The increasing likelihood of a sharp slowdown in economic activity due to the coronavirus pandemic forces the government to take extreme measures. As a result, last Friday, the Fed announced its readiness to purchase municipal debt obligations with a high rating, and the maturity of which is up to one year. This will not only help attract more money to the market, but also protect mutual funds.

Just last week, the Fed has launched swap lines with the central banks of Canada, Europe and Japan. The provision of dollar liquidity was made to be at zero interest rate, and will last for a period of 84 days. The frequency of dollar transactions with other foreign central banks was also increased.

However, despite all the measures, the US stock market still did not improve. Today, the futures in the S&P 500 index reached 2,180 points, maintaining their negative dynamics.

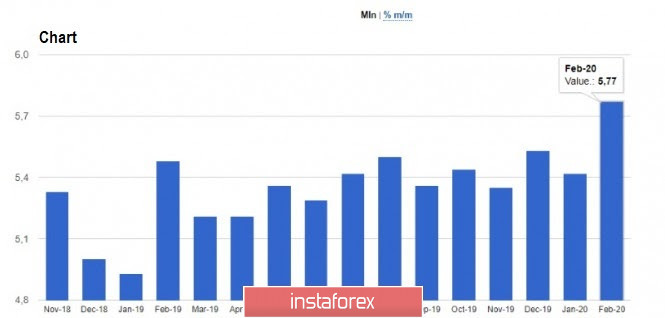

The sharp increase in home sales on the US secondary market also did not help the US dollar. According to the report of the National Association of Realtors, because of the low mortgage interest rates, the index increased by 6.5% in February 2020 and amounted to 5.77 million homes per year. Economists had expected it to increase by only 0.7%, amounting to 5.50 million homes a year.

The pressure on risk assets will continue to persist as long as there is no positive news on countering the spread of the coronavirus. Right now, the buyers of the euro are protecting this year's low, but it is not clear how much they will last. Most likely, a repeated decline to the support area of 1.0650 will lead to a breakdown and further sell-off of EUR/USD in the area of 1.0600 and 1.0530. But, in the case of an upward correction, the bears will act more actively from the resistances around 1.0780 and 1.0830.

GBP/USD

The pound's situation is quite complex. Although its current lows are very attractive for long-term purchases, it is very difficult to trade it because of the high volatility that the pair is demonstrating. Nevertheless, there are still supporters of long positions, and this includes the Bank of America, which believes that the British pound will recover against the dollar because of the reduced tensions in terms of dollar liquidity.

Analysts from UBS Wealth Management also believe that there are those who think that the pound is significantly undervalued against the dollar, and are just waiting for the currency's real recovery.

However, the seriously inflated UK budget deficit in 2020 due to the measures aimed at countering COVID-19, will continue to negatively affect the British pound. The sharp slowdown in GDP growth in the 1st half of the year also pushes those who want to bet on a medium-term recovery of the pair. It is expected that the budget deficit this year may grow from 2% of GDP to at least 8% or more, and the UK economy in the 2nd quarter may shrink immediately by 5%.

As for the technical picture of the GBP/USD pair, the activity of buyers from the level of 1.1540 allowed the formation of the lower border of the new corrective upwards channel. The goal of the bulls for the near future will be to break and consolidate above the range of 1.1800, which will open a direct road to the highs of 1.1930 and 1.2030. If the growth above the resistance of 1.1660 fails, the pressure on the pair, and another decline to the annual lows will surely lead to their breakdown and fall to the area of 1.14 and 1.13.

In any case, even if traders miss the formation of the bottom, which can be formed at the current annual lows, long positions will be available due to the terrible fundamental statistics that are waiting for us in the 2nd quarter of this year. However, given the current situation of the market, I would not rush to determine the bottom and search for the next lows, as it is better to follow the trend and sell on corrections.