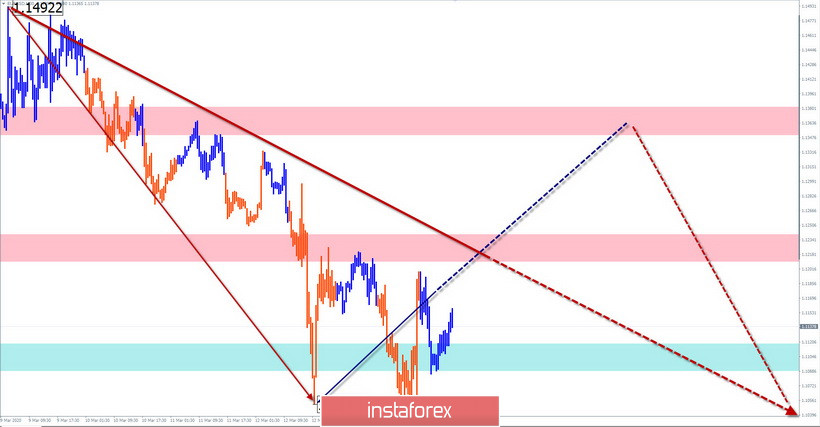

EUR/USD

Analysis:

The bearish wave from March 9 formed a potentially reversal structure on the euro chart. The coronavirus pandemic in Europe has adjusted expectations for further strengthening of the European currency. At the end of last week, the price began to form a counter-movement that corrects the downward section.

Forecast:

The closure of borders within the EU does not contribute to expectations of growth in the euro. There are fewer "bulls" in the market. Today, we expect a flat mood of the movement, with a general upward vector. The probability of a breakthrough to the upper calculated resistance zone before the final change of rate is still preserved.

Potential reversal zones

Resistance:

- 1.1350/1.1380

- 1.1210/1.1240

Support:

- 1.1120/1.1090

Recommendations:

Purchases on the euro market are possible today, but only within the framework of intraday. It is recommended to focus on searching for sell signals at the end of the upcoming price rise.

AUD/USD

Analysis:

Over the past two years, the Australian dollar has been steadily declining. The last section of the trend wave started at the beginning of this year. The intermediate correction of the first decade of March ended with another jump in the direction of the main trend. The price is approaching the next support level.

Forecast:

In the coming day, you can expect a short-term corrective rise in the pair's quotes. A break above the resistance zone is unlikely. By the end of the day or tomorrow, you should expect a reversal and a return to the downward rate.

Potential reversal zones

Resistance:

- 0.6220/0.6250

Support:

- 0.6140/0.6110

Recommendations:

There are no conditions for buying Australian currency. Transactions in growth are risky. The best tactic is to refrain from trading, with an attempt to sell the instrument at the end of the upcoming pullback.

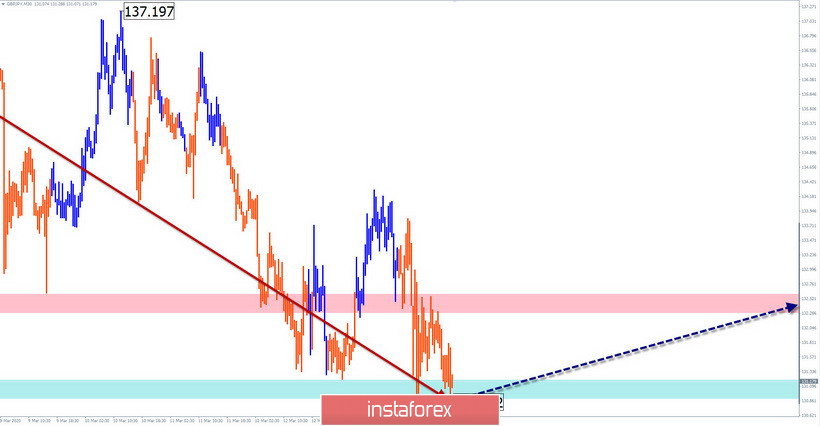

GBP/JPY

Analysis:

The pair's downward wave from December 13 last year reached the upper limit of the preliminary completion zone. The wave structure has been formed and the desired proportions have been achieved. There are no reversal signals on the chart yet.

Forecast:

In the near future, the price is expected to move mainly in the lateral plane on the pair's chart. The range of the daily course is limited to the nearest oncoming zones. Breaking the borders in any direction is unlikely.

Potential reversal zones

Resistance:

- 132.30/132.60

Support:

- 131.20/130.80

Recommendations:

Trading on the pair's market today is only possible with an intraday style. In the first half of the day, purchases will be relevant. At the end of the day, conditions may arise for the sale of the instrument.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of arrows shows the formed structure and the expected movements - dotted.

Note: The wave algorithm does not take into account the duration of the tool movements in time!