The fight has already begun and Saudi Arabia had won the first round. We will discuss the oil market and its prospects.

It is obvious that Saudi Arabia has chosen a blitzkrieg tactic, accompanied by powerful information. First, SA announced an increase in oil production to 12.3 million barrels per day, and second, it began offering a significant discount to European buyers, seeking to use its reserves to oust Russia from this market.

The moment, I must say, the Saudis chose quite well. Europe has become the epicenter of the coronavirus, and fuel consumption on the continent has fallen significantly. This brought down the price of oil, and Russian oil in Europe became impossible to sell. According to Reuters, oil traders were unable to sell oil in Europe, despite the offered discount:

* Trafigura offered to load Urals from Primorsk or Ust-Luga on March 30-April 3 at the price of Brent -$3.35 per barrel, but could not find a buyer.

* Glencore offered to ship 100 thousand tons of Urals from the Baltic ports on April 4-8 at the price of Brent -$3.70 per barrel.

* Glencore also offered to load the cargo on March 27-31 at the price of Brent -$ 3.80 per barrel, but could not find a buyer.* Shell offered 100 thousand tons of Urals ex-Baltic ports on March 31-April 4 at the price of Brent -$3.25 per barrel, but no one was interested.

* Total offered Urals-cargo for loading on March 28-April 1 at the price of Brent -$3.30 per barrel, but was also unable to find a buyer.

* Trading house Glencore has chartered the 3-million-barrel oil carrier Europa to store oil at sea for at least 6 months, trade sources said on Tuesday.

As a result of falling demand and discounts offered, oil fell to the lowest levels in 2002. North American grade WTI #CL in the April contract fell to the level of $20, North sea grade Brent in the may contract fell to the level of $24.50.

Thus, it is safe to say that Saudi Arabia has won the first round of confrontation in the oil price war. The actions of the gas station country scared even American congressmen - Republicans, who wrote a letter to the king asking him to stop destroying the American oil industry.

However, a battle won is not a war won. In order to win the war, Saudi Arabia must keep prices low for a long time. Initial analysis shows that shale producers are insured against price cuts for 3-6 months. We can assume that Russian producers are also insured for this depth, and the Saudis themselves probably hedged their risks. Thus, the price should be kept at the current values for at least a year, preferably two. Perhaps during this period, the demand for oil will be really low, which will help the Saudis to keep dumping, but will they be able to keep oil prices low themselves? This is a big question that the US Energy Information Agency (US EIA) is trying to answer.

Let's use this information and look at the prospects for oil production by OPEC countries. As follows from the data published by the Agency in the short-term forecast for March 2020, made after the beginning of the confrontation between Saudi Arabia and Russia, in February the cartel countries produced 28.5 million barrels per day, and in December 2020 their oil production will be 29.4 million barrels, an increase of just 0.9 million barrels. The problem with the Saudis is that their increase in production is compensated by interruptions in supplies in other countries. And SA's ability to significantly increase production, while reducing Saudi Aramco's capital expenditures, also raises big questions for many analysts.

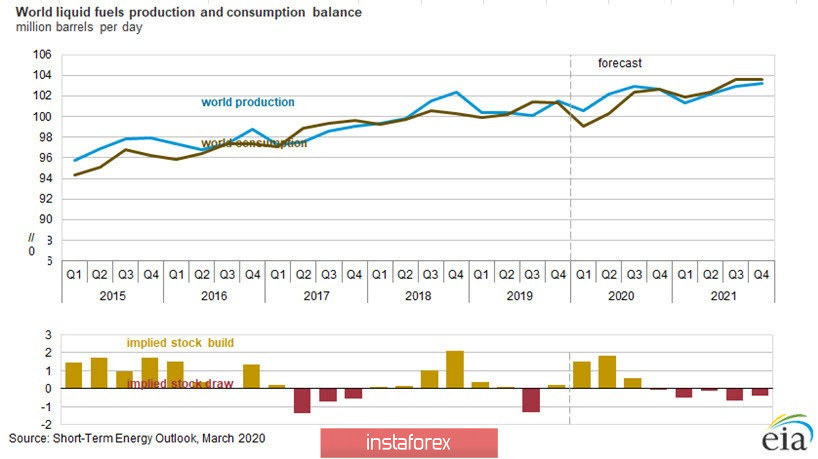

Rice.1: Balance of supply and demand in the oil market in 2020 and 2021

Shale producers will not reduce their production this year either. According to the US EIA, US oil production in December 2020 will be 12.99 million barrels per day against 12.23 million barrels in 2019. At the same time, according to analysts of the agency, the price of oil in the second half of the year will begin to grow and the average for Brent will be $43 per barrel. World oil production will be at the level of 102.1 million barrels per day, while consumption will be at the level of 101.1 million barrels (Fig.1), which will cause a surplus in the oil market. In turn, the surplus will lead to an increase in inventory.

At the same time, the COVID-19 coronavirus pandemic may make its own adjustments and lead to a deeper drop in oil consumption and price. In any case, Saudi Arabia needs to prepare for a long standoff, and it is still unclear whether it will be able to maintain current production levels at high values, especially since it is now simply selling off its reserves and actively bluffing in the information field.

At the same time, Saudi Arabia and the United States can agree on joint actions against Russia. The US is already taking steps to close the world market for Russian oil through the introduction of various sanctions. This was problematic in the context of a shortage of oil, but in an environment where the markets are under pressure from a surplus, removing Russian oil may be a compromise option acceptable to both sides. Therefore, it is highly probable that this is the case. At the same time, the main factor affecting oil and other markets is the COVID-19 coronavirus pandemic, which caused a sharp drop in demand for fuel. To paraphrase a well-known saying - God created all countries different, but the coronavirus equalized their chances.