4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - downward.

CCI: -74.8107

The British pound resumed its downward movement, however, we can say that below the level of Murray "-1/8"-1.1475, it can not gain a foothold. Unfortunately for the British currency, it is simply impossible to say otherwise, nothing is changing at this time in the world. The factors that operated at the time when the British currency collapsed by 1,500 points continue to operate now. Thus, for the time being, only technical factors keep the pound/dollar pair from further collapsing. First, it seems that there is a strong support level around 1.1500, which is also a psychological level. Secondly, one currency can not constantly get cheaper. We need at least corrections from time to time. In the situation with the pound, the correction has already taken place, but to call it strong, or at least tangible, the language does not turn. This was a formal correction.

On Tuesday, March 24, traders will finally be able to pay attention to macroeconomic statistics from the UK and the United States. These are just preliminary values of business activity indices in the services and manufacturing sectors. However, we believe that these publications will be the most important this week, as they will reflect the changes in the state of the economy of each country, which is waiting for us at the end of March. So, business activity in the UK manufacturing sector, according to experts, will decrease from 51.7 to 45.0, and in the service sector - from 53.2 to 44.0-45.0. In the United States, business activity in the manufacturing sector is likely to decrease from 50.7 to 42.0-42.8, and in the service sector - from 49.4 to 40.0-42.0. Thus, a serious drop in business activity is expected in both countries. However, first of all, there are even more significant ISM business activity indices in the States, and secondly, we need to look at the real values. There are concerns that even ultra-weak forecasts will not match the real values. Since this data will be available by March, traders can stop ignoring it. Tomorrow, at least, we will know whether market participants are paying attention to the statistics, or whether they do not matter now.

Meanwhile, the notorious and publicized package of financial assistance to the US economy did not pass through the Senate. Representatives of the Democratic Party refused to vote for this bill of Donald Trump, as they believe that workers should be supported, first of all, and not companies. During the voting process, there were not without quarrels and mutual insults between Democrats and Republicans, relations between which were especially strained after the long process of impeaching Trump. The vote to approve the package of financial assistance to companies and citizens of the United States has already failed twice in the Senate. At least 60 "yes" votes are required for the package to be accepted. Both times, the bill did not get even 50 votes. Recall that the package of financial assistance for 1 trillion dollars, which can also be expanded to 2 trillion, according to the plan of Donald Trump and Steven Mnuchin, should be aimed at helping airlines that are on the verge of bankruptcy due to the sagging more than 50% of the volume of air travel, to help ordinary citizens who can not work because of the pandemic, as well as in general to support the entire economy. The US Treasury Secretary himself has publicly stated several times that Congress must accept this proposal to maintain liquidity. These measures, according to Steven Mnuchin, will help preserve small businesses and protect employees from mass layoffs. "We are using the funds we have, but we need Congress to agree to provide additional funding today so that we can support American workers and the American economy," Mnuchin said.

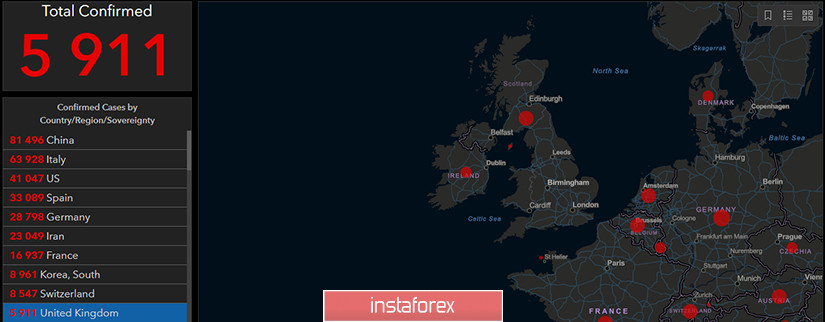

Meanwhile, the number of people infected with "coronavirus" in the UK exceeded the mark of 5,900 people. So far, this number is not significant. However, health experts warn Boris Johnson that if certain changes are not made to the current strategy to combat the "coronavirus", the number of victims could be from 35,000 to 70,000 Britons. According to experts, the COVID-2019 virus is an increased threat not only for people over 65 years of age but also for people with various cardiovascular diseases or chronic health problems. At the moment, the British population is urged to keep a distance of two meters and, if possible, self-isolate at home. However, these measures are not mandatory or compulsory. As a result, a large number of people were seen in parks in many cities in the United Kingdom this weekend. If the British government does not take measures to tighten the quarantine, more than a million people may become infected, and up to 70,000 people may die, according to doctors.

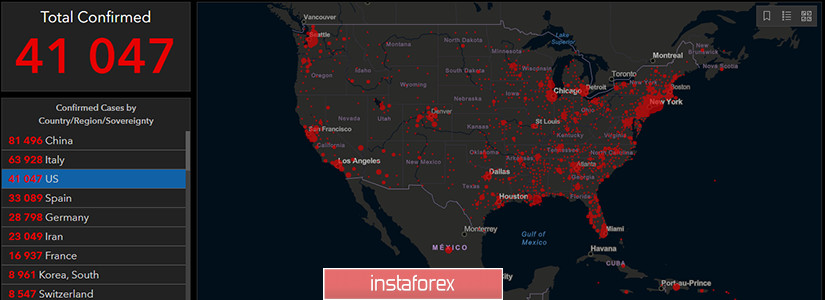

In the United States, the number of cases of the new "coronavirus" has doubled over the past two days. Now the total number of infected is 41,000. In three States, almost martial law was imposed with the patrolling of the army. Donald Trump also continues that the death rate from the COVID-2019 virus in America will not exceed 1%. It is not known where such calculations came from for the US President. However, this is not the first time that an odious leader is trying to make an optimistic forecast. In all cases, after just a few hours, representatives of the medical field shattered these forecasts, claiming that they were not wealthy. This time it's exactly the same. US chief surgeon Jerome Adams, for example, believes that "this week, things will get worse." He urges the country to prepare for a strong increase in the number of infected. According to Dr. Adams, the disease spreads very quickly due to the fact that many people, especially young people, do not take the threat of an epidemic seriously and do not adhere to quarantine rules.

From a technical point of view, the pound/dollar pair keeps the level of 1.1475 from falling further. If this level is overcome, the pound may go to conquer new lowlands.

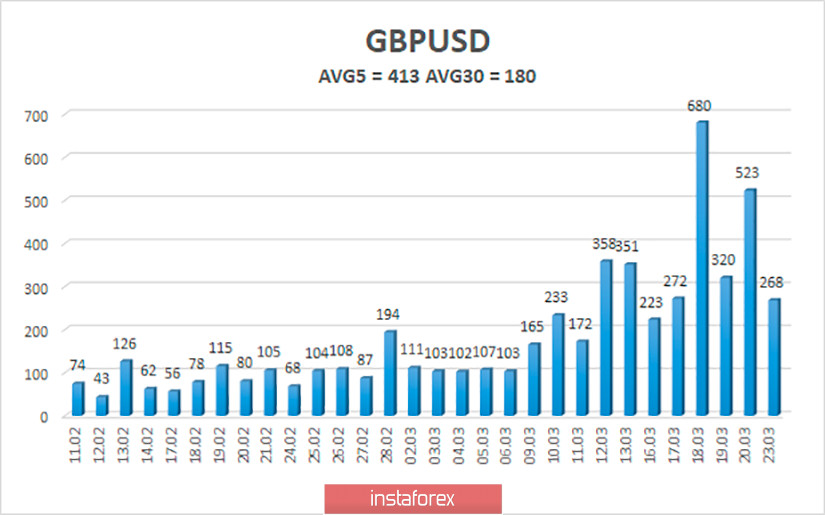

The average volatility of the pound/dollar pair over the past 5 days is already 413 points and continues to grow. On Tuesday, March 24, we expect the pair to move within the volatility channel of 1.1104-1.1930. This pair is likely to return to the lower border, but the level of 1.1475 still keeps the pound from falling again.

Nearest support levels:

S1 - 1.1475

S2 - 1.1230

Nearest resistance levels:

R1 - 1.1719

R2 - 1.1963

R3 - 1.2207

Trading recommendations:

The GBP/USD pair is trying to resume its downward movement. Thus, sales of the pound with the target of 1.1230 remain relevant, but it is recommended to open new sell positions, not before the price is fixed below the level of 1.1475. It is recommended to buy the British currency with the target of 1.2207, but not before fixing the price above the moving average, which is not expected again today (the price is too far from the moving average). We remind you that in the current conditions, opening any positions is associated with increased risks.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.