Mass media and disinformation continue to increase the hysteria and panic about the coronavirus, against which a perfect financial storm is taking place. Apparently, the markets are still far from feeling for at least some semblance of the bottom. The most dramatic events unfold in the currency market, where new records are set every day. The pound was especially distinguished yesterday, which, having reached the previous lows, effortlessly took down the long-forgotten stop-losses there and set off for free fall into unknown depths. After all, what is interesting is there. However, this time, it was not without the help of the Brussels bureaucracy, which is not going to start any specific negotiations on a trade agreement designed to regulate relations between Great Britain and the European Union as early as next year. And there is less and less time. In general, Brussels does not exclude the possibility of postponing negotiations, as it now has more important things to do. Naturally, the main and only cause is called coronavirus. But the result is the same. Europe is systematically attacking any attempts by London to conclude at least some kind of agreement that will allow it to minimize future economic losses. And this is done solely in order to win the European business, which will simply displace British companies from the European market. To achieve this goal, any means are good. Moreover, no one dares to reproach Brussels with malicious intent, since it is busy with the noble work of saving Europe from the terrible ailment. Well, then , everyone will just raise their hands and say that, they say, we no longer have any negotiations on an agreement there, so, I'm sorry, but the UK will have to face terrifying economic consequences. Brussels' officials will cry and swear that they wanted the best and made every conceivable and unthinkable effort, but the coronavirus pandemic confused all the cards. In short, everything is as always the same - in matters of achieving economic benefits, no one cares about the principles of free trade and competition. Any of the dirtiest and meanest tricks are used. Nevertheless, Brussels has one goal - to throw British companies out of the European market. And the fact that Brussels is the winner is clearly seen in the behavior of the single European currency, which, unlike the pound, was able to slightly improve its position even at the end of the day and showed everyone how the local rebound looks in the current situation. And of course, when you look at the speed with which the pound is going, you can't help but remember the words of Mark Carney that Brexit can cause the parity of the pound with the dollar.

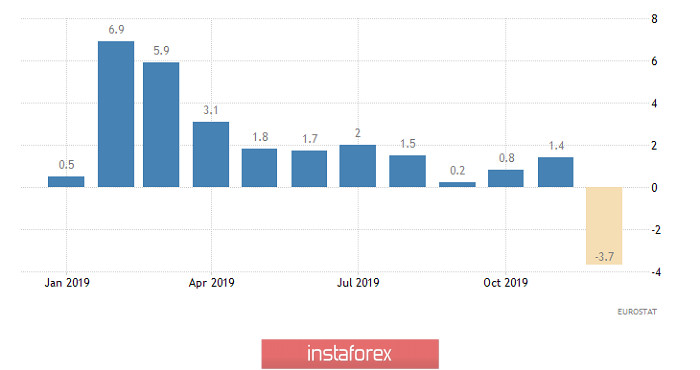

Nevertheless, the single European currency continues to decline in the bottom line, although not at such a terrible pace as the pound. In fact, the common European currency has no reason to increase. As expected, inflation declined from 1.4% to 1.2%, so it is time for the European Central Bank to think about the possibility of lowering the refinancing rate. However, there were strong fears that the slowdown in inflation would turn out to be somewhat larger due to its sharper decline in Italy and Spain. But it worked out this time. What can not be said about the trade balance of the eurozone, the surplus of which is rapidly shrinking to zero. If it amounted to 23.1 billion euros in December, then in January, it was only 1.3 billion euros even though they were expecting a trade surplus of 2.8 billion euros.

Inflation (Europe):

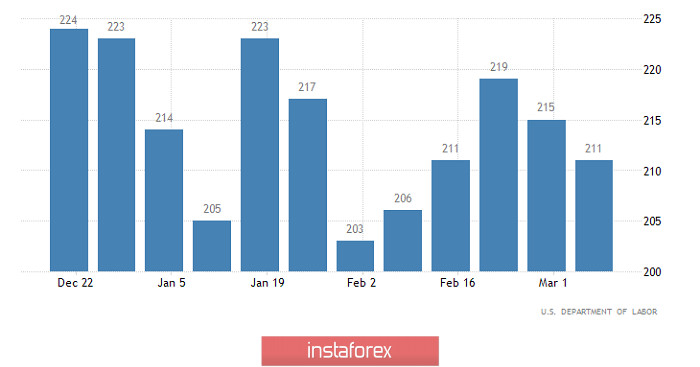

In conditions of an ideal financial storm, any macroeconomic statistics has practically no value. The market did not notice data on the construction sector of the United States yesterday, which reported a decline once again. So, the number of issued building permits decreased by 5.5%, from 1,550 thousand to 1,464 thousand. Moreover, the volume of new house construction decreased by 1.5%, from 1,624 thousand to 1,599 thousand. Another thing is that these data were never particularly worrying about the market and their impact was extremely limited. Although this data is directly related to industry, which recently showed zero growth, the decline in construction hints that the recession in US industry will resume soon.

Number of Building Permits (United States):

Today, Europe reports on construction, where they also do not expect anything good, since construction volumes can decrease by 2.8%. At the same time, there was already a decrease in the previous month, as much as by 3.7%. So the construction industry may show a decline for the second month in a row, which further casts doubt on the prospects for the industry to emerge from the protracted recession.

Scope of construction (Europe):

However, the United States also does not expect anything good. The total number of applications for unemployment benefits should increase by 14 thousand. In particular, the number of initial applications for unemployment benefits may increase by 8 thousand. The number of repeated applications for unemployment benefits by another 6 thousand

Number of Initial Jobless Claims (United States):

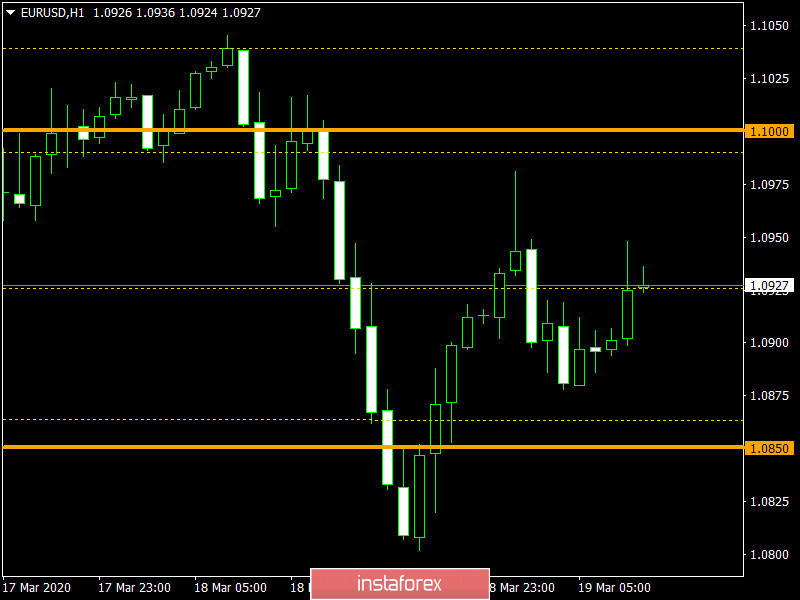

The euro / dollar currency pair was also subject to panic decline, where it managed to go down locally towards 1.0802. In fact, a reverse stroke occurred after the jump, practicing about half the inertia. It is likely to assume that we are waiting for a temporary fluctuation in the range of 1.0870 / 1.0980.

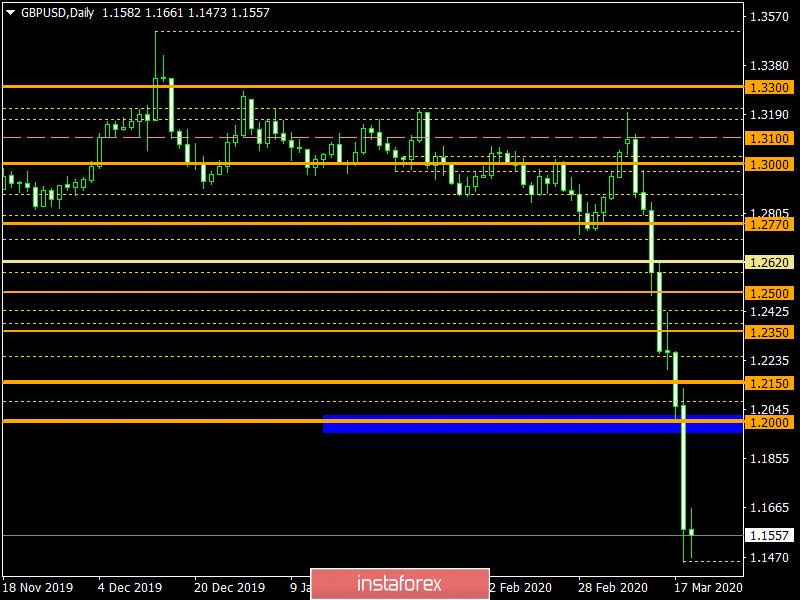

The pound / dollar currency pair showed extremely high activity, where the quote managed to reach a critically low level of 1.1452 during the past day. In fact, we ran into a panic and on the basis of which, there was an update of historical lows. It is likely to assume that stagnation and technical rollback are possible with the overheating, but at the same time, it is worth monitoring the existing minimum of 1.1452 to fix the price below it, where panic decline may occur again.