Economic calendar (Universal time)

In today's economic calendar, we can single out the publication of the following data:

9:00 German business climate index;

12:30 basic orders for durable goods in the United States;

14:30 stocks of crude oil (USA).

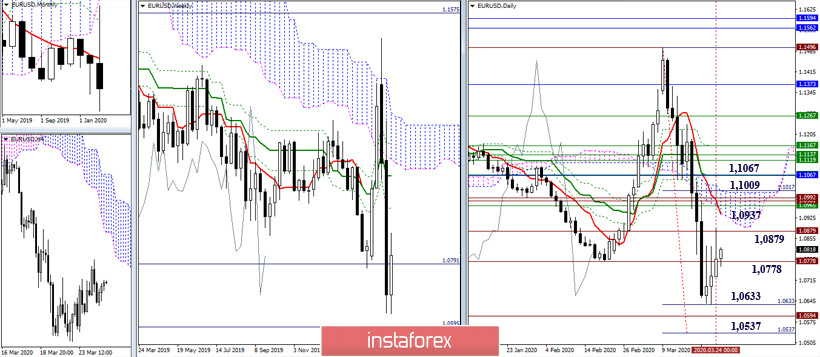

EUR / USD

The players to increase are striving for the development of an upward correction, thanks to which they tested the resistance of the historical level of 1.0879 yesterday. At the moment, the resistance of the daily Ichimoku cloud is located a little higher, which currently unites several important levels at once. As a result, the most significant resistance zone today can be identified as the area 1.0937 - 1.1009 (daily Tenkan + weekly Fibo Kijun + daily Senkou Span B). An attraction in the current situation is provided by the level of 1.0778 (the minimum extremum, which allows to fully restore the monthly downward trend). The role of support and the nearest bearish landmarks is retained by the target for the breakdown of the daily cloud (1.0633 - 1.0537).

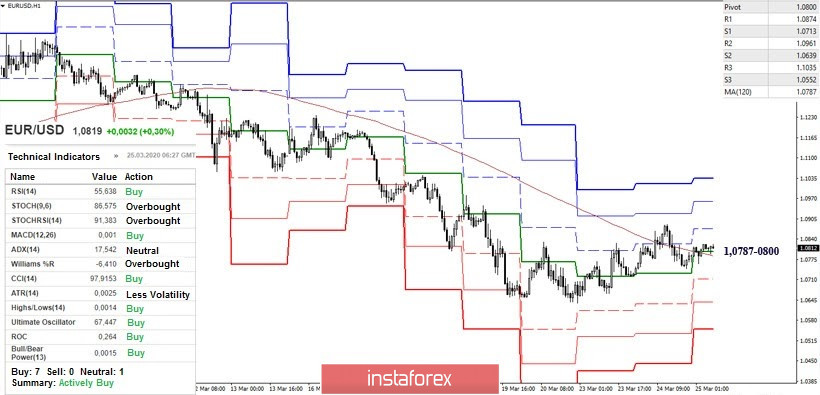

On H1, we observe testing of key levels, which are combined today in the area of 1.0787 - 1.0800 (central Pivot level + weekly long-term trend). Now, to continue the rise, it is important to update yesterday's maximum (1.0888), after which the interests of players to increase within the day will be directed to testing R2 (1.0961) and R3 (1.1035). Moreover, since the duration and slowness of the developing upward movement indicates the weakness of the players to increase, under the current circumstances, the opponent has good prerequisites for completing the corrective rise and restoring the downward trend (1.0636 minimum extremum). Among the downward trends within the day, one can also note the support of the classic Pivot levels (1.0713 - 1.0639 - 1.0552). Meanwhile, the downward trend recovery is a bearish scenario.

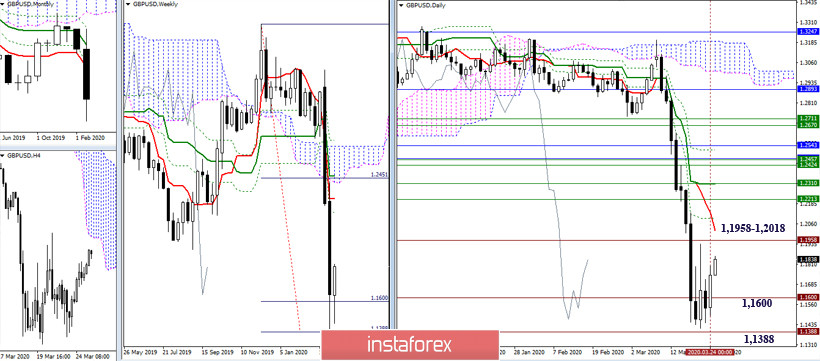

GBP / USD

At the moment, we are observing how the players to increase are trying to translate the indicated inhibition into effective upward correction. A daily Tenkan hurries to help the bulls, actively reducing the distance to the price chart. Thanks to the daily short-term trend, important resistance can be identified today in the region of 1.1958 - 1.2018. The role of supports remains behind the levels of the weekly target for the breakdown of the cloud (1.1600 - 1.1388).

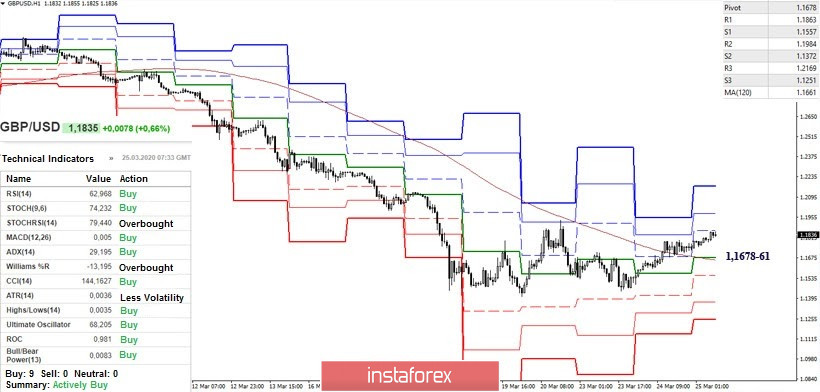

Another attempt to develop an upward correction led to the conquest of key levels at H1. In the current situation, there is a bullish advantage on H1. Today, among the interests of players to increase, we can identify the maximum extremum of the current correction zone (1.1934) and the final resistance of the classic Pivot levels of the current day R3 (1.2169). The key levels of the lower halves are united today in the most significant support area at 1.1678-61 (central Pivot level + weekly long-term trend). Further, the minimum extreme of the downward trend (1.1411) and the support of the classic Pivot levels 1.1372 (S2) - 1.1251 (S3) play an important role.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)