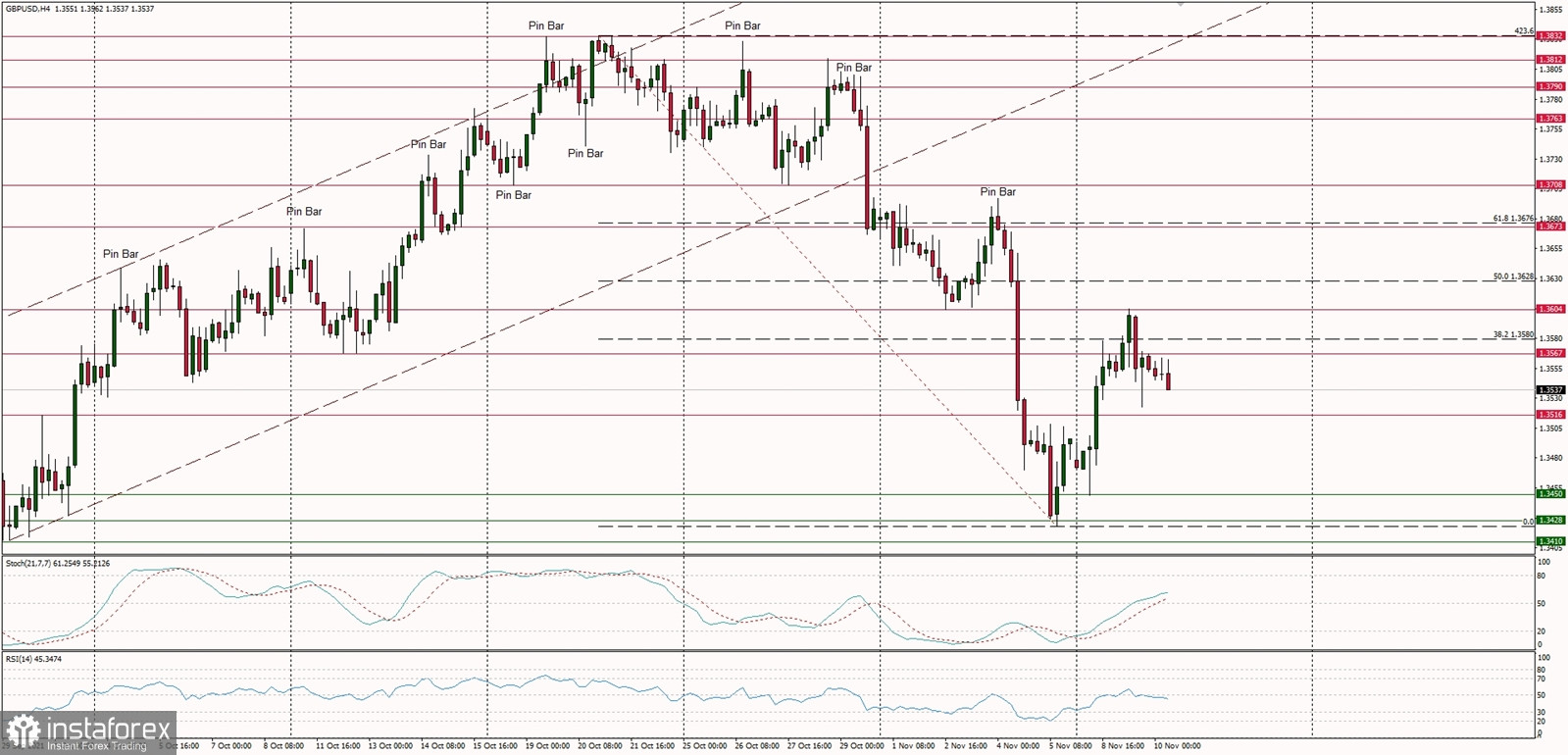

Technical Market Outlook

The GBP/USD pair has retrace more than 38% of the last wave down and the bulls hit the level of 1.3604, which is the nearest technical resistance. The next target for bulls is the 50% Fibonacci retracement located at the level of 1.3628, but it looks like the bounce from the level of 1.3428 had been completed. The larger time frame trend remains up, but the corrective cycle might be more complex in price and time. Please notice the market is bouncing form the extremely oversold conditions and weak momentum just broke back below the neutral level of fifty.

Weekly Pivot Points:

WR3 - 1.3894

WR2 - 1.3796

WR1 - 1.3617

Weekly Pivot - 1.3523

WS1 - 1.3346

WS2 - 1.3245

WS3 - 1.3078

Trading Outlook:

The up trend on a larger time frame charts is being continued, but only a sustained breakout above the level of 1.4000 would improve the outlook to more bullish with a target at 1.4200. 100 DMA is located at the level of 1.3792 and 200 DMA is seen at 1.3846.