Economic calendar (Universal time)

The publication of important economic indicators is not expected today.

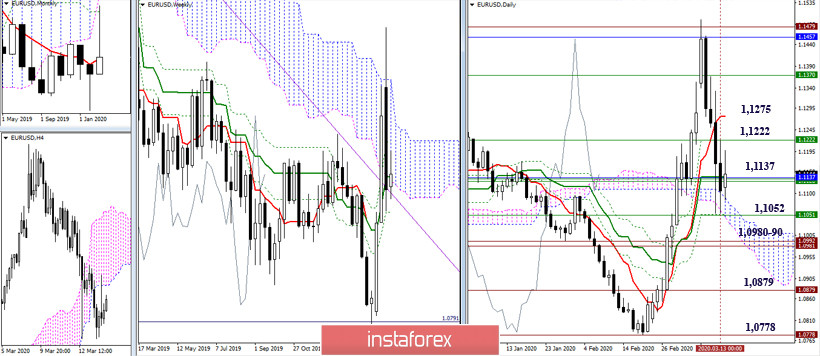

EUR / USD

Last week, the pair performed a productive decline, testing the final support of the daily and weekly Ichimoku crosses (1.1052), as well as the daily cloud. At the same time, the Penetrating Lines reversal pattern has been formed in the weeks, so our priority is now on the bearish side. It is possible that the decline will resume only after a slowdown, some backward movement from the met supports and / or retest of the passed levels. The attraction is now exerted by the accumulation of various levels of the upper halves in the region of 1.1137, and the nearest resistance is located at 1.1222 (weekly Fibo Kijun) and 1.1275 (daily Tenkan). In case of breakdown of support of 1.1052 and resumption of decline, bearish reference points will be historical levels and minimal extremes located at 1.0980-90 - 1.0879 - 1.0778.

.

.

In the lower halves, the pair is in the correction zone. The players to increase tend to take possession of the central Pivot level (1.1127). Reliable consolidation of the above will help strengthen players on the rise, for the support of which some technical indicators have already advocated. The most important reference point for the correction now is the weekly long-term trend (1.1272). This level is able to change the existing balance of power. On the other hand, the nearest resistance can be noted at 1.1200 (R1). In the case of updating the minimum of the last week (1.1055), the bears will most likely continue to actively decline again. The classic Pivot levels 1.1034 - 1.0961 - 1.0868 will act as supports within the day.

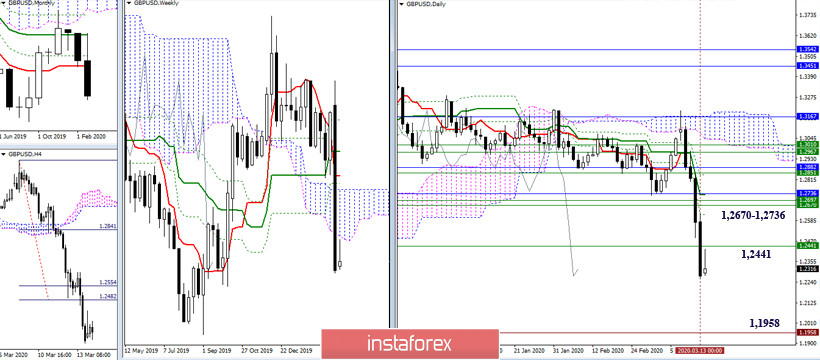

GBP / USD

Perhaps, we can say that the bears exceeded all expectations last week and their weekly absorption is impressive. If the players on the rise can not oppose anything in the near future, then the decline is likely to resume with renewed strength. The reference point now is the monthly minimum extreme of 1.1958 again, then the interests of the bears will be aimed at fulfilling the new weekly target for the breakdown of the cloud. The nearest resistance in this situation can be identified in the areas of 1.2441 (the lower border of the weekly cloud) and 1.2670 - 1.2736 (accumulation of weekly levels and monthly short-term trend).

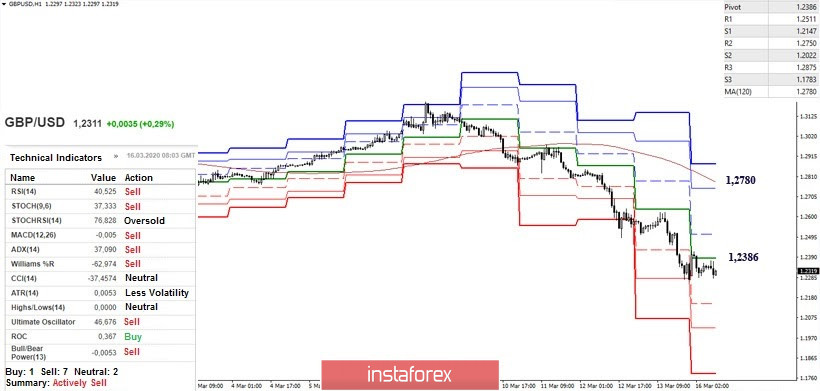

At the moment, the preferences of the analyzed technical elements belong to the players to the downside. The bearish reference points for the downward trend within the day are the support of the classic Pivot levels 1.2147 - 1.2022 - 1.1783. In case of consolidation above the central Pivot level of the day (1.2386), we can expect further development of an upward correction, the main guideline of which on H1 will be the resistance of the weekly long-term trend. Today, this level is located at 1.2780, so the nearest resistance can also be important R1 (1.2511) and R2 (1.2750).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)