To open long positions on GBPUSD, you need:

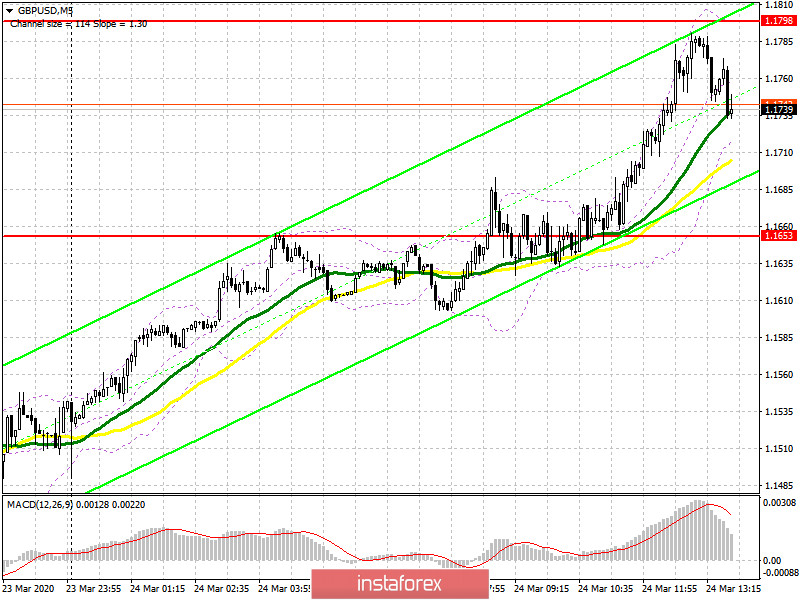

The growth of the pound in the first half of the day after fixing above the resistance of 1.1653, which can be seen on the 5-minute chart, and which I paid attention to in my morning forecast, led the pair to a maximum of 1.1798, where the bears again declared themselves. However, it is not necessary to talk about a further decline in the pound, since even the terrible data on the state of the service sector was ignored by the bears. If there is no activity on the part of sellers at the beginning of the North American session, a return to the level of 1.1798 may lead to a test and a breakdown of this range, which will open a direct path for the bulls to the highs of 1.1926 and 1.2023, where I recommend fixing the profits. In the scenario of a return of pressure on the pound, it is best to return to long positions on a false breakout from the middle of the side channel of 1.1653 or buy immediately on a rebound from the year's low of 1.1470.

To open short positions on GBPUSD, you need:

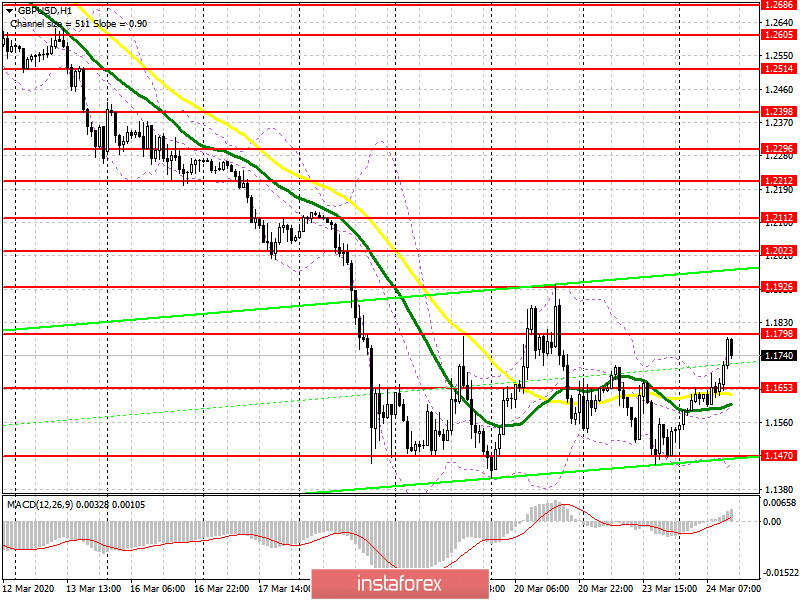

Bears need to focus on protecting the resistance of 1.1798, and the next formation of a false breakout from this range, similar to March 20, will increase pressure on the pair and lead to a decrease in the support area of 1.1653. However, it will be possible to speak more boldly about the resumption of the bearish trend only after the breakout of this range, which will lead to the demolition of a number of buyers' stop orders and a faster decline in GBP/USD to the area of the year's minimum of 1.1470, where I recommend fixing the profits. In the scenario of growth of the pair above the resistance of 1.1798, which will coincide with the breakdown of the top border of the current descending channel for short positions, it is best to go back to test a high of 1.1926 or sell immediately for a rebound from a larger resistance of 1.2023.

Signals of indicators:

Moving averages

Trading is conducted above the 30 and 50 daily averages, and while the market is on the side of buyers of the pound.

Bollinger Bands

The bears need to break below the average border of the indicator in the area of 1.1610, which will lead to a larger fall of the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20