The fact that the markets have been overheated for a long time has been said for several years, and almost no one doubted that a correction was inevitable, which would resemble a catastrophic collapse. A And if you look at the comments made by many of my colleagues at the end of last year, including me, you can see that there is almost a consensus that this will happen in the late summer and early autumn of this year. However, apparently, here it is, this same collapse. It is happening right now in front of our eyes. If you look at the main stock indexes, you will be frightened. So, the DowJones index declined 9.99% yesterday. Since the beginning of the week, it has fallen in price by 18.03%. But if you count from the maximum value that was recorded on February 12, the DowJones index fell by 28.26%. At the same time, things aren't the best with the NASDAQ, which only decreased by 9.43% yesterday, and as much as 17.57% since the beginning of the week. The maximum value was recorded on February 19, compared with which the current value is 26.64% less. Well, the S & P500 plummeted to 9.51% yesterday. For an incomplete week, it lost 16.54%. The maximum value for it was also recorded on February 19, and to date, the S & P500 has lost 26.74%. And this, despite the emergency reduction in the refinancing rate of the Federal Reserve System from 1.75% to 1.25%. At the moment, I have no doubt that the refinancing rate will be reduced again during the next meeting of the Federal Committee on Open Market Operations. It is significant that against this background, the profitability of US government debt securities is not just decreasing, but it feels like bankers are arranging endless fights for a place in the line, to have time to buy debt receipts. For example, the yield on 4-week bills declined from 0.925% to 0.395%, and on 8-week bills from 0.820% to 0.290%. But it's still more fun when you look at the yield on 30-year bonds, which declined from 2.061% to 1.320%, while the scale of the decline in returns is so great that the recent decline in the refinancing rate does not explain it in any way. This decrease is simply not enough for such large-scale changes in the issue of government debt obligations. This is a consequence of the boom in demand. Investors flee from high-risk assets and are transferred to the most reliable and now, they consider everything and everyone as risky assets.

It is not a joke when I say that investors consider any assets risky, since this can be seen even in the profitability of European debt securities. For example, Italy, where the yield on 3-year bonds jumped from -0.10% to 0.74%. And the yield on 7-year bonds increased from 0.48% to 0.92%. Most 10-year bonds look the most modest, whose yield has grown from 1.00% to 1.29%. And you can try to blame it on coronavirus or yesterday's decision of the European Central Bank as much as you like, but this will not be the right explanation. The yield of debt securities has been increasing for several weeks now, and not only in Italy, but also in other European countries. So yes, it is nothing but a sudden panic from risks into the most reliable defensive assets and you ask, why in the United States? The secret is that it's precisely American investment banks and funds, as well as pension funds, control the largest amount of financial capital in the world. Well, where will you run if it is scary, cold and hungry everywhere? Of course to where, as you think, the most secure. Psychologically, people consider their home the safest place. That's money and flowing river back to the United States, settling in the accounts of a beloved state, even in the form of debt obligations of this very state.

At the same time, the European Central Bank is not doing anything to at least hinder this remarkable process somehow. Although it is unlikely to be able to do this at all. In any case, the European Central Bank decided not to lower its interest rates unlike the Federal Reserve or the Bank of England even the deposit rate remained unchanged, although everyone was sure that the deposit rate would be reduced from -0.5% to -0.6%. This decision was argued by the fact that the existing monetary measures to stimulate the economy are already sufficient. However, it is still not clear where is this very economic growth then. Moreover, Christine Lagarde, who decided not to support financial markets, distributed gifts to the banking sector. In particular, the European Central Bank decided to lower the bank capital adequacy ratio but, in a rather original way. Thus, this issue will be decided on an individual basis instead of setting a new level of capital adequacy. Moreover, banks will be consulted on the timing and extent of inspections. And all these measures can be justified only if these same banks are simply in a disastrous situation. Apparently, the problems with bank balances in Europe have already reached horrific proportions, since you have to go for such serious concessions. Not without money injections, because the long-term lending program was increased by 120 billion euros. In any case, all these measures are aimed only at supporting the banks themselves, and not financial markets, which need a further reduction in the refinancing rate.

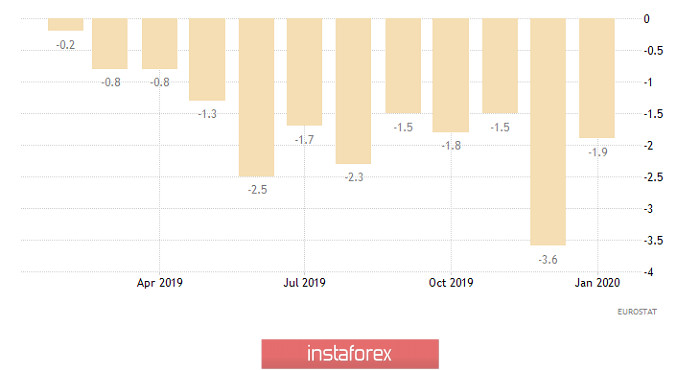

On the other hand, the situation in Europe is not close to being good enough. Of course, we can say that there is a clear improvement in the situation in industry, since the pace of decline in industrial production slowed down from -3.6% to -1.9%. However, this does not negate the remarkable fact that industrial production has been declining for 15 consecutive months.

Industrial Production (Europe):

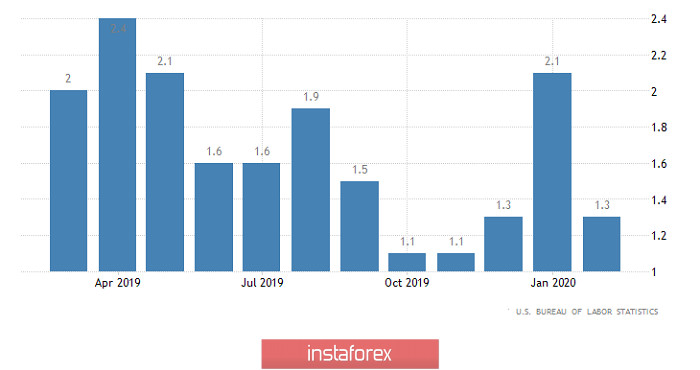

However, the American statistics was multi-directional in nature, but in the conditions of the general abandonment, few people are interested in this. Nevertheless, the total number of applications for unemployment benefits decreased by 15 thousand. In particular, the number of initial applications for unemployment benefits decreased by 4 thousand, and re-applications by 11 thousand. It was forecasted that the number of repeated applications for unemployment benefits by 8 thousand, while the number of primary ones was supposed to increase by 7 thousand. So the labor market, which is already in the best condition in history, continues to persistently demonstrate good results. However, producer prices was somewhat disappointing, as their growth slowed down from 2.1% to 1.3%, which coincides with the general inflationary dynamics. Well, price cuts are just another indication

Manufacturer Prices (United States):

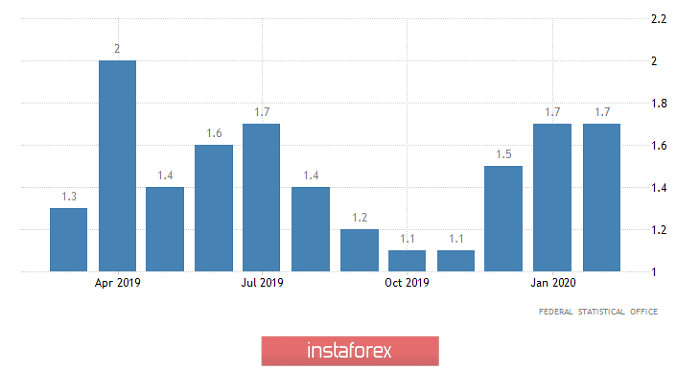

Today, no significant data is published, although there is still something to see. Moreover, Europe has already reported. A number of eurozone countries published inflation data, and, as expected, it remained unchanged in Germany. In France, as predicted again, inflation declined from 1.5% to 1.4%. Well, in Spain, it declined from 1.1% to 0.7%, which turned out to be worse than forecasts, since they expected a decrease to 0.8%. As a result, Europe continues to deliver not the most pleasant news.

Inflation (Germany):

Meanwhile, the United States also does not expect anything good regarding prices. Now, what to expect after inflation has fallen? This time, data on export and import prices will be published. So, export prices, which until recently rose by 0.5%, are likely to show a decrease of -0.5%. A similar focus should occur with import prices but on a large scale, because their growth rate of 0.3% may be replaced by a decrease of -1.5%.

Import Price Index (United States):

The collapse in the markets is far from over. Some stabilization will be most likely outlined only after the meeting of the Federal Committee for Operations on the Open Market. In addition, European statistics are not impressive. So the single European currency will continue the inertial decline. However, yesterday's minimum is unlikely to be repeated, but the reason for this is somehow not observed, at least today. Therefore, we focus our attention on the level of 1.1125.

The pound already demonstrates attempts to rebound due to the incredibly strong decline of the previous days. And judging by American statistics, the pound may be accompanied by success. Thus, do not be surprised if it increases to the level of 1.2700 today. In principle, this will be a kind of rehearsal of what a single European currency can depict on Monday.