To open long positions on EURUSD, you need:

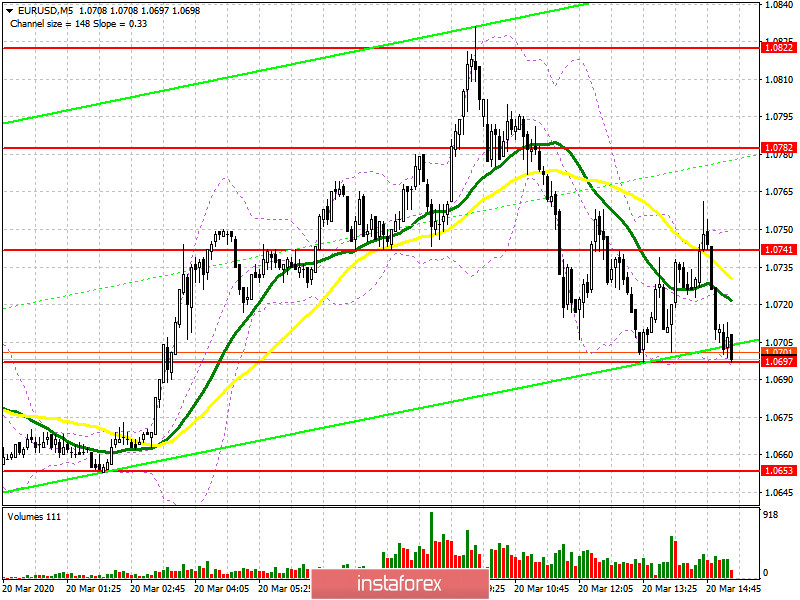

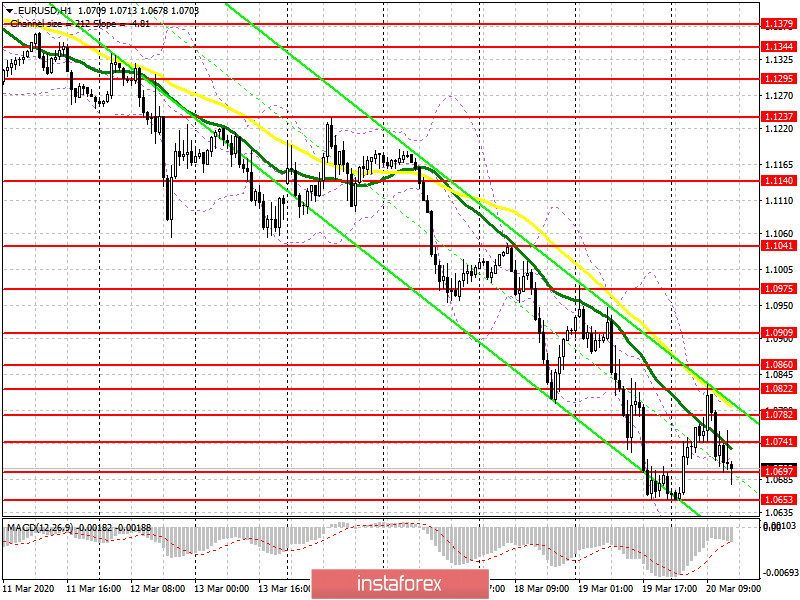

In the first half of the day, after the end of the Asian growth and an unsuccessful attempt to continue it at the start of European trading, buyers began to gradually lock in profits. In the morning forecast, I paid attention to sales from the resistance of 1.0822, which is clearly visible on the 5-minute chart. This arrangement helped to quickly return EUR/USD to the support of 1.0782, where the pressure on the euro increased. In the second half of the day, it is unlikely that buyers will try to save the level of 1.0697, which is now close to the pair. Most likely, the entire focus will be shifted to the weekly minimum in the area of 1.0653, but I recommend opening long positions from it only after the formation of a false breakout. Long positions immediately on the rebound are best postponed until the support test of 1.0607 and 1.0572.

To open short positions on EURUSD, you need:

The bears perfectly coped with the task of forming a false breakout in the resistance area of 1.0822, and then returned to the market again after fixing below the level of 1.0782, which is clearly visible on the 5-minute chart. At the moment, the task remains to break through and consolidate below the support of 1.0697, which will maintain a bearish trend and lead to another test of this year's minimum in the area of 1.0653. A lot depends on this level, as its breakout will open a direct path for sellers to the support area of 1.0607, 1.0572 and 1.0549, where I recommend fixing the profits. In the scenario of another attempt by the bulls to return, it is best to look at short positions with a false breakout from the level of 1.0741, or slightly higher, from the morning resistance of 1.0782.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 moving averages, which indicates a further decline in the euro on the trend.

Bollinger Bands

In the case of an upward correction in the second half of the day, the upper limit of the indicator around 1.0800 will act as a resistance. If the euro declines, the lower border of the indicator of 1.0620 will provide temporary support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20