Economic calendar (Universal time)

The publication of important economic indicators is not expected today.

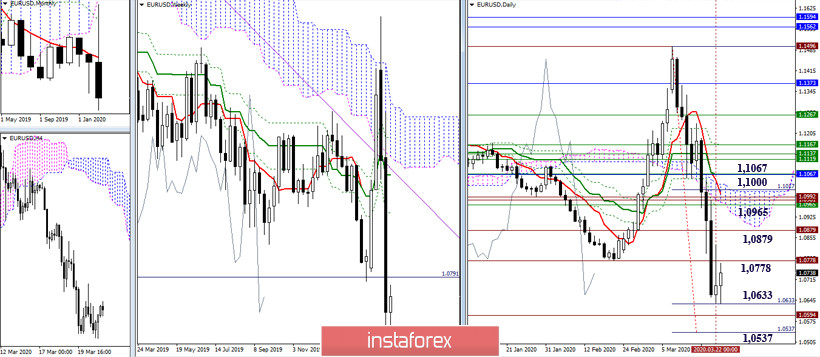

EUR / USD

Players on the increase last Friday failed to cast doubt on the bearish nature of the weekly candle, however, slowing down is indicated on the daily time. On the other hand, the support zone is now formed by bearish landmarks, headed by the target for the breakdown of the daily cloud (1.0633 - 1.0537). Reliable consolidation below will allow us to consider the prospects for a bearish closing of the month. Preservation of slowing down, and especially the formation of rebound from the met supports can help restore bullish positions. At the same time, the next long lower shadow in the direction of the monthly trend will undoubtedly be in the interest of players to increase. Now, the resistance can be the historical levels of 1.0778 and 1.0879, then there is a fairly wide accumulation zone of various levels, the lower limits of which at the moment can be designated at 1.0965 - 1.1000 - 1.1000 - 1.1067.

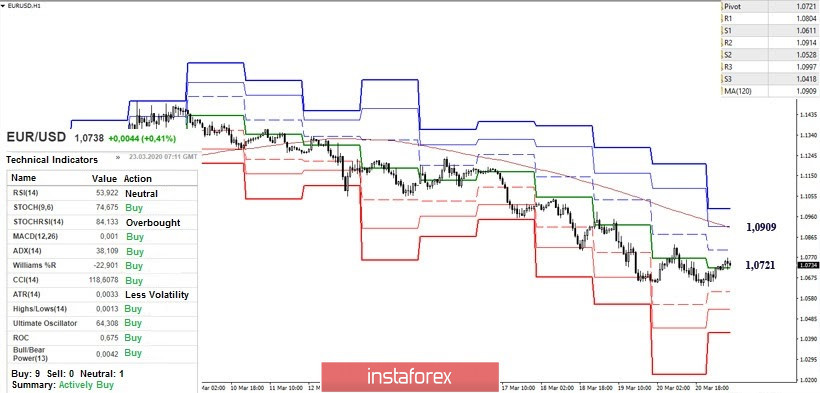

On the lower time frames, we observe how the players to increase strive to take hold of the central Pivot level once again, which is located at 1.0721 today. Fixing it higher and turning this level into support will allow the bulls to more confidently strengthen and restore their positions. The next important guideline in this direction is the weekly long-term trend (1.0909). Intermediate resistance can be identified today at 1.0804, the farthest resistance of the classic Pivot levels is at 1.0997. In the case of a restoration of the downward trend of support for the classic pivot levels, they will meet a pair at 1.0611 - 1.0528 - 1.0418.

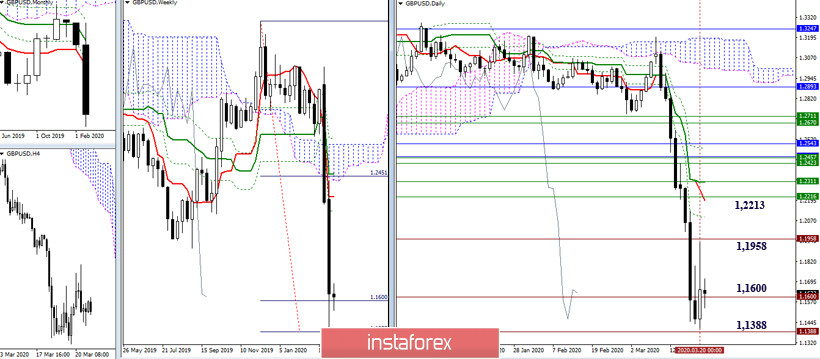

GBP / USD

The players to decline retained their potential at the close of last week, indicating only a slight slowdown over the supports of the weekly target for the breakdown of the cloud (1.1388 - 1.1600). Moreover, the breakdown of the weekly target and reliable fixing below will serve as the basis for choosing new bearish landmarks. The development of inhibition and the formation of rebound may cast doubt on the monthly advantage and prospects of the bears. The nearest resistance can now be identified in the area of 1.1958 (historical level) - 1.2094 (daily Fibo Kijun) - 1.2213 (daily Tenkan + weekly Fibo Kijun).

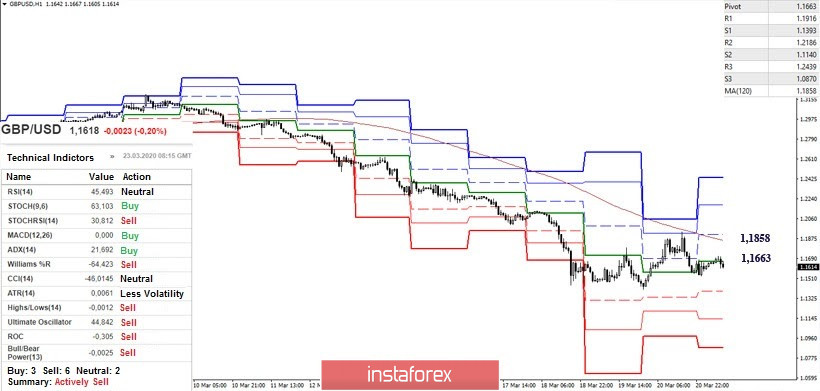

On Friday, the pair rose to the area of influence of the weekly long-term trend, but could not resist the resistance of the moving. At the moment, the location in the correctional zone is maintained, updating the minimum of the previous week (1.1411) will restore the downward trend, while 1.1393 (S1) - 1.1140 (S2) - 1.0870 (S3) will serve as support within the day. Meanwhile, reliable consolidation above the most significant resistance zone of the lower halves, formed by key levels - the central Pivot level (1.1663) and the weekly long-term trend (1.1858), will further strengthen the bullish sentiment and restore the players' positions to increase.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)