To open long positions on EURUSD, you need:

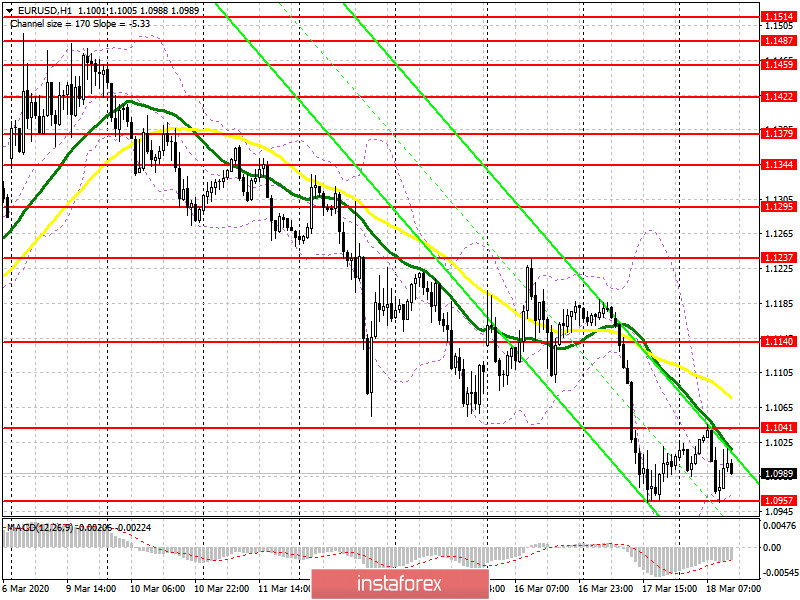

The repeated test of the support of 1.0957, which I did not particularly expect in my morning forecast, stopped the downward movement in the euro, however, after a slight upward correction, and weak data on inflation and the balance of foreign trade in the eurozone, the pressure on EUR/USD returned. If the bears achieve the third support test of 1.0957, then most likely buyers will not fight for it anymore and will retreat to larger lows in the area of 1.0909 and 1.0882, where I recommend opening long positions for a rebound with the goal of correcting by 30-40 points within the day. An equally important task for the bulls will be to break through and consolidate above the resistance of 1.1041, which will lead to the demolition of a number of sellers' stop orders and a sharper increase in EUR/USD to the highs of 1.1140 and 1.1237, where I recommend fixing the profits. Weak data on construction in the US, which may be released in the second half of the day, will only strengthen demand for the US dollar due to fears of an impending crisis.

To open short positions on EURUSD, you need:

Bears will be fully focused on breaking the support level of 1.0957 today, which they failed to do during the European session even on the second attempt. A break in this range will lead to another demolition of stop orders of euro buyers and a further decrease of the pair along with the trend to the area of lows of 1.0909 and 1.0882, where I recommend fixing the profits. Larger sellers will wait for the support test of 1.0807. However, the bears' task is also to protect the resistance of 1.1041, which I recommend opening short positions only if a false breakdown is formed. In the absence of volume and activity on the part of euro sellers, it is best to postpone sales for a rebound until the highs of 1.1140 and 1.1237 are updated.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 moving averages, which indicates a further decline in the euro on the trend.

Bollinger Bands

A break in the lower border of the indicator around 1.0957 will increase pressure on the euro. A break in the upper limit of the indicator at 1.1041 will lead to a larger upward correction.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20