Forecast for March 16:

Analytical review of currency pairs on the scale of H1:

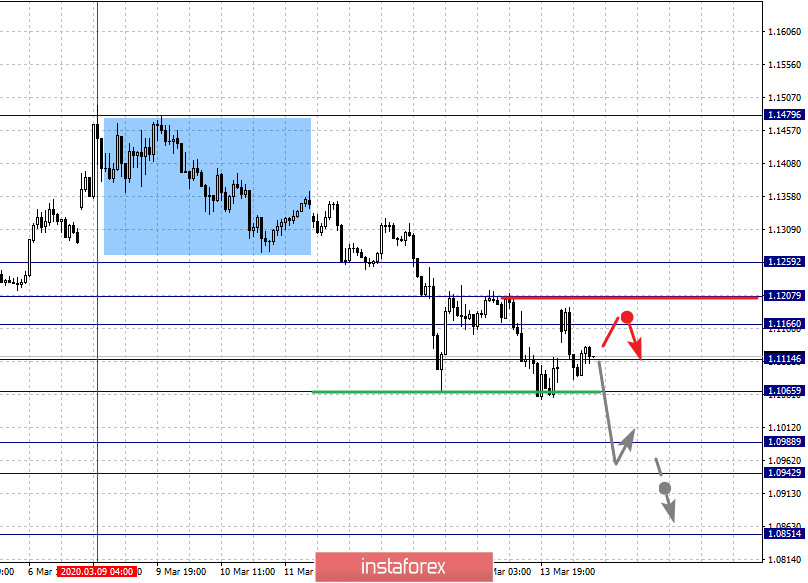

For the euro / dollar pair, the key levels on the H1 scale are: 1.1259, 1.1207, 1.1166, 1.114, 1.1065, 1.0988, 1.0942 and 1.0851. Here, we continue to monitor the development of the descending cycle of March 9. Short-term downward movement, as well as consolidation, is expected in the range 1.1114 - 1.1065. The breakdown of the latter value will lead to a pronounced downward movement. Here, the target is 1.0988. Price consolidation is in the range of 1.0988 - 1.0942. For the potential value for the bottom, we consider the level of 1.0851. Upon reaching this value, we expect a rollback to the top.

Short-term upward movement is expected in the range 1.1166 - 1.1207. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.1259. This level is a key support for the downward structure.

The main trend is the downward trend on March 9

Trading recommendations:

Buy: 1.1166 Take profit: 1.1205

Buy: 1.1208 Take profit: 1.1257

Sell: 1.1065 Take profit: 1.0990

Sell: 1.0986 Take profit: 1.0943

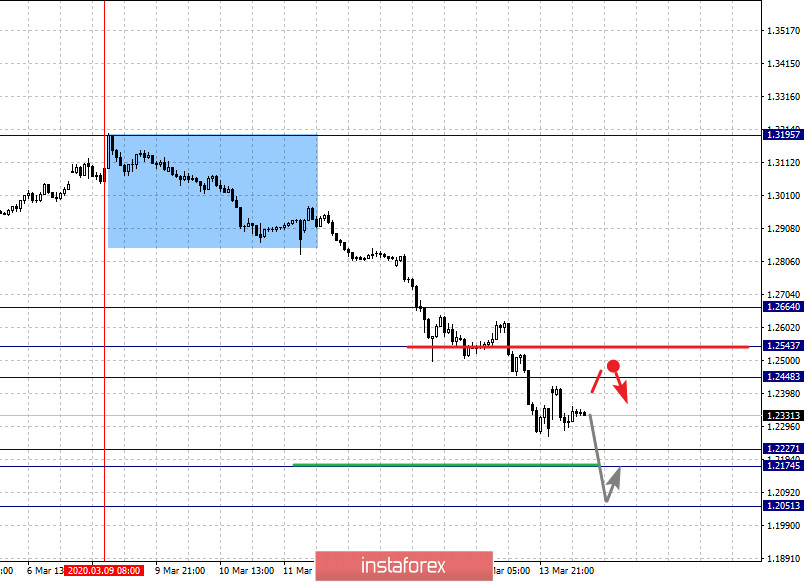

For the pound / dollar pair, the key levels on the H1 scale are: 1.2664, 1.2543, 1.2448, 1.2227, 1.2174 and 1.2051. Here, we are following the development of the March 9 downward cycle. The continuation of movement to the bottom is expected after the price passes the noise range 1.2227 - 1.2174. In this case, the potential target is 1.2051. Upon reaching this level, we expect a rollback to correction.

Short-term upward movement is possibly in the range of 1.2448 - 1.2543. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2664. This level is a key support for the downward structure.

The main trend is the downward trend on March 9

Trading recommendations:

Buy: 1.2448 Take profit: 1.2540

Buy: 1.2544 Take profit: 1.2664

Sell: 1.2174 Take profit: 1.2051

Sell: Take profit:

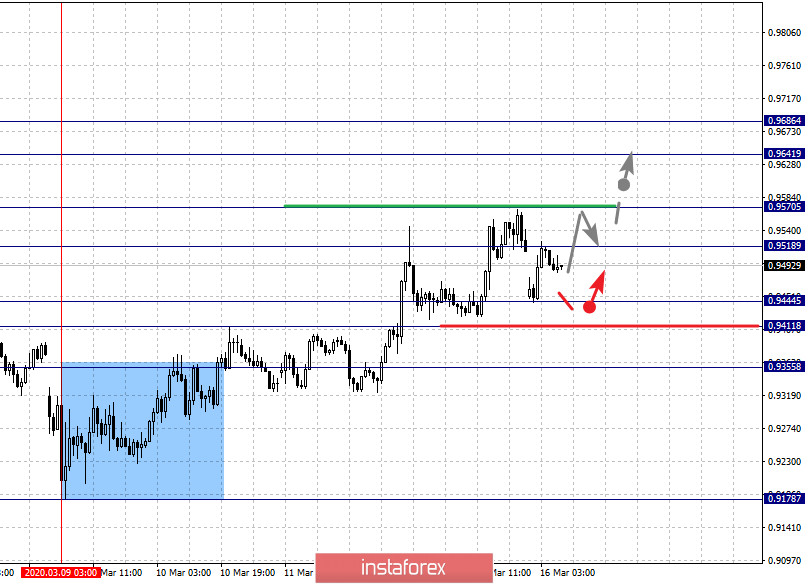

For the dollar / franc pair, the key levels on the H1 scale are: 0.9686, 0.9641, 0.9570, 0.9518, 0.9444, 0.9411 and 0.9355. Here, we are following the development of the upward cycle of March 9. We expect short-term upward movement, as well as consolidation, in the range of 0.9518 - 0.9570. The breakdown of the latter value should be accompanied by a pronounced upward movement. Here, the target is 0.9641. For the potential value for the top, we consider the level of 0.9686. Upon reaching which, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possibly in the range of 0.9444 - 0.9411. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.9355. This level is a key support for the top.

The main trend is the initial conditions for the top of March 9

Trading recommendations:

Buy : 0.9520 Take profit: 0.9568

Buy : 0.9572 Take profit: 0.9640

Sell: 0.9444 Take profit: 0.9412

Sell: 0.9408 Take profit: 0.9360

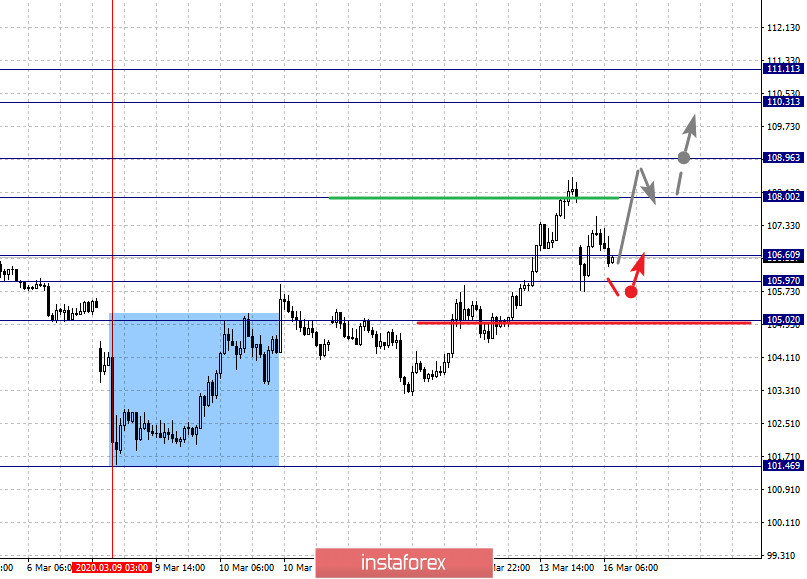

For the dollar / yen pair, the key levels on the scale are : 111.11, 110.31, 108.96, 108.00, 106.60, 105.97 and 105.02. Here, we are following the development of the upward cycle of March 9. The continuation of the movement to the top is expected after the breakdown of the level of 108.00. In this case, the target is 108.96. Price consolidation is near this level. The breakdown of the level of 108.96 will lead to the development of pronounced movement. Here, the goal is 110.31. For the potential value for the top, we consider the level of 111.11. Upon reaching this value, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possibly in the range of 106.60 - 105.97. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 105.02. This level is a key support for the top.

Main trend: upward cycle of March 9

Trading recommendations:

Buy: 108.00 Take profit: 108.92

Buy : 108.98 Take profit: 110.30

Sell: 106.60 Take profit: 106.00

Sell: 105.95 Take profit: 105.08

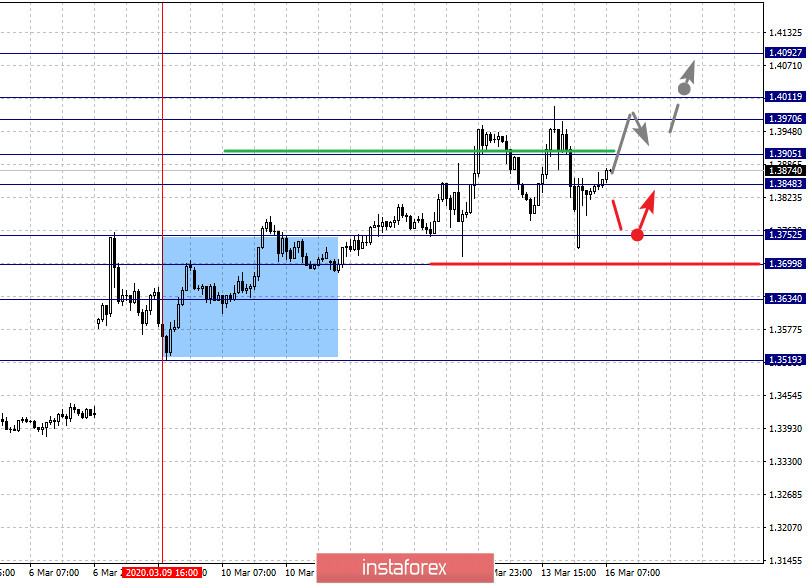

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.4092, 1.4011, 1.3970, 1.3905, 1.3848, 1.3752, 1.3699, 1.3634 and 1.3519. Here, we are following the development of the local ascendant structure of March 9. Short-term upward movement is expected in the range of 1.3848 - 1.3905. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 1.3970. Price consolidation is in the range of 1.3970 - 1.4011. For the potential value for the top, we consider the level of 1.4092. Upon reaching which, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possibly in the range of 1.3752 - 1.3699. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3634. This level is a key support for the top.

The main trend is the local upward structure of March 9.

Trading recommendations:

Buy: 1.3848 Take profit: 1.3905

Buy : 1.3907 Take profit: 1.3970

Sell: 1.3752 Take profit: 1.3700

Sell: 1.3696 Take profit: 1.3636

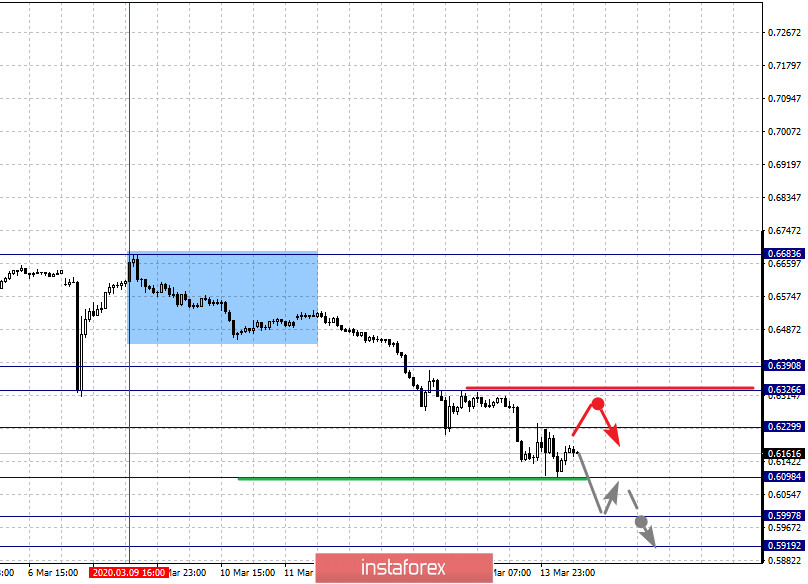

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6390, 0.6326, 0.6229, 0.6098, 0.5997 and 0.5919. Here, we are following the development of the March 9 downward cycle. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.6098. In this case, the target is 0.5997. For the potential value for the bottom, we consider the level of 0.5919. Upon reaching which, we expect consolidation, as well as a rollback to the correction.

Departure into correction is expected after the breakdown of the level of 0.6229. In this case, the target is 0.6326. We consider the level of 0.6390 to be the potential value for the top, this value is key support.

The main trend is the descending structure of March 9

Trading recommendations:

Buy: 0.6230 Take profit: 0.6325

Buy: 0.6327 Take profit: 0.6390

Sell : 0.6096 Take profit : 0.6000

Sell: 0.5995 Take profit: 0.5920

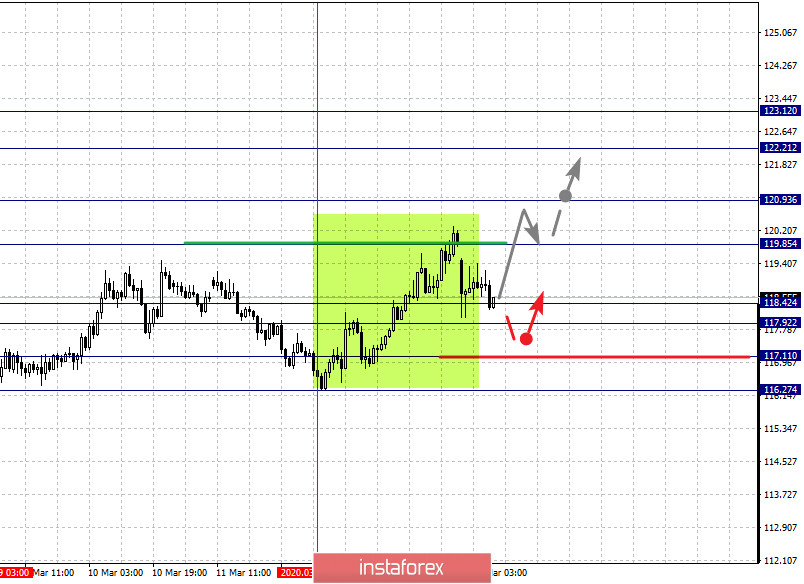

For the euro / yen pair, the key levels on the H1 scale are: 123.12, 122.21, 120.93, 119.85, 118.42, 117.92, 117.11 and 116.27. Here, we are following the formation of the initial conditions for the upward cycle of March 12. The continuation of the movement to the top is expected after the breakdown of the level of 119.85. In this case, the target is 120.93. Price consolidation is near this level. The breakdown of the level of 120.95 will lead to the development of pronounced movement. In this case, the goal is 122.21. For the potential value for the top, we consider the level of 12312. Upon reaching this value, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 118.42 - 117.92. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 117.11. This level is a key support for the upward structure. Its passage at the price will lead to the movement to the first potential target - 116.27. We expect this level designing the initial conditions for the downward cycle.

The main trend is the formation of local initial conditions for the upward cycle of March 12

Trading recommendations:

Buy: 119.85 Take profit: 120.90

Buy: 120.95 Take profit: 122.20

Sell: 177.88 Take profit: 117.20

Sell: 117.08 Take profit: 116.28

For the pound / yen pair, the key levels on the H1 scale are : 135.42, 134.33, 133.14, 132.35, 130.92, 129.95, 128.71 and 127.87. Here, we are following the formation of a local descending structure of March 13. The continuation of the movement to the bottom is expected after the breakdown of the level of 130.92. In this case, the target is 129.95. Price consolidation is near this level. The breakdown of the level of 129.95 should be accompanied by a pronounced downward movement. Here, the target is 128.71. For the potential value for the bottom, we consider the level of 127.87. Upon reaching which, we expect consolidation, as well as a rollback to the top.

Short-term upward movement is possibly in the range of 132.35 - 133.14. The breakdown of the latter value will lead to the development of the upward structure. Here, the goal is 134.33. We consider the level of 135.42 to be a potential value for the top; upon reaching this value, we expect the expressed initial conditions for the ascending cycle to be formed.

The main trend is the formation of the local structure of March 13

Trading recommendations:

Buy: 132.35 Take profit: 133.10

Buy: 133.20 Take profit: 134.30

Sell: 130.92 Take profit: 130.00

Sell: 129.90 Take profit: 128.70