The likelihood of approving the $ 2 trillion US aid package, which supports the US stock market, has increased substantially. Today, it became known that the Trump administration and the representatives of the Democratic Party in the Senate has reached an agreement on the bill, so Senators Mitch McConell and Chuck Schumer will soon announce it. Thus, about $ 2 trillion of assistance will be provided to businesses, companies and households, which will allow for a more calm transfer of the crisis that has already begun due to the spread of the coronavirus pandemic.

Despite the fact that the US dollar now remains under pressure and has slightly lost ground against risky assets, it is still very early to talk about a change in the trend, as it is still unclear how COVID-19 will eventually affect the economy. Thus, in the coming months, the demand for the dollar, which is considered a safe haven currency, will continue, as the situation will only change after the coronavirus pandemic is brought under control.

Anyhow, the data on the US economy that was released yesterday confirms the impending problems that the authorities will face in the near future. According to the preliminary data, activity in the US manufacturing and services sectors fell sharply in March this year, due to the spread of the coronavirus. Many experts already believe that the country is in a recession.

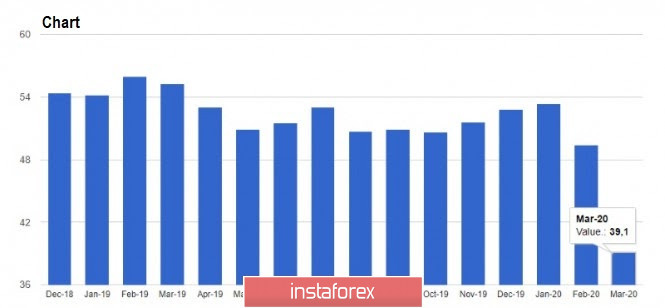

According to the IHS Markit, the preliminary composite purchasing managers' index (PMI) fell from 49.6 points in February to 40.5 points in March 2020. As for the service sector, the PMI fell from 49.4 points in February, to 39.1 points in March this year. Economists had expected the index to reach 42 points in March. Food service, hotels, and airline businesses were particularly affected.

The manufacturing index, on the other hand, declined from 50.7 points in February, to 49.2 points in March. Economists had expected a more significant decline of 42.5 points.

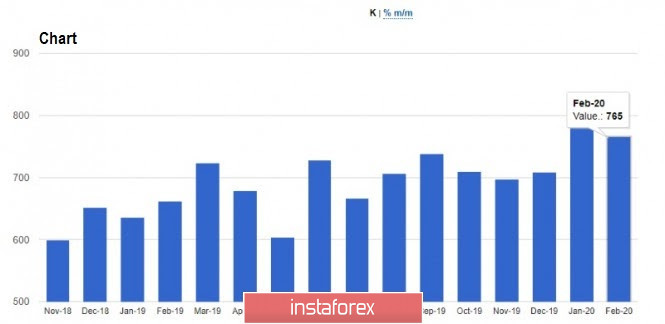

Sales of single-family homes in the United States also decreased by 4.4% in February 2020, and determined to 765,000 per year. The average price of a new home was $ 345,900.

Another report from the Redbook indicates that retail sales in the United States increased by 1.7% in the first three weeks of March as compared to February, and increased by 7.9% as compared to 2019. For the week of March 15-21, sales jumped immediately by 9.1% per annum. All this confirms the nervousness of the citizens regarding the coronavirus. The report from the Retail Economist and Goldman Sachs also indicate a 2.8% increase in the US retail sales index for the week of March 15-21.

The manufacturing activity in the area of responsibility of the Federal Reserve Bank of Richmond also increased slightly in March this year, due to a surge in deliveries and new orders. It came out as 2 points, against its -2 points last February.

As for the technical picture of EUR / USD, the pair remained unchanged, after an unsuccessful attempt to break above the resistance of 1.0890. To continue the upward correction, buyers of risky assets need to try very hard not to allow a breakout in the area of 1.0780, since its breakdown will lead to a reversal of the trend and the return of large sellers of risky assets to the market. The bulls also need to update the highs of yesterday in the area of 1.0930, since without it, the demand for the pair may slow down sharply. The bears, on the other hand, will try to break through the lower border of the upwards channel, and attempt to consolidate under the support of 1.0725, which will lead to another major sell-off of the euro, and a test of the lows of the year.