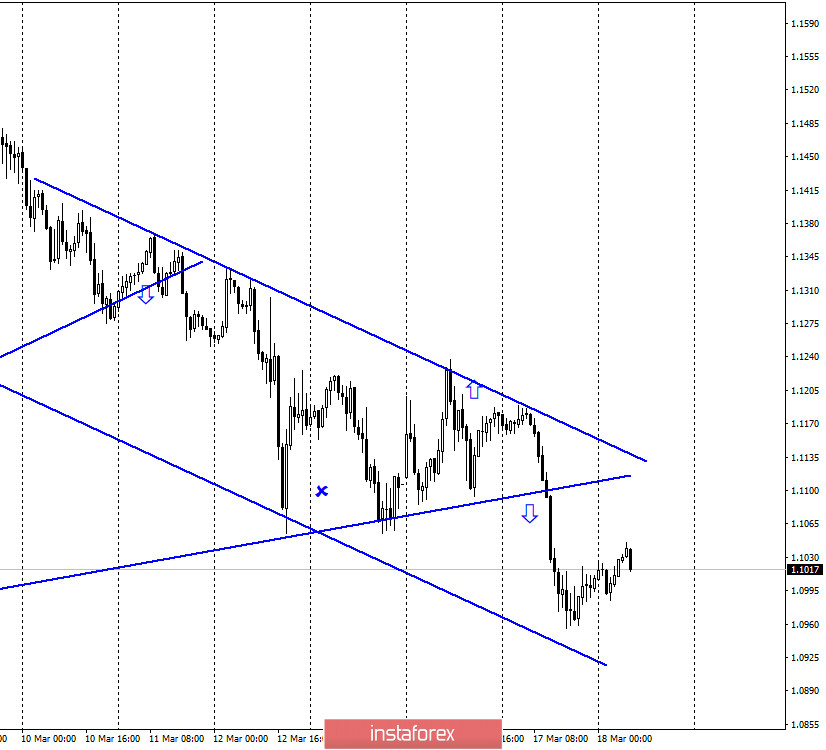

EUR/USD – 1H.

Hello, traders! March 17 was another shocking day for world markets, as well as for the euro currency, which resumed its fall in a pair with the US dollar. Key US stock indices fell again to record numbers, which did not add to the calm. The COVID-2019 virus epidemic also continues to spread. The number of cases of the pandemic, according to WHO, is growing every day. I was counting on the fact that the upward trend line on the hourly chart will keep the quotes above itself. However, bear traders again put pressure on the pair, which led to a new fall. But the downward trend corridor remains in force, which has slightly changed the angle of inclination. But it is now the most powerful graphical construction that keeps the "bearish" mood among traders.

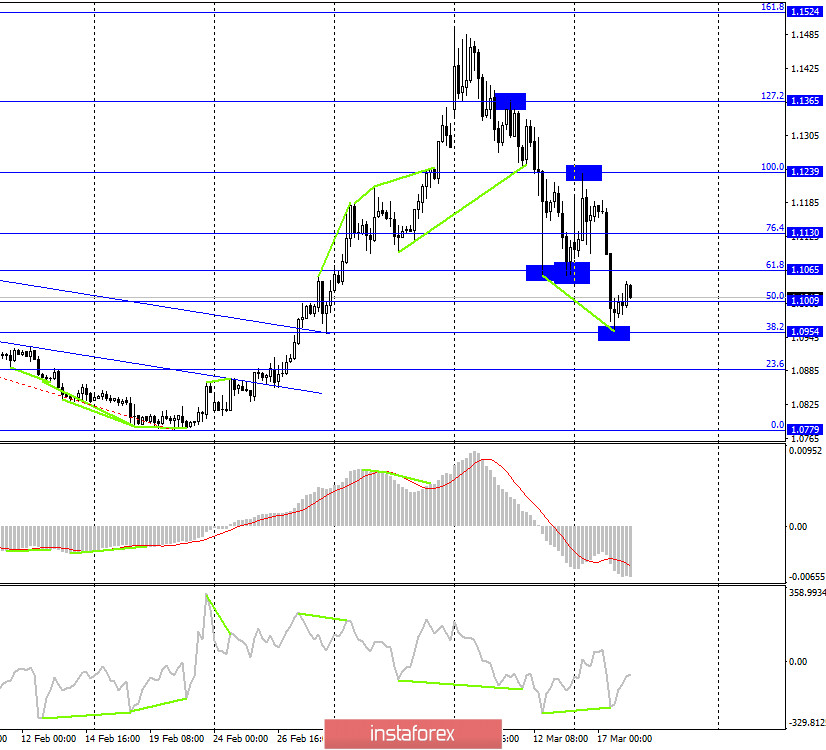

EUR/USD – 4H.

According to the 4-hour chart, the EUR/USD pair performed a fall to the corrective level of 38.2% (1.0954). After the formation of a bullish divergence in the CCI indicator, as well as a rebound from this Fibo level, the pair performed a reversal in favor of the European currency and began the growth process towards the corrective levels of 61.8% (1.1065) and 76.4% (1.1130). At the same time, the trend is now downward, so there are doubts that traders will easily change their mood to "bullish".

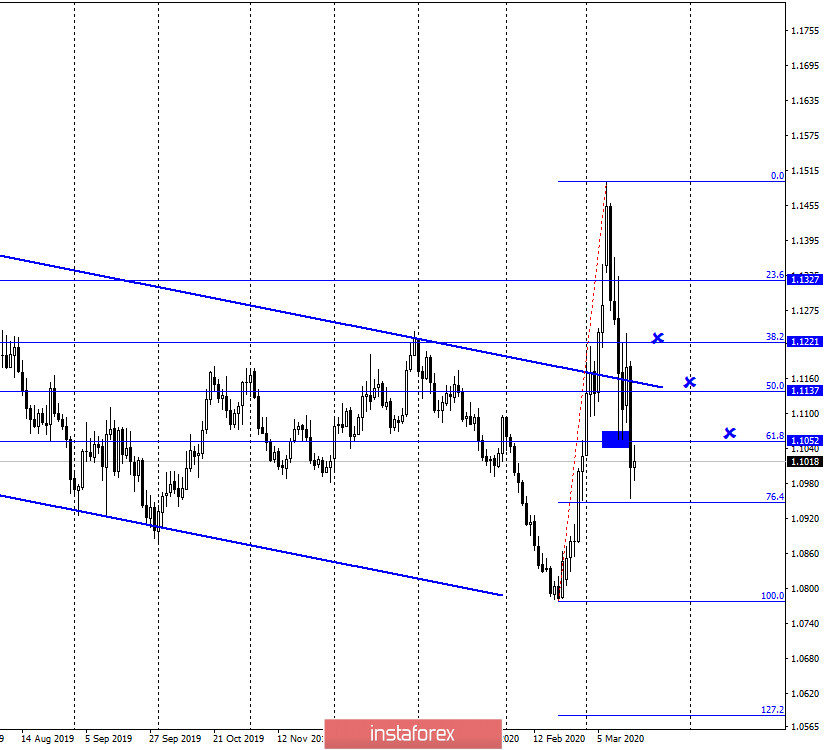

EUR/USD – Daily.

According to the daily chart, the euro/dollar pair made a consolidation under the corrective level of 61.8% (1.1052) and continues the process of falling towards the next corrective level of 76.4% (1.0948). The rebound of quotes from this Fibo level may work in favor of the EU currency on a longer-term chart, which will allow traders to count on some growth of the pair. However, I believe that now you can expect anything from the pair. Markets remain in a state of shock. The dollar is now popular, but everything can change at any time. The end of the pandemic is not yet in sight, so the shock in the markets will continue in the near future, but whether the dollar will be able to grow all this time is a big question.

EUR/USD – Weekly.

As seen on the weekly chart, the target of 1.1600 (approximate) remains in effect. Thus, if new buy signals appear and work out on the lower charts, then the level of 1.1600 will be the final and very realistic goal for bull traders. At the same time, the pair continues to fall in the direction of the upward trend line, and if it closes below it, it will significantly increase the probability of a further fall in the euro currency quotes.

Overview of fundamentals:

On March 17, the European Union released the index of business sentiment from the ZEW Institute, which was -49.5. This value eloquently indicates the current mood of most investors. Retail trade in the US was also expected to slow in February, and only industrial production was slightly higher than forecasts.

News calendar for the United States and the European Union:

EU - consumer price index (12:00 GMT).

On March 18, the EU inflation report will be released. It is expected to be 1.2% y/y in February. I believe that this report will not attract almost any attention from traders since all attention is now focused on reports about the fight against the epidemic.

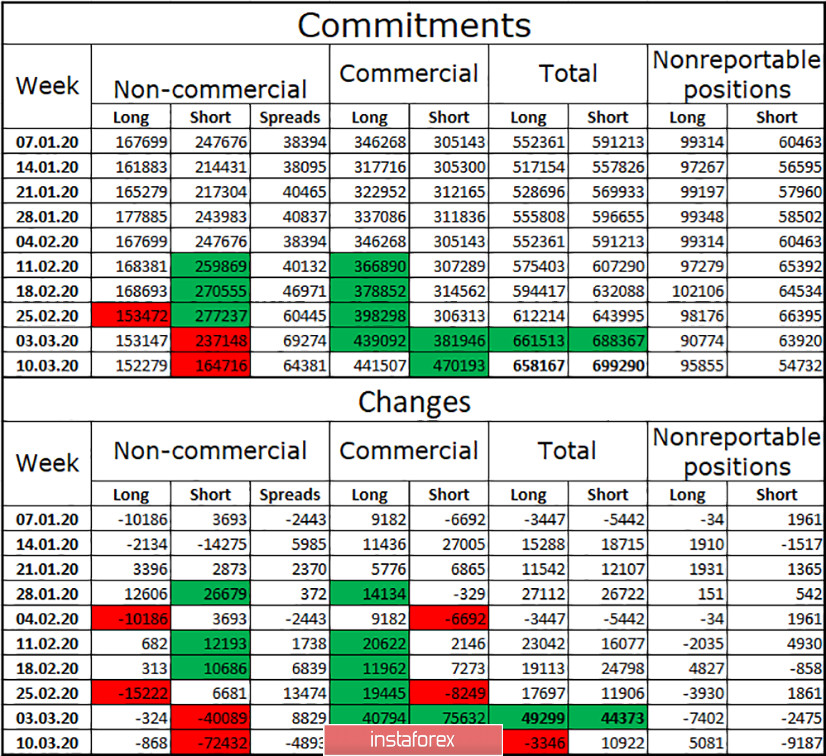

COT report (Commitments of Traders):

According to a new COT report, the total number of Long positions decreased among major players, while Short positions increased, which was clear even without the report, given the strong fall in the European currency quotes over the past week. However, there are also points that need to be highlighted. First, the total number of contracts continues to grow. That is, the activity of traders does not fall. Second, speculators get rid of Short positions and they are immediately picked up by hedgers. This suggests that market players who specialize in making profits from currency operations do not believe in a further fall in the euro. According to our observations, it is speculators who drive the market, and hedgers generally open opposite positions to insure against possible risks. Thus, given the strong reset of Short positions by speculators, I would say that there is a high probability of euro growth in the next week. However, you need specific signals to buy in order to work out this trading idea, which is not available at the moment. This means that the fall in quotes will continue for the time being.

Forecast for EUR/USD and recommendations for traders:

The EUR/USD pair has shown its reluctance to end the downward trend at this time. Closing below the trend line on the hourly chart increases the chances of further falls, but the rebound from the 38.2% level on the 4-hour chart and bullish divergence warns of possible growth. So we have mutually exclusive signals. There are no more specific trading ideas and trading signals at the moment.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.