Terrible data that was published today by the ZEW research center on the mood in the business environment in Germany and the eurozone put serious pressure on the euro. This once again confirms the complexity of the situation that governments of developed countries may face in the context of the spread of coronavirus. Although many people note its peak, which may correspond to April this year, this does not cause any fewer problems. The lack of a vaccine only worsens the situation in many countries, where many factories and enterprises have been quarantined and closed, and the economy has been placed in a state of emergency.

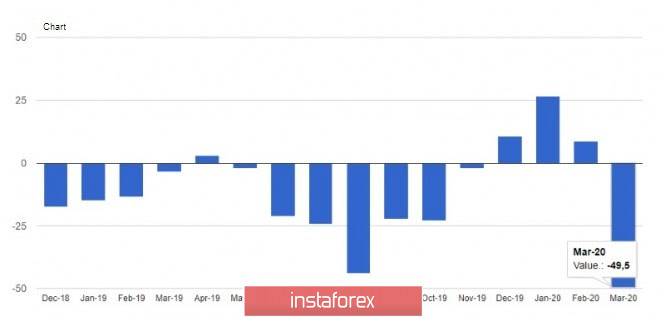

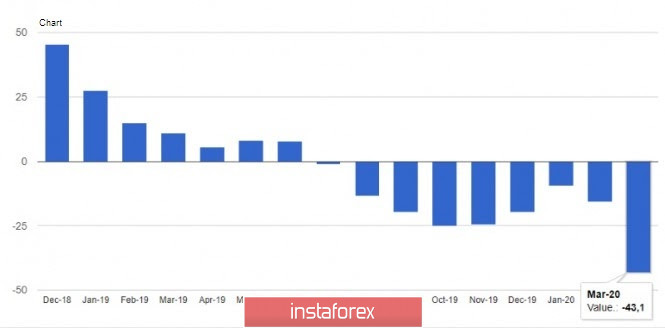

According to preliminary data, the indicator of economic expectations in Germany in March 2020 fell to -49.5 points against 8.7 points in February this year. Economists had expected a drop to -30 points. The main reason for the sharp deterioration in sentiment was the rapid spread of the Covid-19 epidemic in Europe. The ZEW current conditions index fell to -43.1 points from -15.7 in February, while economists had expected a reading of -32.7 points. Despite the fact that the fall was quite expected, however, a serious discrepancy with the forecasts led to the formation of pressure on risky assets. Many experts predict a reduction in Germany's real GDP in the 1st quarter, as well as a recession in the 2nd quarter of this year.

As for the eurozone, the index of economic expectations also fell sharply in March. The reasons are the same. According to the ZEW research center, the preliminary index of economic expectations in the eurozone in March this year was -49.5 points against 10.4 points in February, when it showed a slight recovery. The index of current conditions in the eurozone economy fell to -48.5 from -10.3 in February.

Data on labor costs and wages for the 4th quarter of 2019 remained unnoticed in the current conditions. According to the report, labor costs in the eurozone in the 4th quarter of 2019 increased by only 2.4% after an increase of 2.6% in the 3rd quarter. Wages in the eurozone in the 4th quarter also showed an increase of only 2.3% per annum against 2.6% in the 3rd quarter.

In positive news, we should note the actions of the French government, which promised companies and employees assistance in the amount of 45 billion euros. The French Finance Minister said that he expects the economy to decline by only 1% in 2020, but it is unlikely that the current half-measures will avoid a recession. Most likely, the assistance provided will be useful in the period after the recession, when the coronavirus will go down, and the economy will begin to gradually return to life. This will not happen until the 3rd quarter of this year, and then only if major bankruptcies and a sharp increase in the unemployment rate can be avoided before then.

As for the technical picture of the EURUSD pair, the pressure that is formed on risky assets is likely to continue in the conditions of nervousness and falling of the main world markets. A break in the support of 1.0990 will open the euro a direct path to the minimum of February this year in the area of 1.0900, 1.0860 and 1.0805.