The first half of spring gave investors a real thriller. At first, the EUR/USD quotes soared to more than a year highs and almost reached the mark of 1.15, but then the initiative completely passed to the "bears". The pair began to ignore the ongoing correction in the US equity market and switched its attention to other drivers. Absolutely unexpectedly, the topic of the collapse of the eurozone has sent the euro into a knockout.

The outflow of capital from the United States against the background of the fastest pullback of the S&P 500 from historical highs in history and the transition of the stock index to the bear market, the increase in the probability of reducing the federal funds rate to zero by the end of the year and the limited potential for monetary expansion of the ECB pushed the EUR/USD quotes north at the speed of an express train. Christine Lagarde and her colleagues have indeed proved that the European Central Bank's capabilities are limited. They launched another round of cheap credit programs, expanded QE from €20 billion to about €33 billion a month, but did not reduce the deposit rate from -0.5% to -0.6%, as financial markets expected. Given the fact that the LTRO was not previously popular with banks, and QE has exhausted itself, such actions are a drop in the ocean.

On the other hand, the ECB managed to stop the "bulls" in EUR/USD, reduce the trade-weighted euro exchange rate, which can be entered into the regulator's asset. But at what cost! Lagarde's statement that the Central Bank should not be involved in regulating spreads on eurozone bonds has stirred up financial markets. If Italy, which is dying of coronavirus, has to solve the problem of capital outflow from the local debt market on its own, then why do we need a currency block at all?

The fall of the main currency pair was due not only to the resuscitation of the theme of the collapse of the eurozone but also to the gradual stabilization of the US derivatives market. If a few days ago, CME derivatives believed that the federal funds rate would fall by 75 bps at the FOMC meeting on March 17-18 and fall to zero by the end of 2020, now we are talking about 50 bps and 0.5% at the end of the year. The Fed acted aggressively, easing monetary policy at an extraordinary meeting due to a sharp deterioration in financial conditions, but the indicator is now beginning to stabilize.

Dynamics of financial conditions in the United States

The FOMC meeting is certainly the key event of the week by March 20. Even more interesting in the context of Christine Lagarde's mistake, which led to the fastest sale of European stocks and Italian bonds in history, is the press conference of Jerome Powell. The Fed Chairman has already woken up the "bears" in the S&P 500 several times with his careless phrases. Will he step on the same rake or will he be able to pull himself together and find the right words in an extremely difficult situation?

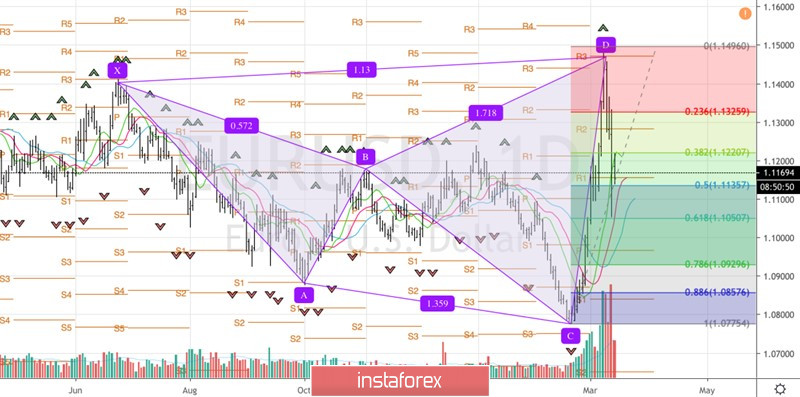

Technically, after reaching the target of 113% for the "shark" pattern, a natural correction of EUR/USD in the direction of 50% and 61.8% for Fibonacci from the CD wave followed. A return to the level of 1.1325 will return hope for a recovery of the "bullish" trend. On the contrary, a drop in quotes to 1.093 and 1.0855 will open the pair's way to the south.

EUR/USD, the daily chart