Traders and analysts were prepared for this development, and, in fact, the disastrous data on the reduction of manufacturing activity in the eurozone, as well as the services sector, were completely ignored by the markets. The services sector, which was the first affected by the crisis, has suffered the most so far.

However, the US dollar continues to remain under pressure against the euro and the pound, after the Federal Reserve said yesterday that it is launching an unprecedented campaign to distribute funds and pump the economy with liquidity. In yesterday's statement, the committee said that the Fed will now buy Treasury bonds and mortgage-backed securities in unlimited amounts. Already this week, it is planned to purchase Treasury bonds for $375 billion, and the volume of purchases of mortgage-backed securities will amount to $250 billion.

However, the US dollar continues to remain under pressure against the euro and the pound, after the Federal Reserve said yesterday that it is launching an unprecedented campaign to distribute funds and pump the economy with liquidity. In yesterday's statement, the committee said that the Fed will now buy Treasury bonds and mortgage-backed securities in unlimited amounts. Already this week, it is planned to purchase Treasury bonds for $375 billion, and the volume of purchases of mortgage-backed securities will amount to $250 billion.

The spread of the coronavirus throughout the eurozone primarily led to a reduction in the activity of catering, tourism, and air transport businesses, as well as directly affected a number of other services provided to the population. Also, a sharp drop in the indices signals a decrease in GDP compared to the previous quarter. There is also a risk of continuing further decline in activity due to the likelihood of taking more stringent measures aimed at controlling the spread of the coronavirus. The production activity also declined due to a sharp increase in delivery times and a drop in inventory, which disrupts supply chains. Problems persist for both external orders and internal market orders. There is also a probability of a sharp decline in the labor market indices.

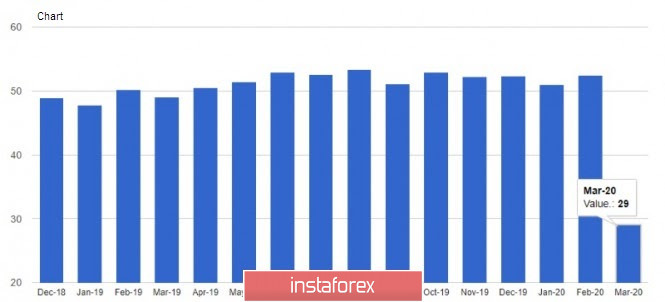

Now let's talk about numbers. According to the report, the preliminary purchasing managers' index (PMI) for the French manufacturing sector in March fell to 42.9 points against 49.7 points in February and the forecast for a decline to 40.4 points, which is not as bad as it seems. But the service sector was much less fortunate. Here, the preliminary index of France in March fell immediately to 29.0 points against 52.6 points in February, with a forecast of 42.5 points. France's composite purchasing managers' index (PMI) fell to 30.2 points in March.

Now for Germany. Here, the preliminary purchasing managers' index for the manufacturing sector also fell less significantly than expected, and amounted to 45.7 points against 48 points in February. But the service sector collapsed. There, the index fell to 34.5 points against 52.5 points in February, with a forecast decline to 43.0 points. The preliminary composite index of managers was 37.2 points.

As for the euro area as a whole, the indicators also declined significantly. The eurozone's preliminary manufacturing PMI for March fell to 44.8 points, while it was expected to fall to 40.0 points, which is quite good since the index was 49.2 points back in February. But the preliminary purchasing managers' index (PMI) for the eurozone services sector in March fell to a historic low of 28.4 points against 52.6 points in February, with a forecast decline to only 40.0 points.

Given that the eurozone's services sector was doing quite well even last year amid the worsening trade relations between the US and the world, it is likely that after the coronavirus pandemic ends, it will recover quite quickly, which cannot be said for the manufacturing sector.

The preliminary composite index of supply managers in the eurozone in March fell to 31.4 points against 51.6 points in March and forecast a decline to 40.0 points.

As for the current technical picture of EURUSD, so far the bears are actively protecting the resistance of 1.0890, which may lead to a return of pressure on risky assets and a repeat test of the support of 1.0815, which was formed during the European session. A break in this area will cancel out the efforts of the bulls and return the trading instrument to a minimum of 1.0725. A break in the resistance of 1.0890 will open a direct path to the local highs of 1.0930 and 1.0980.

GBPUSD

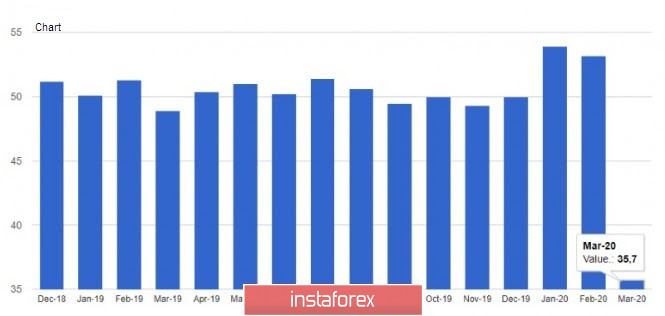

The British pound also ignored a weak report on the sharp decline in the service sector, which brings more than 75% of the economy. According to the data, the UK's preliminary composite purchasing managers' index (PMI) fell to a historic low of 37.1 points in March from 53 points in February. The statistics Agency IHS Markit/CIPS noted that the PMI for the services sector fell to 35.7 points from 53.2 points in February. The manufacturing index fell only to 48 points from 51.7 points in February. A sharp decline in the index indicates a high probability of a quarterly decline in GDP to 2.0%.

The lack of market reaction is due to the fact that the current indicators are only preliminary, but what the final data will be, not to mention the results for the 2nd quarter of this year, remains to be guessed. Most likely, when it is more or less clear how much the economy has declined due to the spread of the coronavirus, the data will be even darker.

As for the technical picture of the GBPUSD pair, the small growth of the pound is still limited by the resistance of 1.1800, an unsuccessful breakout of which may return new sellers to the market, which will increase pressure on the trading instrument and lead to its return to the area of the year's lows.