Unlike oil, which is sensitive to the dynamics of supply and demand, paper gold is separated from the physical asset. The main drivers of changes in XAU/USD quotes are the situation on the currency and securities markets. A strong dollar, high US Treasury bond yields, and the S&P 500 rally create an unfavorable environment for the precious metal. And vice versa. However, the situation during global crises is seriously changing: gold can fall along with the world stock indices and grow against the background of a strong dollar. Today is a unique time in general: the paper market has followed the lead of the physical asset market.

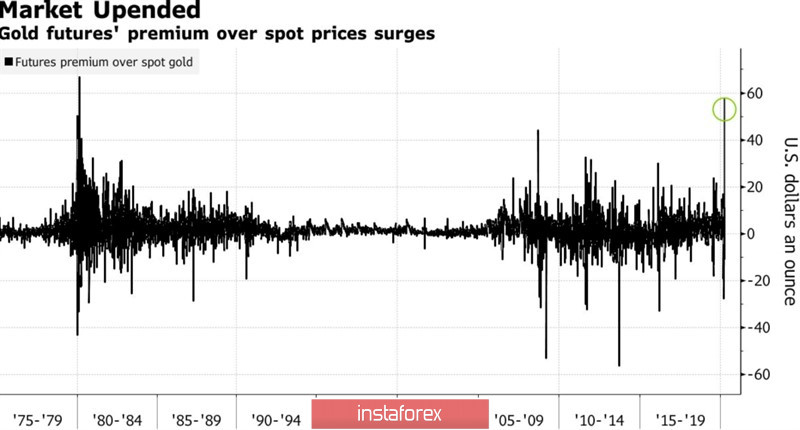

Traders with experience are in shock: even wars and natural disasters did not stop the extraction of precious metals. The coronavirus changed the rules of the game. The closure of businesses for some time severed the link between the spot and the gold futures market. Spreads soared to an unprecedented $60 per ounce, which was the catalyst for the XAU/USD rally.

Dynamics of price spreads of the futures and spot gold markets

Any trader needs strong nerves. For traders who work with gold, they must be iron. It would seem that the collapse of the S&P 500, the associated deterioration in global risk appetite and uncertainty about the impact of the pandemic on the global economy, create a favorable environment for the precious metal. However, it managed to collapse 12% from its peak of $1,700 an ounce in early March amid increased demand for the liquidity needed by investors to maintain positions in the securities market. Speculative net longs for gold at the end of the week to March 17 fell to a 9-month bottom, and it seemed that the market will continue to be dominated by "bears"...

With the help of unlimited purchases of treasury and mortgage bonds, the Fed seems to be able to solve liquidity problems and prevent a default crisis. At the same time, Goldman Sachs' optimistic forecast for gold at $1,800 per ounce for 12 months inspired buyers to new attacks. The bank calls the precious metal the currency of last resort. If central banks issuing global monetary units are actively using aggressive monetary expansion, there is nothing left for the XAU / USD quotes to grow. A strong argument proved by the simultaneous rally of gold and US stock indices.

The disruption of Intermarket relations is rare, and aptly. In 2008, the precious metal lost about 20% of its value against the background of a rapid fall in the US stock indices, but then found the strength to restore the lost positions and continue the rally towards a new historical high of more than $1,900 per ounce in 2011. As noted earlier, history repeats itself. The current global economic crisis seems more serious than 12 years ago, the need for safe-haven assets is great, so the forecast of Goldman Sachs looks quite adequate.

Technically, the rapid return of gold quotes to the trend line of the surge stage of the "surge and reversal with acceleration" pattern indicates a "bullish" market situation. To continue the northern campaign, buyers need to break resistance at $1645 and $1670 per ounce.

Gold, the daily chart