To open long positions on EURUSD, you need:

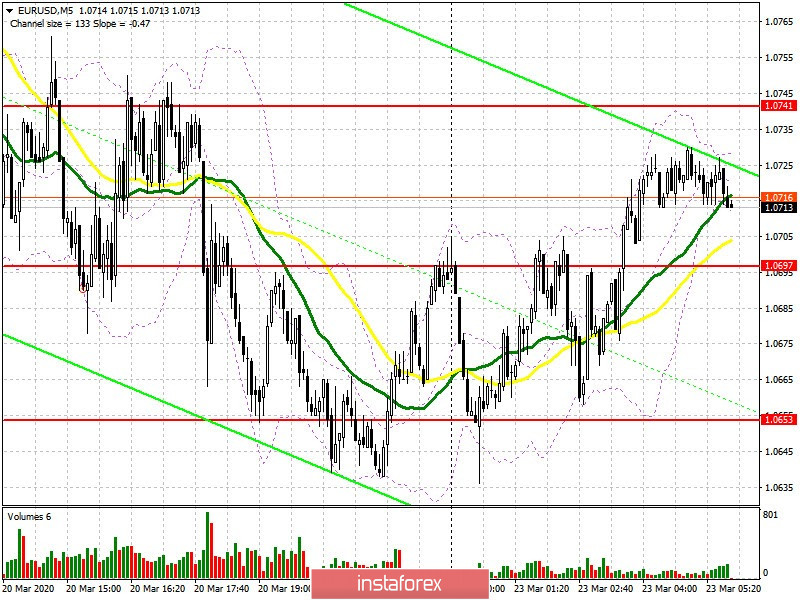

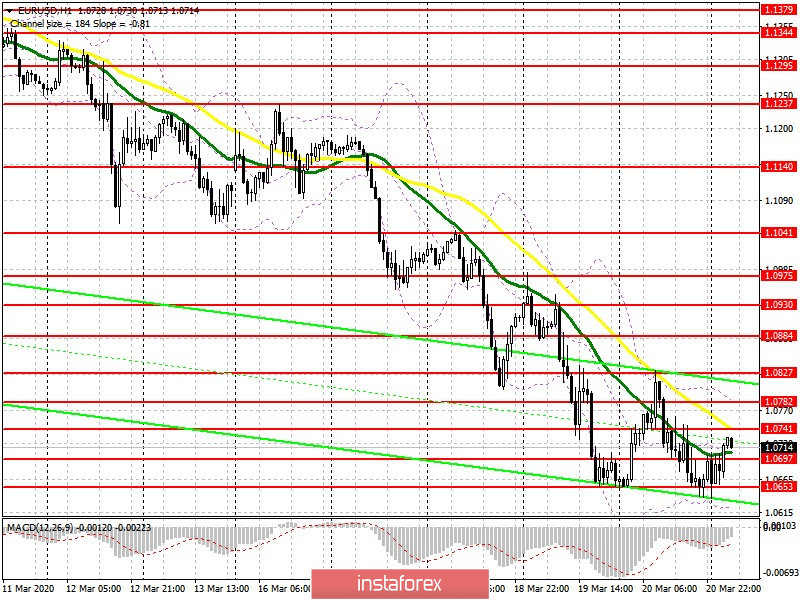

All attempts to raise the European currency during Friday trading led to another sell-off after updating fairly large resistance levels, which can be clearly seen on the 5-minute chart. I have repeatedly drawn attention to these levels. At the moment, a very important task for the bulls to keep the pair in the side channel is to break and consolidate above the resistance of 1.0741, which will strengthen the demand for the euro and lead to an upward correction to the high of 1.0782, and even to a return to the upper boundary of the side channel of 1.0827, where I recommend taking profits. Given that there are no important fundamental statistics planned for today, except for a weak report on the consumer confidence indicator in the eurozone, it is not quite correct to expect a large increase in the euro. In the scenario of EUR/USD returning to 1.0697 support in the first half of the day, it is best to open long positions against the trend only after a false breakout at this year's low, or after testing new supports in the area of 1.0607, 1.0572 and 1.0549.

To open short positions on EUR USD you need:

The sellers of the euro performed well on Friday after the test of a large resistance of 1.0822, from which I recommended opening short positions. Today, the bears need to protect the resistance of 1.0741, where the formation of a false breakout will be another signal to open short positions in the expectation of a decline to the lows of 1.0697 and 1.0653. A breakout of these supports will quickly push EUR/USD to new levels of 1.0607 and 1.0572, where I recommend taking profits. Weak reports on the state of the eurozone economy, which are expected today in the morning, will only worsen the euro's situation. In the scenario of the pair's growth above the 1.0741 resistance, it is best to return to short positions after a false breakout in the 1.0782 resistance area, or sell EUR/USD immediately to rebound from the highs of 1.0782 and 1.0827. The inability of the bulls to update the high of Friday last week will also be a signal to sell the euro on the current trend.

Signals of indicators:

Moving averages

Trading is carried out below 30 and 50 moving average, which saves the likelihood of a further downward trend in the pair.

Bollinger bands

Growth will be limited by the upper indicator level at 1.0782. In case the euro declines further, the lower boundary of the indicator in the 1.0645 area will provide support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20