same prices can be used to open long positions in case of a correction.

However, at the moment of completion of this article, the pair breaks up again and shows the intention to re-test the resistance of sellers at 1.3820. If this level is broken and fixed higher, you can try to buy on the rollback to it.

Despite the bullish mood of the USD/CAD pair, it is not easy to make a decision to enter the market at the moment. Probably, it would not be the worst option to observe the further development of events and the appearance of clear signals for opening positions.

Good luck!