According to the WSJ forecast, the Fed is likely to cut interest rates to zero this year. 54% of economists expect the Fed to ease interest rates to zero while 75% anticipate that the coronavirus is likely to have a more negative impact on the world economy in 2020.

The US GDP outlook for 2020 was revised to 1.2% from 1.9% in the previous month. Most significantly, recession risks in the US for the next 12 months skyrocketed to 49% in March from 26% in February this year, which is also confirmed by the fall in the US stock market. Thus, S&P 500 futures dropped to new lows. At the moment, futures are trading at 2,420 versus 2,900 on Monday. The market collapsed by more than 17% in just one week.

A sharp decline in risk assets, in particular the euro and the pound, also indicates that investors are nervous as the European Central Bank's decision to keep interest rates steady was not enough to support the EUR/USD growth. Yesterday, the regulator left the deposit rate at -0.5% and the discount rate at 0.00%, saying that interest rates are likely to stay at the current or lower levels until inflation reaches the target. So far, the ECB have not seen serious problems with the spread of the coronavirus.

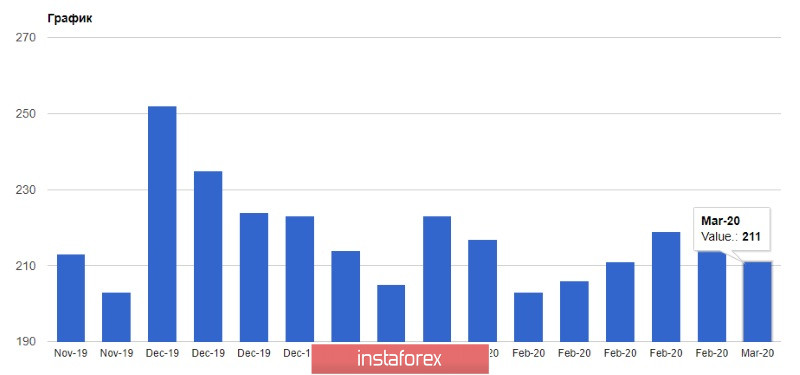

As for the US economic data, the Labor Department report indicated a low percentage of layoffs amid the spread of coronavirus in the United States. Moreover, initial jobless claims dipped to 211,000, decreasing by 4,000, in the week ended on March 7. Economists had expected jobless claims to inch up to 219,000. Continuing claims dropped by 11,000 to 1.722 million in the week ended on February 29.

The dollar did not react on producer prices data in the US as many economic indicators were likely to decrease under current circumstances. According to the US Labor Department report, producer price index fell by 0.6% in February compared to 0.5% growth in January amid the spread of the coronavirus. Economists expected the index to drop by 0.1% in February. Producer prices rose by 1.3% from the same period in 2019. Core index, which does not include volatility, jumped by 1.4% from February 2019.

Technical picture for EUR/USD:

The downward trend is likely to reverse when the price rises to the resistance level of 1.1240. In this case, it is better to open buy deals at 1.1300 and 1.1380. If the euro remains under pressure today, the break through the support level of 1.1160 is likely to increase pressure on the trading instrument and the price can fall to the lows of 1.1060 and 1.0990.