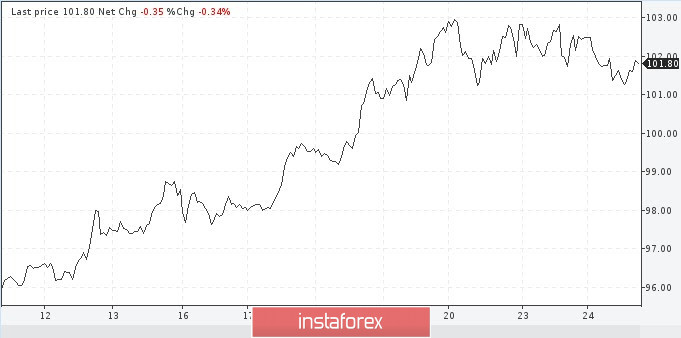

The dollar index came under pressure after the measures announced by the Fed. This included a large-scale flow of liquidity to the markets. The greenback fell from record highs against a basket of major currencies, losing up to 1.5% and preparing to end the day with the strongest intraday fall in the past three weeks. The US currency managed to reduce the decline by Tuesday evening, and the assumption that the dollar's strength will remain with it, began to take real shape.

The world needs defensive assets, and the US currency is doing an excellent job of this function, despite significant uncertainties in the American economy and the increase in the number of coronavirus diseases in this country. The United States came in third place in the number of cases. As of March 23, the number of infected people increased from 33.3 thousand to 43.8. At the moment, according to John Hopkins University, it has reached 46,450, of which 593 people have died.

The epidemic continues to rage in Italy, where 63,927 people are sick, while the number of deaths per day increased by 602, to 6,077 people. Meanwhile, the number of people who have recovered is 7,432. The only positive thing in the country is that the number of fatalities has decreased for the second day in a row.

Why will the dollar rise?

Many currency strategists are confident that the US currency will still prove itself. They call the current pullback from the 103 mark a normal profit taking, but there is no question of an upward trend reversal here.

Global financial markets are facing a serious problem – there are not enough dollars to make transactions. This explains why the trade-weighted dollar index gained more than 4% last week. The broad dollar index measures the value against a basket of currencies, i.e. the euro, pound, yen, C anadian dollar, Swiss franc, and Swedish Krona.

The Federal Reserve, given the shortage of dollars, announced the creation of financing channels with nine other central banks, including the RBA and the Monetary Authority of Singapore. There was access to additional dollar funds with an obligation to maintain an agreement for at least six months.

Nevertheless, it is unlikely that it will be possible to contain the fear of investors who are saving up dollars. They do not believe that these measures will be enough.

Representatives of ANZ Bank, analyzing the situation, said the following: the dollar will grow to the 105 level against a basket of six competitors in the short term. It was last seen at this level in late 2002.

"Swap lines will help to some extent. However, this is unlikely to be enough, given the volume of demand for dollars. From a technical point of view, the dollar looks overbought, so we can expect some consolidation. Nevertheless, this is probably just a pause before another increase," CIBC strategists write, acknowledging in part that the additional stimulus announced on Monday affected the dollar's rally.

"We are likely to see the consolidation of the dollar for a while, but the key will be how other major central banks will react," the experts added.

It is also worth noting that the actions of the Fed officials can be a good help for the unrelenting demand for the dollar. The purpose of these operations is to convince markets that any number of dollars will be readily available. This should help financial companies lend more confidently to each other.

Before the markets see the bottom for risk reduction and a turn in the dollar exchange rate, it will be necessary to fix the peak of new indicators of coronavirus infection and the beginning of the decline.