Hello, colleagues!

Global financial markets are in a state of panic and chaos. Yesterday, the stock market collapsed, and the price of Brent oil fell to the area of $30 per barrel.

To increase the liquidity of the global financial system, 5 (five) leading world central banks decided to support the Fed in the process of injecting liquidity into global financial platforms. This is a rather serious step that indicates the vulnerability of the entire global financial system to the threat of new coronavirus infection.

The Bank of Japan is one of the five central banks that supported the Federal Reserve's actions on coordinated regulation of global financial platforms. Something similar already happened in 2011, when the agreed swaps and the provision of liquidity to the Fed were supported by the Bank of Japan, the Bank of England, the Canadian Central Bank and the European Central Bank (ECB). The current similar decision only underscores the gravity of the situation caused by the coronavirus outbreak.

If we go to the technical picture of the USD/JPY currency pair, the situation is extremely interesting here. Let's try to understand it, and if we have technically sound trading ideas, we will determine the positioning.

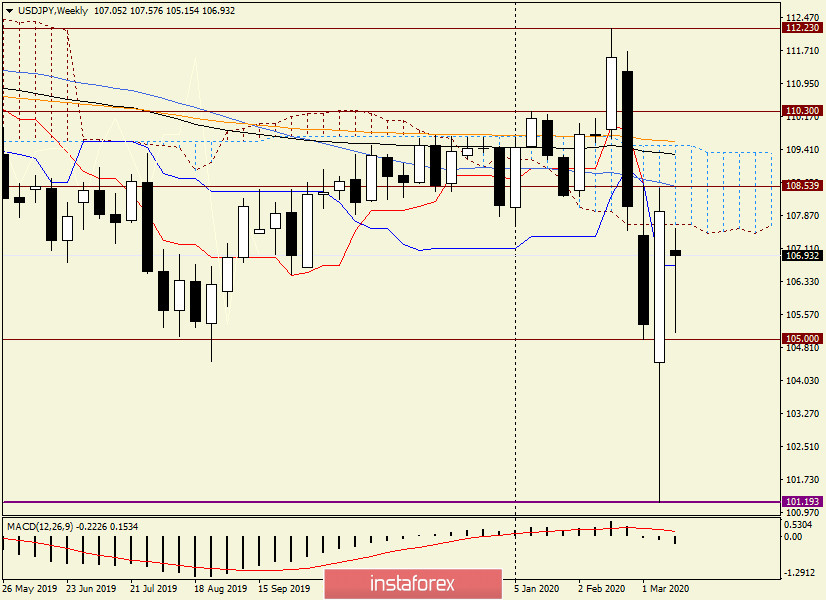

Weekly

It is difficult to call that what happened at the auction last week was a reversal. The bears wanted to continue to put pressure on the USD/JPY exchange rate, and at first, they were successful. However, after reaching 101.19, the pair found very strong support and started to recover.

At the same time, it is necessary to note the strength and intensity of this recovery. As a result of the strongest growth, a single-digit bullish absorption candle was formed. Absorption that does not cause the slightest doubt!

Moreover, the trading of the last five days ended within the cloud of the Ichimoku indicator, which in itself indicates a further tendency of the pair to grow.

This week's auction, in my opinion, is not inferior to the previous ones. Despite the fact that today is only Tuesday, the quote managed to fall to 105.15 and from there began an active recovery.

At the time of writing, the USD/JPY pair is trading near the opening price of weekly trading with the clear intention to move into positive territory, that is, to begin growth. If the current highs of this week are reached at 107.57, an attempt will be made to enter the limits of the Ichimoku cloud, the lower limit of which is at 107.66. If successful, the bulls on the instrument will try to move the rate higher, to the area of the past highs of 108.50.

Here it is necessary to note that the price zone of 108.00-108.50 is very strong and has repeatedly held back the price movement, turning it in the opposite direction. However, these prices still need to grow. At the end of the review, the dollar/yen is trading near another important and strong level of 107.00.

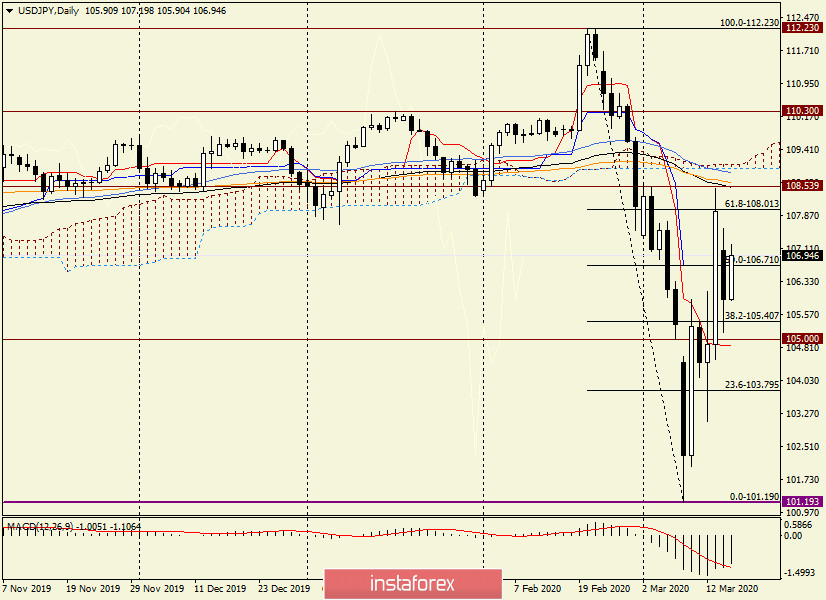

Daily

On the daily chart, the situation is ambiguous. We see a deep correction to the fall of 112.23-101.19, after which the "Harami" candle appeared. It is unlikely that it will be worked out by the market since it appeared in the middle of a downward movement. I am more inclined to think that in the context of the spread of the coronavirus epidemic, market participants will once again start buying the Japanese yen as the most popular and sought-after protective asset on the Forex currency market.

If this assumption turns out to be correct, I assume attempts to update previous highs at 108.50, which will most likely be unsuccessful.

In my opinion, the strong technical area itself near 108.50 has additional protection from the price going up in the form of 89 EMA, 144 EMA, and 50 MA. Thus, the area for sales can be designated as 108.00-108.85. More aggressive and risky sales can be tried from 107.35.

Given the difficult and constantly changing situation on the market, there is room for purchases of USD/JPY, which can be considered when the pair declines to the area of 106.60, and below near 105.80.

In my personal opinion, sales on the rise to the area of 108.00-108.50 have a higher priority. However, the current situation in the markets can present any surprises, and both scenarios must be considered.

Good luck!