Hello, dear colleagues!

The number of deaths from COVID-19 over the last day in Italy has increased again and reached 743 people. In France, at the moment, there are more than 16,000 people who have contracted the coronavirus. There is a state of emergency in the country, which was approved by the French Senate last Sunday.

Germany has also been exposed to the COVID-19 epidemic. About 25,000 people have been infected in the country, and 93 fatal cases have been registered. In the EU countries, measures to counteract the pandemic are being tightened, but they do not have a significant effect.

People are still not recommended to leave the house unless absolutely necessary. Also, in some countries, it is forbidden to gather more than two people.

Meanwhile, the Federal Reserve System (FRS) has promised to undertake unlimited bond purchases in order to support its own economy. However, this message did not support the US currency, which suffered losses on a wide range of the market at the auction on March 24.

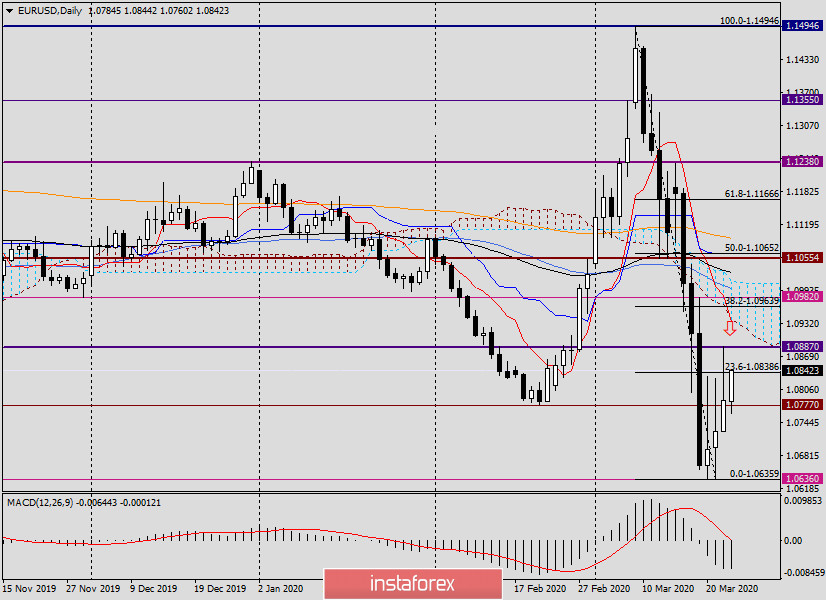

Daily

In particular, the euro/dollar currency pair managed to strengthen yesterday. However, the formed candle with a long upper shadow leaves questions about the further ability of the quote to move in the north direction.

The continuation of the upward dynamics will be possible if the resistance breaks 1.0887 (yesterday's highs) and the session closes above this level. With this development, EUR/USD will head to a strong technical area near 1.0935, where the Tenkan line and the lower border of the Ichimoku indicator cloud pass. At the moment, opening short positions on the euro/dollar in this area looks technically justified. Although more information will be received after the formation of today's daily candle. If it turns out to have a long upper shadow and a small white body, this will indicate the weakness of the bulls in the euro and call into question their ability to further move the quote up.

If a bearish candle appears with a closing price below 1.0777, it will be assumed that the pair has completed a corrective pullback and is ready to continue its downward dynamics.

In my opinion, the market mood has changed, and now it is not on the side of the US currency. If so, the euro/dollar has every chance to continue rising, which will confirm the true breakdown of the sellers' resistance at 1.0887.

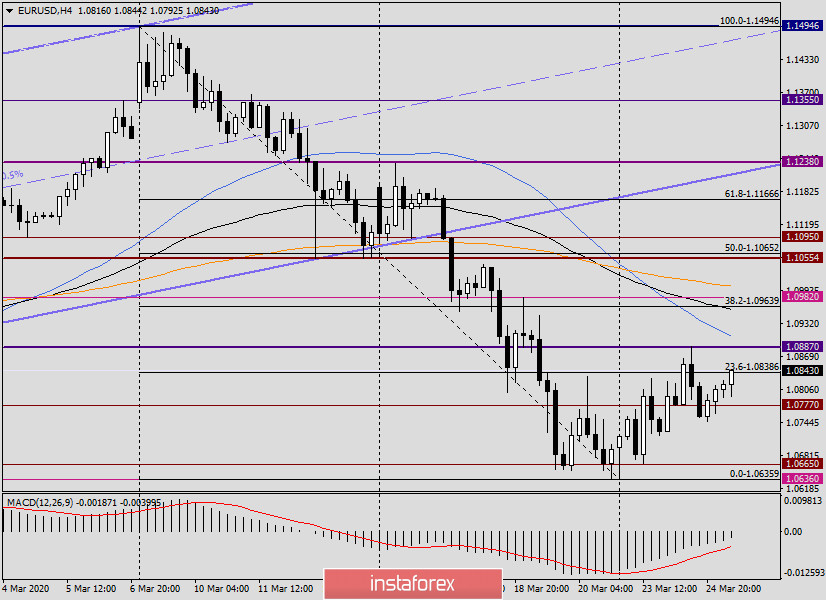

H4

The situation on this chart also indicates the importance of the moment relative to the breakdown of the resistance of 1.0887. The situation for the euro bulls is complicated by the simple moving average that is slightly above this level of 50, which can provide serious resistance.

But the passage of 50 MA up will not remove all questions about the further ability of the pair to move up. It is worth noting that near 1.0960 passes 89 exponential moving average, and 200 exponential settled at 1.1003.

Taking into account all the indicated technical factors, as well as the most important psychological and technical level of 1.1000, I consider sales from the area of 1.0935-1.1000 to be the main trading idea for the EUR/USD currency pair. A confirmation signal for opening short positions will be the appearance of bearish reversal patterns of Japanese candles in the selected zone on four hourly and (or) hourly charts.

Now about the events that are scheduled today in the economic calendar.

From Germany, the IFO expectations and business climate index are expected to be published. The United States will publish data on orders for durable goods. All details are in the economic calendar.

Successful trading!