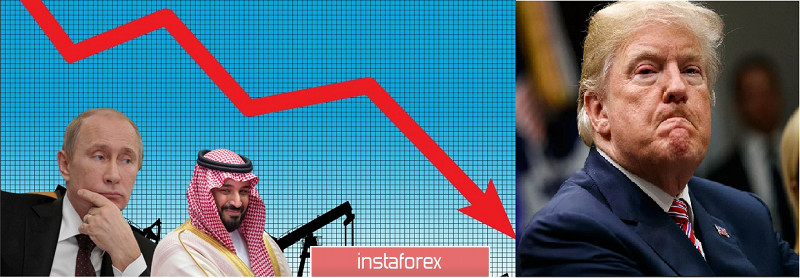

US is trying to weaken the rivalry between Russia and Saudi Arabia.

On Wednesday, the US tried to intervene in the strained relations between Russia and Saudi Arabia, as US Secretary Mike Pompeo called Prince Mohammed bin Salman of Saudi Arabia before the G-20 meeting.

Pompeo stressed that Saudi Arabia, as it is an important energy leader, can calm the energy markets during the most important period when the world is facing serious economic uncertainty. Unfortunately, the drop in oil demand continues to increase, as flights are canceled around the world, and employees are encouraged to work from home to prevent the spread of the coronavirus.

Meanwhile, independent oil company Occidental Petroleum (OXY) said that it would cut costs by another $ 600 million, and reduce wages significantly. CEO Vicki Hollub is cutting her salary by 81%.

The outlook of jobs in the oil sector is bleak due to the drop in oil demand. 1 million jobs is estimated to be lost this year. In North American shale operations, the worst of the cuts is expected to be around 32%, while offshore jobs will fall by about 19%.

"Low oil prices are likely to persist in 2021, and could lead to a further reduction in the workforce," Audun Martinsen, head of oilfield research at Rystad (Norway), said in a report.

At the same time, on Tuesday, Chevron (CVX) announced that it will cut capital spending by 20%, or $ 4 billion in 2020, where $ 2 billion from it will be spent on unconventional mining, mainly in the Permian basin. It will also suspend share buybacks, but keep its dividend, which was increased to $ 1.29 last January.

"Our dividends are our number one priority and they are very safe," CEO Mike Wirth said on Tuesday. "We are taking measures to save money. This will have some impact on production in the short term, but we have maintained our financial priorities, including the protection of our dividends."

Also on Tuesday, leading oilfield services provider Schlumberger (SLB) announced a 30% reduction in spending in 2020, and estimated that the number of operating rigs could fall to 2016 levels. Its rival, Halliburton (HAL), also announced a significant cut to its $ 1.2 billion budget, and warned of the layoff of 3,500 workers within two months. Exxon Mobil (XOM), on the other hand, informed its contractors and suppliers of short-term reductions in capital and operating expenses, even though earlier this month, it still has plans to increase capital spending from $ 33 billion to $ 35 billion a year through 2025, which is the lower end of the previously announced range. However, with the growing coronavirus pandemic, they had to abandon their plans.

On Monday, Total (TOT) said that it would also cut its capital spending in 2020 by 20%, or more than $ 3 billion, and is suspending its $ 2 billion buyback program, after buying $ 550 million worth of shares this year.

Earlier, BP (BP) chief financial officer Brian Gilvary said that the company could cut its capital spending by about 20% this year, and some of the cuts are likely to take place in US shale fields.

On Wednesday, oil prices rose slightly in connection with these events.