Despite the active measures from the governments, many world currencies continue to show large-scale decline against the dollar, due to the increased expectations related to the spread of the coronavirus and the financial crisis, which will drive the world economy into a deep recession. Commodity currencies have suffered the most from this, including the British pound, which has lost more than 600 points in its pair with the US dollar. Moreover, sell-offs have also persisted in the stock markets.

New measures to help the US government:

US President Donald Trump announced yesterday that he is temporarily closing the Northern border with Canada, but it does not apply to trade. Both parties accepted the decision.

Trump also signed a bill providing paid time off and free testing for coronavirus, which the Senate approved later on.

US Treasury Secretary Steven Mnuchin also made another proposal, promising that the next stimulus package will include loans for the small businesses forced to suspend their operations, which will help maintain the stability of companies during a period of market tension. Mnuchin also said that the government will provide any assistance needed in this difficult time.

The Treasury Department also asked the Congress for permission to support the money markets by offering two rounds of direct payments ($ 250 billion each) to citizens, under the new program. Payments are scheduled to start on April 6.

Given how quickly panic is developing in the markets, the European Central Bank announced a new program, which will be aimed at fighting the economic slowdown caused by the coronavirus. Under the new program, the ECB will buy private, government bonds worth €750 billion euros until the end of 2020, but the full completion of the program will commence when the crisis passes.

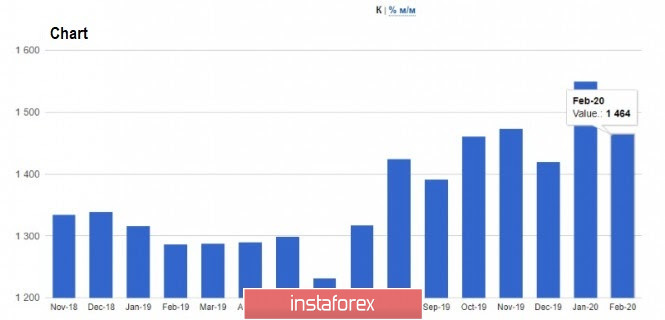

As for fundamental statistics, yesterday, the US Ministry of Commerce reported that new home construction fell by 1.5% in February, and amounted to 1.599 million homes per year. The number of issued housing permits also fell by 5.5% compared to January, and amounted to 1.464 million a year.

As for the technical picture of EUR/USD, the bears of the pair received a significant rebuff around 1.0800. However, in order for them to regain control in the market, they must not only return the pair to the support of 1.0860, but also prevent growth from happening above the resistance of 1.0975, where active sales of risky assets are expected. If the bearish scenario persists, the next targets for euro sellers will be the lows of 1.0740 and 1.0680.

GBP/USD

All these negative factors seriously affected the position of the pound:

The pound weakened due to the expected interruptions in the flow of foreign capital caused by the spread of the coronavirus. Foreign capital is necessary for the normal functioning of the UK financial system.

The second reason is the breakdown of negotiations between UK and EU after Brexit. Most likely, the UK government will be forced to ask EU for an extension in the term of negotiations on trade relations with the European Union, as the negotiations that were supposed to start in March this year did not take place.

The third reason is the decline in the service sector of the United Kingdom. This sector is a key in the UK economy, and its sharp decline will seriously hit the GDP growth rate of the country.

The statements from the UK Treasury and the Bank of England saying that the British economy is likely to weaken significantly in the coming months, did not add to the optimism of the buyers of the pound. Andrew Bailey, Governor of the Bank of England, tried to calm the markets by talking about the strength of the UK financial sector, but it did not help the currency much.

As for the technical picture of the GBP/USD pair, we should not expect any growth or rebound from the pair, as the lows are still very far away. Moreover, yesterday's decline of more than 6.0% may only be the beginning of a prolonged downward trend, just like what was observed in 2008.