To open long positions on GBPUSD, you need:

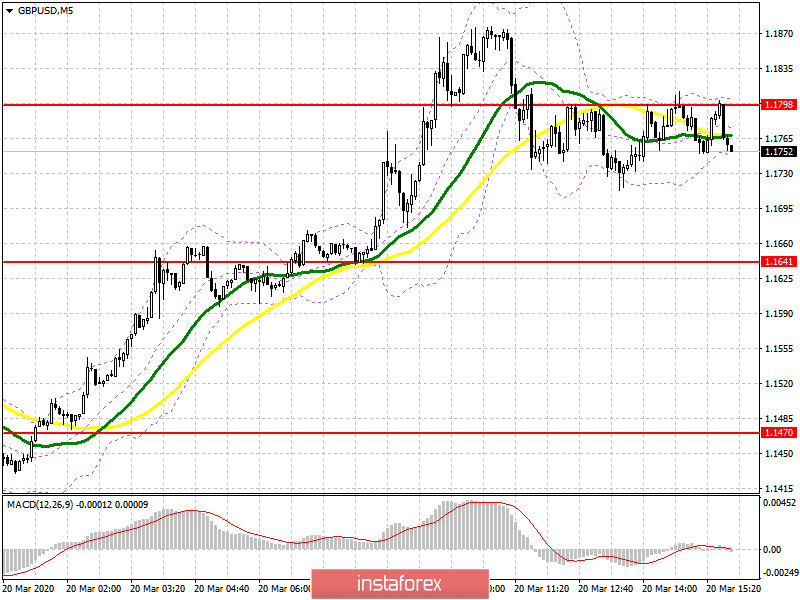

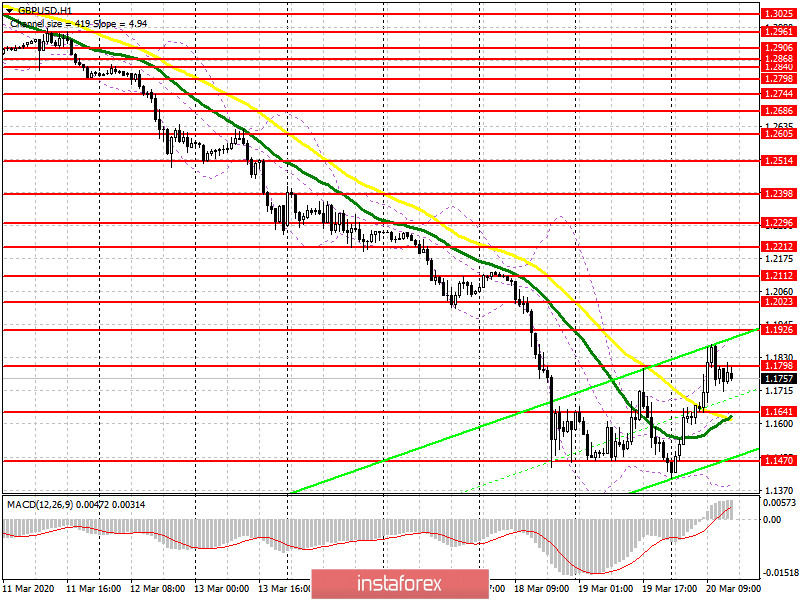

In the first half of the day, the bulls tried to break above the resistance of 1.1800, and it would seem that they managed to do so. However, after small profit-taking by speculators, the bears took advantage of this moment and returned the GBP/USD to the level of 1.1800, for which there is now an active battle. This is clearly visible on the 5-minute chart. In the second half of the day, a repeated breakout of the resistance of 1.1800 may lead to a new upward wave already in the area of highs 1.1926 and 1.2023, where I recommend fixing the profits. However, in my opinion, it is best to open long positions after a correction to the support area of 1.1641, with the condition that a false breakout is formed there, or to rebound from this year's low in the area of 1.1470.

To open short positions on GBPUSD, you need:

The bears will continue to focus on protecting the resistance of 1.1798, which they almost missed today in the first half of the day. While trading is below the level of 1.1798, the pressure on the pound will continue, which allows us to count on a repeated decline in the GBP/USD to the intermediate support of 1.1641, the breakthrough of which will provide the sixth test of this year's minimum of 1.1470, where I recommend fixing the profits. In the scenario of the pound rising above the resistance of 1.1798, and in the second half of the day, the release of important fundamental statistics is not expected, which may cause major sellers to postpone the activity until next week. Short positions can be returned after updating the maximum of 1.1926 and rebound from the resistance of 1.2023.

Signals of indicators:

Moving averages

Trading is conducted above the 30 and 50 daily averages, but it is very early to talk about the end of the bearish trend.

Bollinger Bands

In the case of an upward correction, the upper limit of the indicator in the area of 1.1880 will act as a resistance. In the scenario of a decline in the pound in the second half of the day, the average border of the indicator around 1.1641 will provide support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20