Economic calendar (Universal time)

The economic calendar today has a lot of diverse statistics, but among the important indicators, we can only mention the European Consumer Price Index (10:00), the number of building permits issued in the USA (12:30) and crude oil reserves (USA, 14:30).

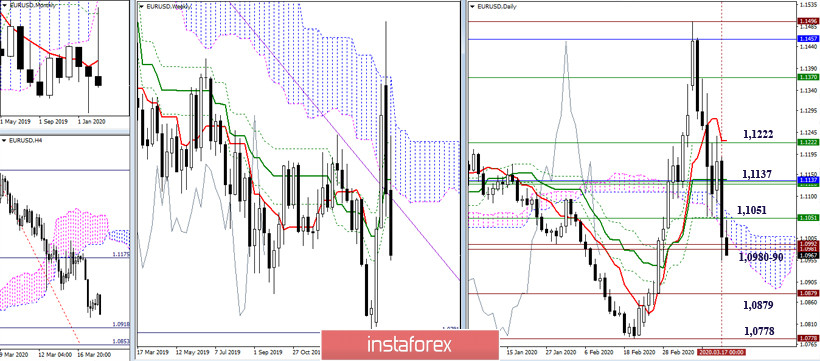

EUR / USD

The deceleration at the final supports of the daily and weekly Ichimoku crosses, as well as the daytime cloud, has ended. The players on the downside continued to decline, having violated the elimination of dead crosses and forming a new bearish target for the breakdown of the daytime cloud. At the moment, historical levels of 1.0980-90 are met, which now provide support and attraction. Among the further reference points, support 1.0918-1.0853 (historical level + target for the breakdown of the H4 cloud) and 1.0778 (minimum extremum) can be identified. At the same time, resistances formed by the accumulation of various levels of higher time intervals retain their location today at 1.1051 - 1.1137 - 1.1222.

Yesterday, the pair continued to decline after consolidating under the central Pivot level. In the current situation, the advantage is still completely on the side of the players to decline, despite being in the zone of a nascent upward correction. Moreover, updating yesterday's low (1.0955) will further strengthen the bearish sentiment and continue the downward trend. Today, the reference points for the decline within the day can be noted on the support of the classic Pivot levels 1.0912 - 1.0817 - 1.0678.

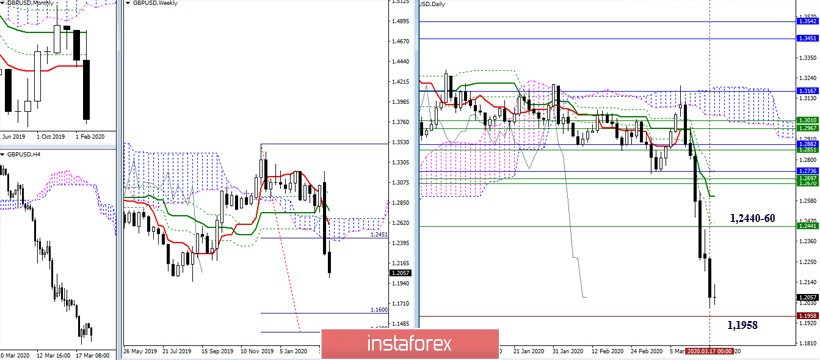

GBP / USD

The decline continues. The players to decline dominate using the potential of last week. The pair is close to the restoration of the monthly downward trend (1.0958). The next reference in this direction will be the target for the breakdown of the weekly cloud (1.1600 - 1.1388). The most significant resistance of the higher halves can now be noted in the area of 1.2440-60, where day Fibo Kijun and weekly Senkou Span A join their efforts.

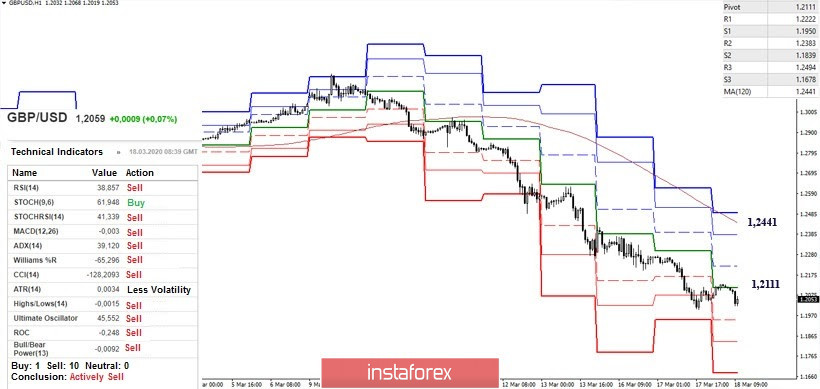

The downward trend continues its development, bearish reference points within the day are the support of the classic Pivot levels 1.1950 - 1.1839 - 1.1678. The downgrade players with the current decline are now using minimal adjustments. Under the current conditions, consolidation above the central Pivot level of the day which is located today at 1.2111, can serve the development of a longer and more effective upward correction. The next reference point for correction in this case will be the resistance of the weekly long-term trend (1.2441), intermediate resistance today can be noted at 1.2222 (R1) and 1.2383 (R2).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)