EUR/USD – 1H.

Hello, traders! March 18 was another shocking day for world markets, as well as for the European currency. US stock indices fell again, and oil updated multi-year lows, falling to the level of $20 per barrel. The COVID-2019 virus continues to take over the planet Earth. Thus, there is no reason why the markets should calm down yet. The new downward trend corridor clearly shows the "bearish" mood of most traders in the market. Yesterday, even below this corridor, the pair's quotes were fixed for some time. Fortunately, in the late afternoon, a corrective pullback began, which gives hope for the recovery of not only the euro but also the pound, oil and US stock indices. The EUR/USD pair has almost fulfilled the target level of 1.0786.

EUR/USD – 4H.

According to the 4-hour chart, the EUR/USD pair resumed the process of falling, despite the formation of a bullish divergence in the CCI indicator. The pair's quotes performed a reversal on March 18 in favor of the US currency and closed under the corrective level of 76.4% (1.0949) and continued for some time to fall towards the next Fibo level of 100.0% (1.0779). However, at the moment, a reversal in favor of the EU currency has been made and a return to the correction level of 76.4%. Closing the pair's rate above this Fibo level will work in favor of continuing the growth of quotes.

EUR/USD – Daily.

As seen on the daily chart of the euro/dollar pair, the picture is identical to the 4-hour chart, since the same Fibonacci grid is in effect. The total drop in the last seven days is almost equal to the previous increase in 13 days. It turns out that in exactly 20 days, the euro currency first went up 700 points, and then down the same amount. The rebound of quotes from the Fibo level of 100.0% (1.0779) will allow traders to count on a reversal in favor of the euro currency and long-term growth. However, closing quotes below this level will significantly increase the probability of a further fall in the direction of the next Fibo level of 127.2% (1.0584).

EUR/USD – Weekly.

On the weekly chart, the target of 1.1600 (approximate) remains in effect. However, the pair's quotes returned to the lower line of the "narrowing triangle". Thus, once again, the question is whether there will be a rebound from this line or closure under. In the second case, traders can expect a long fall in the European currency.

Overview of fundamentals:

On March 18, the European Union released the consumer price index for February, which was 1.2% y/y and 0.2% m/m. Given how much the euro/dollar pair went down during the day, and only then up, I believe that this economic report did not attract the attention of traders, as well as any other reports in recent weeks.

News calendar for the United States and the European Union:

On March 19, important economic reports and events are not included in the calendar of the European Union and the United States.

The information background that really interests traders is still only about the coronavirus and its spread around the planet. All other news is almost not marked by traders.

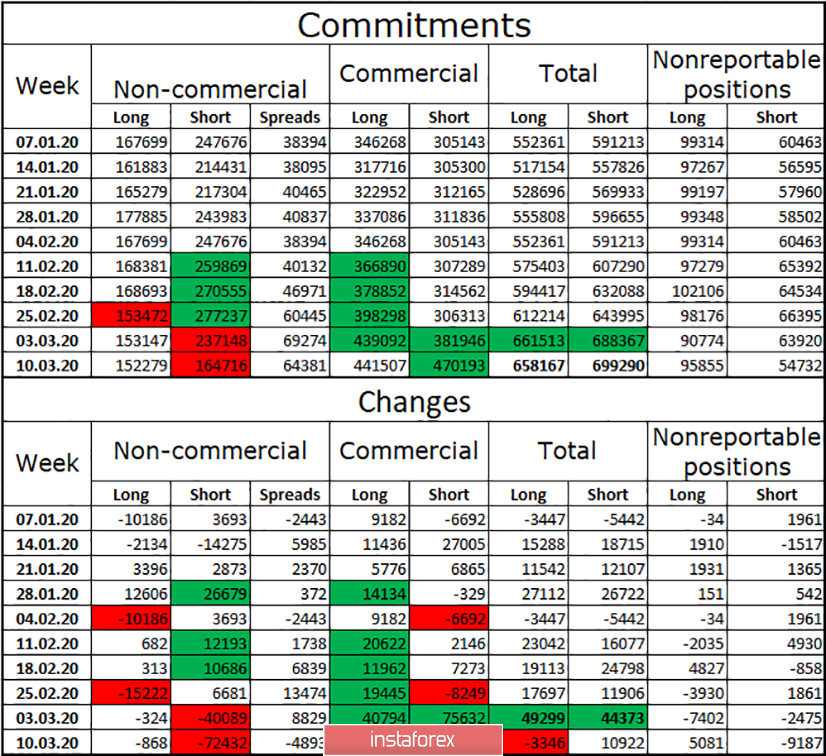

COT report (Commitments of Traders):

The new COT report will be available tomorrow. Given the severe storm in the market and the fact that the report was formed on Tuesday, but it comes out with a three-day delay, the data in it may already be outdated. However, I still hope to see figures on the reduction in the total number of short positions, as well as a reduction in the number of short positions in the "Non-commercial" group. Right now, bull traders need to stay above the upward trend line on the weekly chart at all costs. Otherwise, the euro currency will be prone to a longer and stronger fall in the future of the next year.

Forecast for EUR/USD and recommendations for traders:

The situation for the EUR/USD pair is now a little confused. A strong signal to buy (although counter-trend) will be a rebound from the corrective level of 100.0% (1.0779) on the daily chart. The new signal for sales will be a rebound from the Fibo level of 76.4% (1.0949) on the 4-hour chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.