The attempt to push the $ 1.6 trillion package of emergency economic measures through the Senate has failed. It led to the further weakening of the US stock market yesterday, as well as its fall to another year's lows. The package of measures proposed by the White House aims to fight the consequences of the coronavirus pandemic, and mainly applies to large companies. However, yesterday, Democrats and Republicans could not agree on the amount of financial support. Nevertheless, Treasury Secretary Steven Mnuchin said that the negotiations are approaching a consensus, and all differences will be resolved soon.

Meanwhile, James Bullard, President of the Federal Reserve Bank of St. Louis, said that the unemployment rate in the US in the 2nd quarter of 2020 may reach 30%, due to the impact of the coronavirus. In addition, US GDP in the 2nd quarter of 2020 may also decrease by 50%.

Yesterday, the Federal Reserve announced a large-scale increase in support for the markets, introducing several new lending programs, as well as bond purchases. It will now buy Treasury bonds and mortgage-backed securities in unlimited amounts. It already has plans to purchase Treasury bonds worth $ 375 billion and mortgage-backed securities worth $ 250 billion this week. The Central Bank also said that it is ready to buy quasi-government securities.

With regards to lending, there are three new programs for consumers and business. The first one is the term loan program secured by asset-backed securities (TALF), while the other two will be aimed at supporting corporate lending markets. In total, these three programs provide for the allocation of $ 300 billion.

The Fed said that it will continue using the full range of measures to support the US economy, which is already facing serious difficulties. These new solutions will limit the loss of jobs, as well as limit the loss of incomes.

As a result, the dollar weakened slightly against the euro and the pound, as providing unlimited liquidity to support the corporate and municipal credit markets would inevitably reduce tensions over the shortage of the dollar and ease the economic damage of the coronavirus outbreak. If companies and banks around the world manage to replenish their reserves of dollars, its exchange rate may rebound slightly, allowing gold's price to increase, which is already observed in the commodity market.

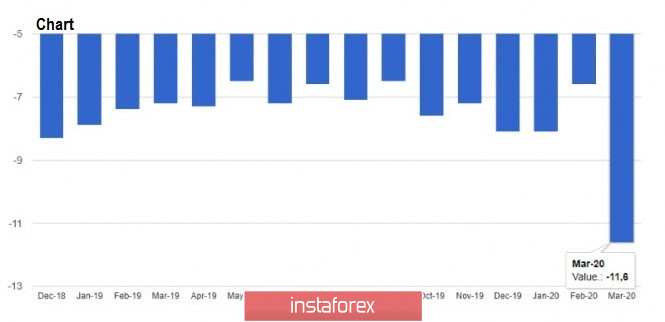

The data released yesterday on consumer confidence in the Euro zone did not have much impact on the markets, even though it was the largest drop recorded since November 2014. According to the European Commission, the preliminary index of consumer confidence in the Euro zone fell from -6.6 points in February to -11.6 points in March 2020. However, the real rate of economic decline will only be possible after the end of the pandemic and the curtailment of restrictive measures against activity in the region.

Today, a number of important reports on manufacturing activity in the Euro zone and the service sector will be released, including the composite purchasing managers' index (PMI) of the Euro zone for March this year. The index is expected to fall sharply to the level of 33 points, which actually coincides with the value from 2008-2009.

As for the technical picture of EUR/USD, the pair's bulls came close to the upper border of the side channel (1.0825). After yesterday's rebound downwards, the demand for risky assets remains. The lack of pressure on the euro, even after weak reports on activity in the Eurozone, is a clear signal that major players expect an upward correction to the area of highs at 1.0930 and 1.1040. However, if the pressure on risky assets returns, the break in the middle of the 1.0725 channel will certainly lead to a repeat test of the year's low at 1.0635, as well as to its breakdown, which will open a direct path to the levels of 1.0530 and 1.0425.

CAD

According to Statistics Canada, wholesale trade increased by 1.8% and amounted to 61.18 billion canadian dollars. However, it was ignored by traders, so the loonie remains to be under pressure. Moreover, the situation of oil still has not stabilised, and the price of black gold still has not hit the bottom.