The US Federal Reserve is taking unprecedented measures aimed at preventing a liquidity crisis and supporting business activity. The reason for the sharp recession is called the coronavirus pandemic - this is how US Treasury Secretary Steven Mnuchin described the situation, saying on Sunday that the consequences of the coronavirus pandemic led to a "slowdown" in the US economy, but no full-scale recession is expected.

The real reason for the Fed's actions may be completely different. According to the Congressional Budget Committee, the federal budget deficit for the first 5 months of fiscal year 2020 amounted to $ 625 billion, an increase of 80 billion from a year ago, the growing trend of the deficit is obvious and there is no way to reverse it.

Trump's tax reform did not give any results – budget filling has not increased, despite a significant reduction in the debt burden for corporations. The preferred funds of the corporation were preferred to use to disperse the stock market, increasing capitalization and adding points to justify the growth of the premium fund to shareholders.

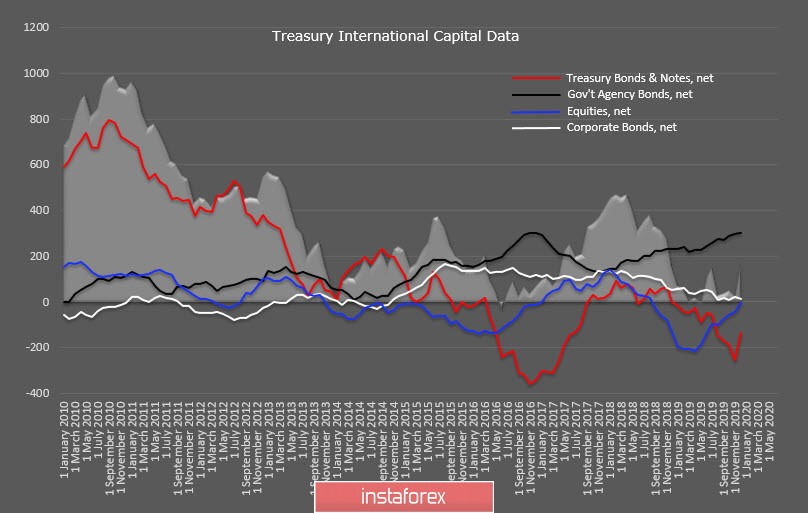

At the same time, the dynamics of the inflow of foreign capital in the United States. The monthly reports of the Treasury are degrading before our eyes. Investments in T-bills in a stable minus, the boom in the stock market has only led to a slowdown in the outflow of funds, and the total result can not be compared not only with the times before the crisis of 2008, but also with the level of 10 years ago.

There is no one to finance the budget deficit, and so, it is necessary to find internal reserves. In addition, the Fed buys about half of all government-issued debt, whose liabilities are growing by leaps and bounds. It is necessary to pay off 2.323 trillion only in the next 3 months. However, there is no place to take this money, except through the issuance of new debts, and the Fed will redeem them.

This explains the first unscheduled reduction in the Fed rate by 0.5%, and then the increase in repo volumes to 175 billion. These extraordinary measures failed to produce any results, and over the last 2 days of the past week the Fed released more than $ 1.5 trillion of "temporary" liquidity to the market, which is essentially an unprecedentedly compressed QE4.

Coronavirus is an ideal cover for an operation to rescue the US debt market, temporary measures will become permanent, since it will be impossible to return the issued money from the economy. The CFTC report showed that over-volatility in the financial markets led to a drop in demand for the dollar, the total long position in the US dollar declined by almost $ 14.5 billion, and currently the total long position in the dollar is the lowest since 2028. This means that demand on the dollar observed on Friday will most likely not be protracted.

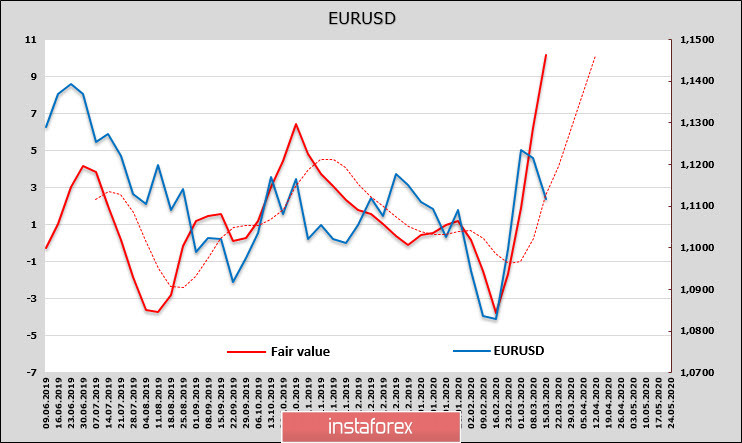

EUR/USD

The total position in the euro is still too much in short, but the dynamics are very much changing in favor of the euro. There is a weekly change of 10 billion, and this is a lot. The estimated fair level is higher than 1.1450, and therefore, EUR/USD rollback to the downside may make it possible to buy euros at more convenient levels after the completion of the correctional decline.

On the other hand, Germany announced firm commitments to increase costs and provide unlimited liquidity to the affected enterprises. German Finance Minister Scholz said that if the situation worsens, the country will consider the possibility of full-fledged budget stimulation.

The euro is trying to push off from the support zone of 1.1050 / 90, and there is reason to expect that support will stand. The goal is the middle of the deviation of the estimated price from the spot, which is approximately at the level of 1.1270.

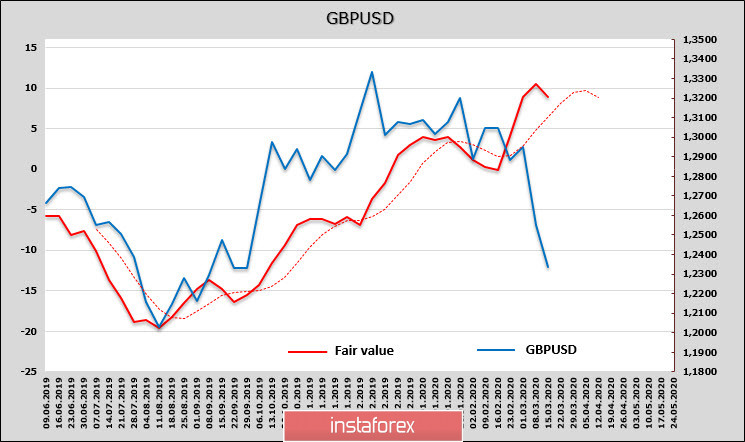

GBP/USD

As part of the correction, the pound went much deeper than the euro, since it is located on the other side of the barricades in operations to exit the carry trade. The CAEC report showed a slight decrease in the total position; in the conditions of falling oil, the pound will be under pressure further.

Nevertheless, a strong gap from the estimated price gives a chance for corrective growth. The goal is the resistance zone 1.2550 / 70. There is no expectation of a stronger growth of the bases yet.