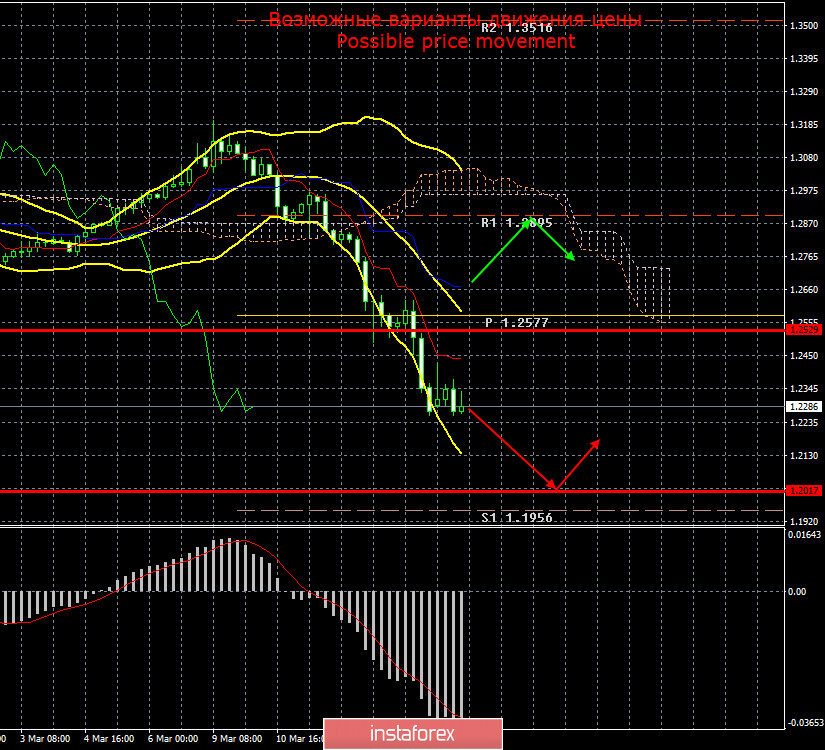

4 hour timeframe

Amplitude of the last 5 days (high-low): 165 pips – 233 pips – 172 pips – 358 pips – 351 pips.

Average volatility over the past 5 days: 256 pips (high).

A new trading week has begun for the pound with the Fed's unexpected lowering of the interest rates by 100 basis points. However, despite the euro, the pound paid little attention to the event. The question is the following: is it possible to imagine the Fed to cut the interest rate by 1% and the US dollar to continue rising under ordinary conditions. We still believe that what is happening in the market today is a panic. Consequently, all macroeconomic data does not matter at the moment. Traders are opening deals solely on the basis of their own opinion as it is impossible to predict the price movement under current circumstances.

Meanwhile, UK Prime Minister Boris Johnson delivered a speech stating that many families can lose their relatives due to coronavirus disease. It is hard to tell whether it was the right thing to do. Johnson failed to calm down citizens of the UK but succeeded in spreading the panic. According to the National Health Service, 80% of the UK population could become infected with coronavirus and the epidemic is expected to last till the spring of 2021. About 8 million of the UK citizens are likely to be hospitalized due to the spread of the disease. However, this is the worst case scenario. There is a possibility that the situation can be a little bit better. However, it is preferable not to expect that the coronavirus can disappear when the weather gets warmer. Looking back, Donald Trump expressed optimism that impending springtime warmth could stymie the virus spread. According to the Ministry of Health, the coronavirus is likely to be less dangerous for humans with time as immunity will be developed. However, in any case, the epidemic can last for at least a year. It is hard to imagine what such a situation can cause to the British and American economy. What is more, medical staff is not enough to test all people. Moreover, there is not enough space for all the infected at hospitals. More than 170 thousand people around the world were infected with the novel virus in 150 countries as of March 16. More than 77 thousand have fully recovered.

Recommendations for Short positions:

According to the 4-hour timeframe, the pound-dollar pair continues falling.Those traders who stay in sell positions can hold them with targets at 1.2017 and 1.1956. If the MACD indicator rises with a parallel increase in the price it can indicate the beginning of a correction. It is better to refrain from opening Short positions at the moment.

Recommendations for Long positions:

It is better to buy the GBP/USD pair if the price rises above the critical line with the target at the first resistance level of 1.2895. However, it is better to act as carefully as possible and keep in mind the increased risks.

Explanation of the chart:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A is the light brown dashed line.

Senkou Span B – light purple dashed line.

Chikou Span is the green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support/Resistance Classic Levels:

Red and gray dashed lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support/Resistance Levels:

Gray dashed lines without price designations.

Possible price movements:

Red and green arrows.