Hello, traders!

At the auction on March 16-20, the US dollar strengthened against all major competitors. In particular, the main EUR/USD currency pair lost 3.96%.

The main topic that continues to excite global financial markets is COVID-19. The number of infected and dead from coronavirus is constantly growing. The epidemic has already reached almost two hundred countries, and the total number of infected people is close to 340,000.

In Europe, the worst situation is still in Italy, where 651 people died from COVID-19 over the past day. The situation is not much better in Spain, where the number of cases is close to 29,000.

As it became known last night, German Chancellor Angela Merkel went into quarantine. This decision was made after a doctor with whom Merkel had contact tested positive for the coronavirus.

As for the economic situation in the world, it is getting worse every day. Due to the closure of enterprises, more and more people are out of work, and, as experts predict, the situation with unemployment will only get worse.

Many world leaders, including US President Donald Trump, refer to everything that is happening as "war" and is ready to act according to the laws of wartime. The words "recession" and "crisis" are increasingly being heard. According to some reports, because of COVID-19, US companies may miss about four trillion dollars, and global losses are estimated at 12 trillion. However, this is still just speculation and forecasts, as no one actually knows.

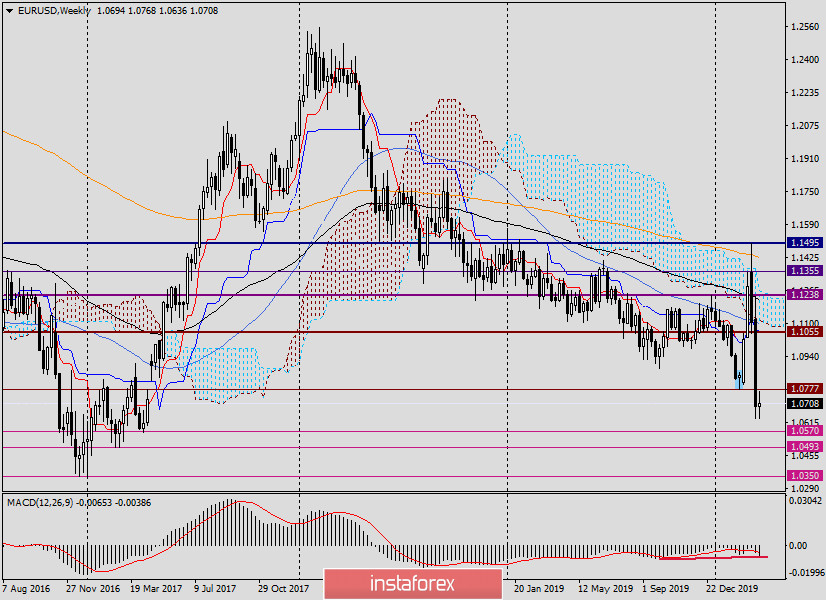

Well, let's go to the charts of the main currency pair of the Forex market, and start with the weekly timeframe.

Weekly

According to the results of the last five trading days, a huge bearish candle appeared on the weekly chart with a closing price of 1.0693. Thus, a very important support level of 1.0777 was broken. At the moment of writing, the euro/dollar is trading near another very significant mark of 1.0700. At the same time, after the opening of today's trading, the pair already gave a pullback to the area of 1.0770.

Judging by the weekly timeframe, if the downward trend continues, the next targets of the players to lower the rate will be 1.0570, 1.0493 and possibly 1.0350. If there is a true breakdown of the last mark, in my opinion, there is a high probability of a decline to parity.

The situation will be corrected by the appearance of a large white candle with a closing price above 1.0777, or even better, above the significant level of 1.0800.

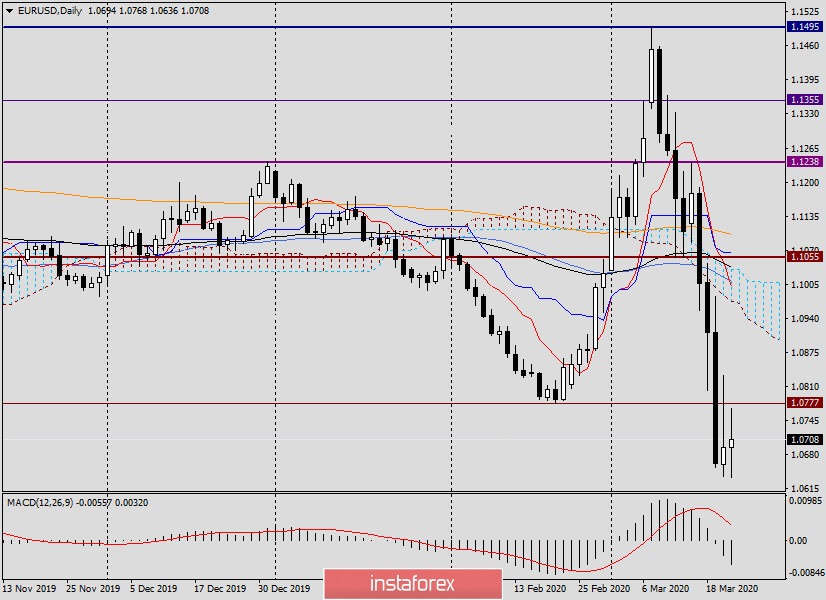

Daily

As you can see, on the last day of trading last week, the euro bulls made an attempt to turn the situation in their favor and return the quote above 1.0800. What came out of this is shown by the large upper shadow of the candle for March 20 and its small bullish body.

Most likely, we will still see attempts of the pair to return to the price zone of 1.0770-1.0800. It is difficult to imagine how successful they will be. Due to the COVID-19 epidemic, the market situation can change rapidly. From a technical point of view, a pullback to the selected zone should be considered for opening short positions on EUR/USD.

On the other hand, if a bullish candle appears with a closing price above 1.0831 (highs on March 20), there is a high probability of a deeper pullback to the area of 1.0930-1.0970. However, such a development now looks extremely unlikely. In the meantime, the nearest resistance zone where you can prepare for sales is 1.0770-1.0830.

Today's economic calendar is virtually empty. I believe that Monday's trading will be influenced by technical factors, as well as the impact on the market will have messages and (or) comments about the cursed coronavirus.

Have a nice day!