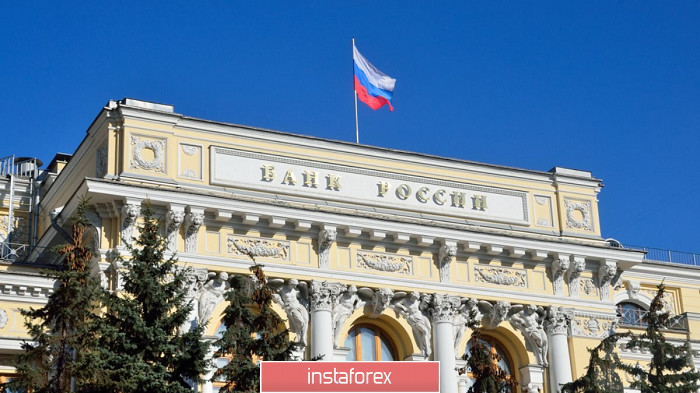

The Russian rouble continues to be flat. The pair was trading around 73.50 roubles per dollar. The US dollar was trying to strengthen during the day to 75 roubles. At some point, the dollar managed to increase to this level, however, failing to consolidate there. At the same time, oil prices collapsed. Both Brent and WTI crude plunged below 30 dollars per barrel. The Bank of Russia continues to enter the market in order to sell the currency, restraining and correcting fluctuations. In other words, the regulator is trying to artificially hold back the rouble at the reserves expense. By doing so, the bank invites speculators to attack the rouble. As a result, all of the Central Bank's reserves worth over half a trillion dollars are likely to run out. If the Bank of Russia does not increase the interest rate in the near future and stop selling off currencies, it is likely to repeat the mistake of other central banks during 2013-2015. Back then, the rouble unexpectedly collapsed. It took the market a lot of time to stabilize the situation. The bank did not play games with speculators at that time. It just increased the interest rate and left speculators face to face with their losses and creditors. A large number of speculators went down and out. The majority of central banks decided to maintain visible stability and wasted their reserves to support national currencies. As a result, reserves ran out and national currencies collapsed. Entire countries were left without reserves, which led to negative economic consequences. Thus, Latin American countries are still recovering. So, the Bank of Russia is better to change the strategy. A couple of years ago, the regulator was one of those central banks that managed to fool speculators. That is why, the current actions of the central bank are so confusing.

The main factor for the Bank of Russia's actions is collapse in the oil price. Thus, if oil rises, the rouble is likely not to be affected significantly. There are signs that oil prices have already stopped falling dramatically. Brent crude plunged by 16% while WTI dropped only 4.6% yesterday. Oil prices have nowhere to fall as they have already reached the average production cost. It means that it is not profitable for oil-producing countries to extract petroleum. This will inevitably lead to oil shortage. However, the modern world depends on oil. Thus, even a slight hint about shortage can cause the prices to skyrocket. Considering the fact that there are speculators in the market at the moment, and large investors are busy buying the US debt securities, a steady increase in oil prices is likely to be a reason for the ruble to grow. However, it is still possible that oil prices can stay near bear minimums a little longer. It can last for a couple of months, which is likely to be enough for speculators to empty the reserves of the Bank of Russia.

Anyway, this whole situation once again shows the vulnerability of the Russian financial system to external factors. The regulator needs to put a lot of effort in order to form and expand the domestic financial market.

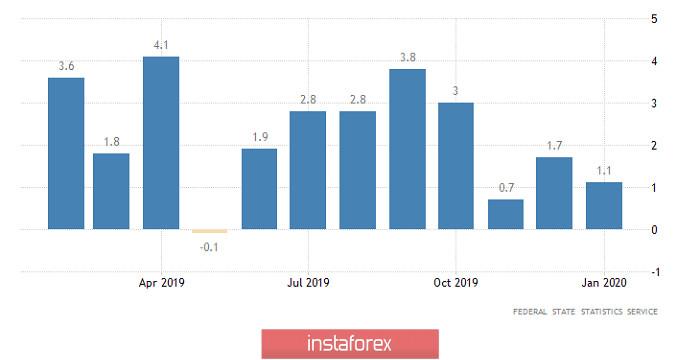

At the same time, the government announced the introduction of measures designed to support the economy in the current financial turmoil, which, according to mass media, is caused by the coronavirus outbreak. For example, small and medium-sized businesses are given a three-month delay in paying rent but only those who rent spaces from state funds and institutions. Moreover, tour operators have been exempted from paying insurance until the end of the year, which can seriously reduce their financial burden. In addition, the government vaguely announced its intention to provide assistance to enterprises that are experiencing difficulties due to the current situation. However, it is still not clear what measures they were talking about. The Bank of Russia announced easing requirements for loans to manufacturers of pharmaceuticals and medical equipment. It looks well-timed, as Russia's industrial production data is set to be released today which is expected to slow down to 0.7% from 1.1%. Only time will tell whether these measures are enough.

Industrial production (Russia):

Speculators are likely to take a break due to the increase in oil prices. The dollar is expected to cost around 73.50 roubles. Until the situation in the global market is stable the price is unlikely to fall below 70 roubles per dollar.