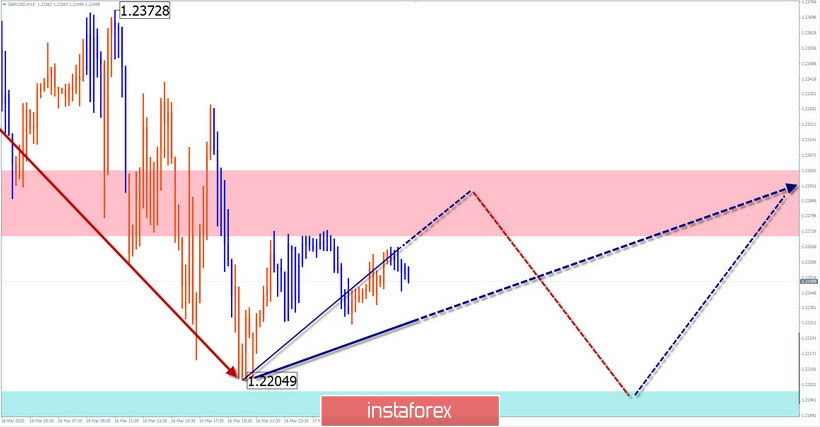

GBP/USD

Analysis:

The current wave of the British pound is descending, with the starting point on December 13. The wave structure is now fully formed. The price has reached the upper limit of the preliminary completion zone. There are no reversal signals on the chart.

Forecast:

In the coming days, we can expect the creation of conditions for the beginning of the upward movement of the pair. In the coming days, a general lateral mood of movement between the nearest oncoming zones is expected. A downward mood is likely in the European session.

Potential reversal zones

Resistance:

- 1.2270/1.2300

Support:

- 1.2200/1.2170

Recommendations:

There are no conditions for conducting long-term transactions on the British pound market. Trading is possible within the intraday with a reduced lot, according to the expected sequence.

USD/JPY

Analysis:

The high wave level of the upward movement that began on March 9 allows us to classify it as a new trend wave. From the intermediate resistance zone, the price of the pair forms a downward correction from the beginning of the current week.

Forecast:

In the next trading sessions, you can expect the continuation of the downward mood of the pair's movement. In the European session, a short-term rise in the area of the resistance zone is possible. The preliminary section of the end of the entire decline shows the far support zone.

Potential reversal zones

Resistance:

- 106.80/107.10

Support:

- 106.00/105.70

- 104.70/104.40

Recommendations:

With the upcoming decline in the yen, sales are possible within the intraday trading style. For longer trades, it is recommended to track buy signals after the entire correction is completed.

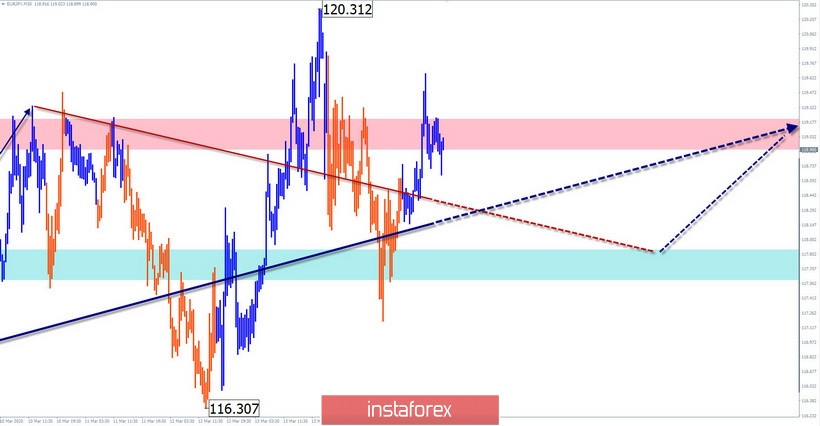

EUR/JPY

Analysis:

The latest current wave of short-term scale on the European cross-market started on December 13. Since March 9, an upward wave has been forming to meet it. At a minimum, it will correct the previous trend wave. In the last 2 days, the price rolls back down.

Forecast:

Today, the general flat mood of the pair is expected, mainly with a downward vector. By the end of the day, the probability of a change in the exchange rate and the beginning of a price rise increases. A breakthrough beyond the settlement zones is unlikely.

Potential reversal zones

Resistance:

- 118.90/119.20

Support:

- 117.90/117.60

Recommendations:

Today, short-term sales with a reduced lot are possible on the pair's market. It is optimal to refrain from trading during the correction, with the search for buy signals at the end of it.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of arrows shows the formed structure and the expected movements - dotted.

Note: The wave algorithm does not take into account the duration of the tool movements in time!