Hello, traders!

The decision of the US Federal Reserve System (FRS) to reduce the main interest rate in the range of 0-0.25 percent and the announcement of a new QE program worth $700 billion only increased the panic on world exchanges. The maximum fall in stock indices since 1987 and the collapse in oil prices are evidence of this.

Meanwhile, US President Donald Trump made a series of lengthy statements exclusively in his style. Their essence boils down to the fact that after a certain recession caused by the coronavirus, we should expect a phenomenal recovery of the American economy. According to Trump, the epidemic will end in June-July, and maybe later. Let me remind you that, in addition to this encouraging statement about the upcoming recovery of the US economy, Donald Trump declared a state of emergency in the country and allocated $50 billion to fight the coronavirus pandemic.

Despite the fact that the main influence on global trading platforms is focused on the theme of the ill-fated coronavirus, it is still worth looking at the economic calendar and highlighting the most important events that can affect the price dynamics of the EUR/USD currency pair.

Today at 11:00 (London time), reports on the index of business sentiment from the ZEW Institute will be received from the eurozone and Germany.

Starting at 13:30 (London time), a whole block of macroeconomic statistics is expected from the US, where you can highlight data on retail sales and industrial production. All the details (release time, forecast) for these and other reports can be found by looking at the economic calendar.

Now let's go to the technical picture that is forming for the main currency pair, and see if you can see any actual trading ideas.

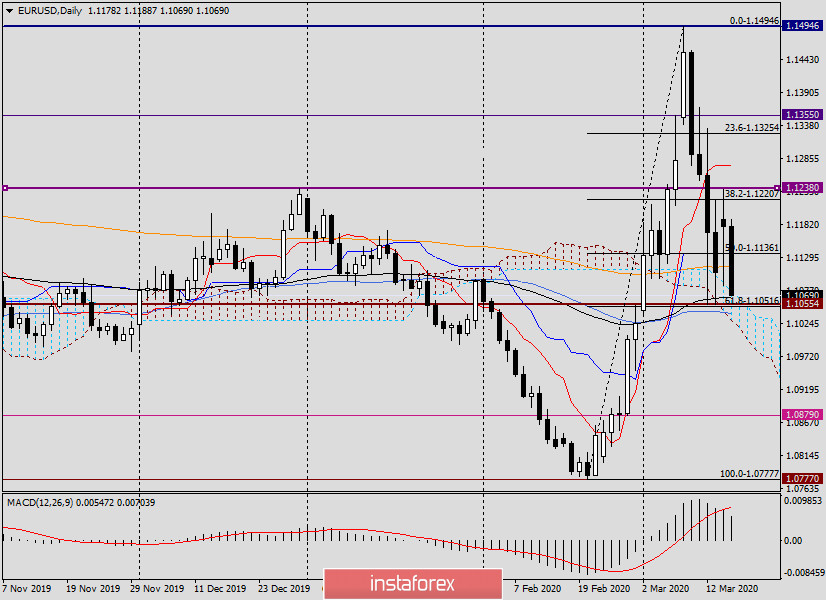

Daily

Yesterday's assumption to stay out of the market was not without reason. This conclusion can be reached by looking at the daily candle for March 16. The market went down, found support at 1.1085, where the upper border of the Ichimoku indicator cloud passes, after which there was a strong rebound and trading ended at 1.1178.

The long lower shadow of yesterday's daily candle indicates that the market is unwilling to move in a southerly direction. However, there are no sufficient grounds for growth yet. They will appear if the daily trading closes above the Tenkan line, which runs at 1.1275. At the time of writing, the euro/dollar is trading in the range of 1.1236-1.1055.

At the bottom, the same upper border of the Ichimoku cloud, 89 exponential, and 50 simple moving averages, as well as a strong support level of 1.1055 will definitely try to provide support. Do not forget about the lower border of the cloud, which today passes near 1.1028. I believe that only a true exit down from the Ichimoku cloud will indicate further bearish prospects for EUR/USD. All of the above represents a strong support area, which can be designated as 1.1075-1.1025. However, at the moment, the pair is trading near the 200 EMA and the Kijun line, which are also able to support the quote and send it up.

Resistances are represented by the level of 1.1236, the Tenkan line and the marks of 1.1355 and 1.1494.

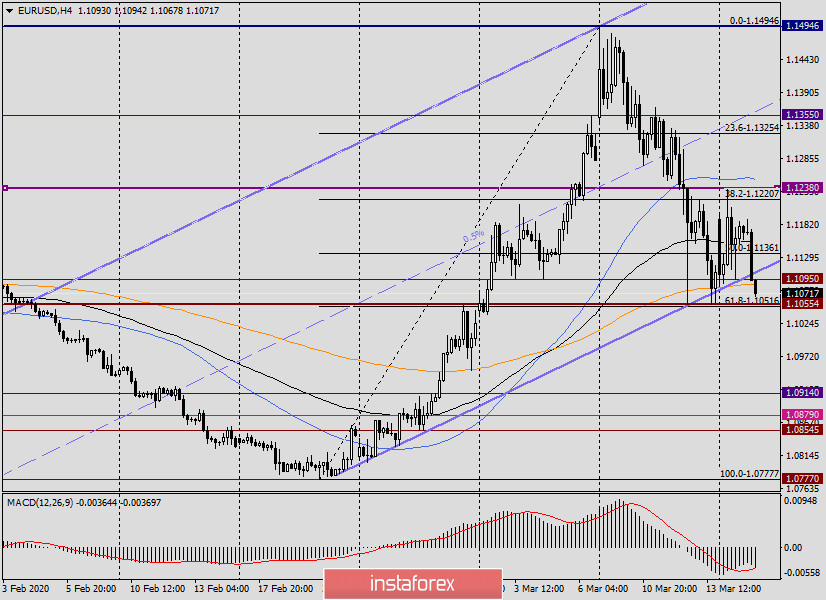

H4

In this timeframe, the pair breaks the support line of the ascending channel and the 200 exponential moving average. If the quote manages to get a foothold under the lower border of the channel and under 200 EMA, you can try to sell on the pullback to them.

However, the strong support level of 1.1055 is slightly lower. Perhaps a more reliable option for opening short positions on EUR/USD will be to wait for the breakdown of 1.1055 and consolidate under this level.

If this happens, we consider selling on a pullback to the price zone of 1.1055-1.1105. At the moment, this is the main trading idea for the euro/dollar.

Alternatively, you can try buying if the support of 1.1055 has a reversal bullish candle. In this case, I do not recommend setting large goals. Alternatively, this is the price zone of 1.1100-1.1125.

Regarding the goals, the same applies to sales. I believe that 1.0975/65 will be quite an adequate profit.

Due to the spread of the coronavirus, the markets are clearly feverish, and the situation can change dramatically at any moment. Be vigilant!