Hello!

Tonight came the news that the Reserve Bank of Australia (RBA) has again cut the main interest rate by 25 basis points. I don't think this news surprised anyone very much.

In the current situation associated with the spread of the coronavirus epidemic, any central bank in an emergency, without waiting for its next meeting, can resort to reducing rates. This is done to support the economy and financial system in the context of COVID-19 spreading around the globe.

So the RBA statement says that this measure should help maintain the banking system, as well as cheaper loans for medium and small businesses. The Australian Central Bank also hopes that the economy will soon recover from the effects of the coronavirus and is ready to continue making decisions that will help support the country's financial and banking system.

In addition, data on the Australian labor market was published today, which turned out to be better than expected. Thus, unemployment fell to 5.1%, although the indicator was expected to remain at 5.3%. Employment in the country also significantly exceeded the forecast of 10,000 and amounted to 26,700.

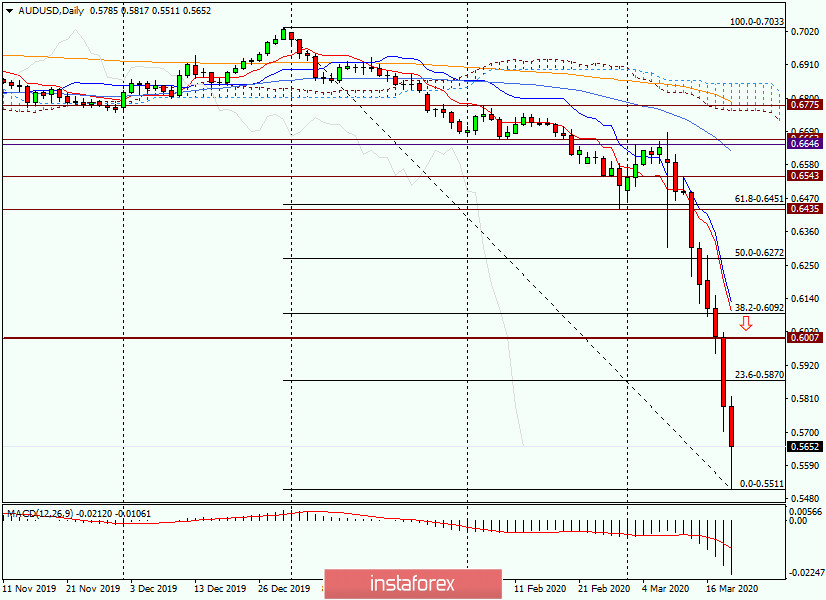

Let's see how the AUD/USD currency pair reacted to these events, and start with the daily chart.

Daily

After the initial decline to the level of 0.5511, on the news of the RBA's interest rate cut, the pair bounced back from this level and is trying to adjust to its fairly long and strong decline.

The nearest target for a possible corrective pullback may be the level of 23.6, according to the Fibonacci grid, which is stretched for a fall of 0.7033-0.5511. I consider the important psychological and technical level of 0.6000 to be a longer-term goal. In the case of an even deeper correction, the "Aussie" will rise to the area of 0.6100-0.6130, where 38.2 Fibo from the indicated decline, as well as the Tenkan and Kijun lines of the Ichimoku indicator.

I have repeatedly noted that after such strong movements as the current downward movement, the correction is often limited to the first pullback level of 23.6, after which the main movement resumes. We'll see what happens this time. I believe that a lot will depend on the candle model that will be formed after the closing of today's trading. If an explicit bullish reversal pattern appears, the assumption of a rate adjustment will be confirmed.

In this case, those who want to try to buy AUD/USD, I would like to emphasize that such positioning against a strong downward trend carries significant risks.

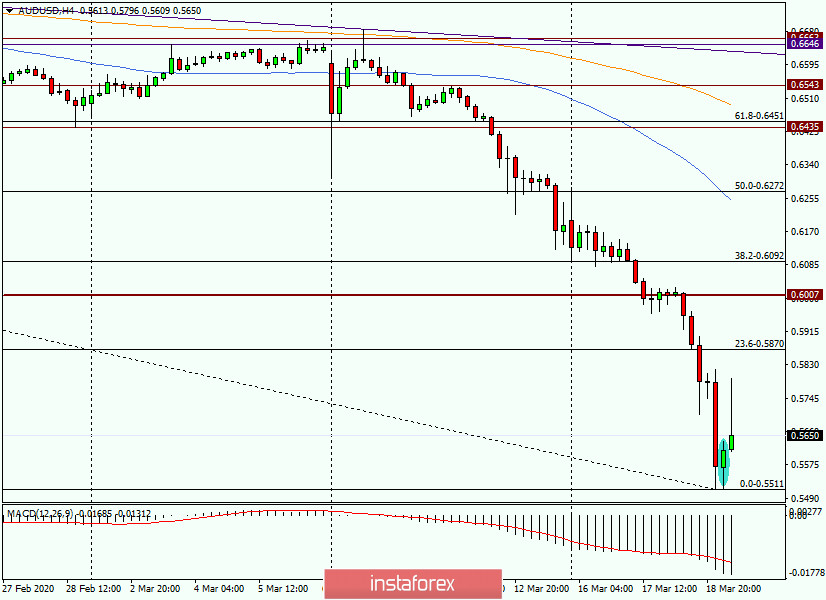

H4

On the 4-hour chart, we see a typical example of how risky positions are against the trend.

After the appearance of a highlighted candle, which could be considered a reversal, the pair rushed up, and it would seem that it will continue the corrective rise. However, this was not the case. Already near 0.5800, the growth has dried up, and at the end of this article, the current four-hour candle has a long shadow at the top, and the bullish body is melting before our eyes.

If the candle remains that way, it is likely that this will be a signal to complete the correction and resume the decline. However, anything can happen, and it will not be surprising that the bulls on the "Aussie" will make another attempt to break the level of 0.5800, which will be successful.

The main trading idea for the AUD/USD pair, of course, is sales, which are better considered after the rise to the designated correction goals. For those who use a breakdown trading strategy, another option will be to sell when the current support level of 0.5511 is broken.

Success and profitable trading!