As a rule, Forex paradoxes are not of a long-playing nature, however, the fact that the Fed with the help of unlimited QE and a sharp decrease in the federal funds rate has changed the rules of the game can seriously affect the USD / JPY pair. Over the years, she has been sensitive to the dynamics of the American stock market: the S&P 500 rally was perceived as an improvement in global risk appetite and contributed to the purchase of the dollar against the yen and vice versa. Alas, at the present time, a high correlation of US stock indices and the analyzed pair is given up. The yen behaves inappropriately, and no one knows how long this will last.

Reducing borrowing costs to almost zero, the Fed allowed the dollar to take away the status of the main asset-refuge from the yen, which in the face of panic provoked by the coronavirus in the financial markets led to a sharp increase in the USD index. The $ 2 trillion fiscal stimulus from the White House and the Fed's intention to buy as many treasury and mortgage bonds as needed turned everything upside down. The Fed's balance sheet began to grow by leaps and bounds and for the first time in history exceeded $ 5 trillion, and investor interest in the American currency faded sharply. As a result, the week of March 27 was the worst for her in a decade.

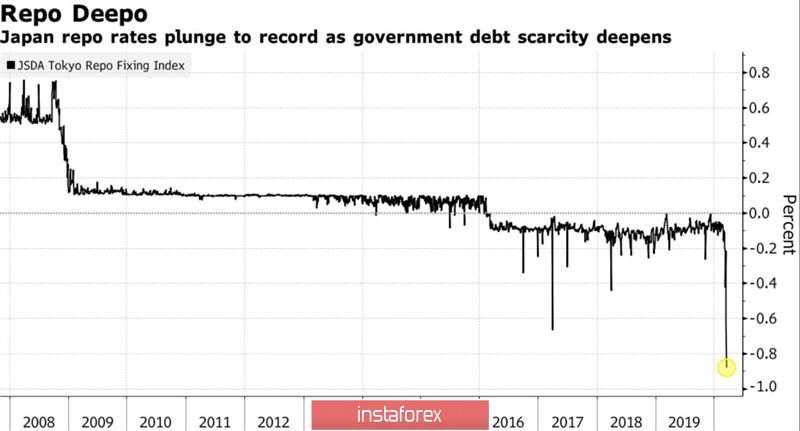

Of course, the desire of investors to get away with the recently at the zenith of fame dollar is the main reason for the drop in USD / JPY quotes. However, there are other "bearish" drivers. The Bank of Japan is not able to follow in the footsteps of the Fed and buy up as many debt obligations as it wants. The reason for this is the high demand for local bonds. Rates on repo transactions with their use fell to -0.88%, which means that the buyer, the owner of cash, must pay for the transaction.

Dynamics of repo rates on the Japanese bond market

Japanese bonds are actively used by American dealers as collateral, so the high demand for them in the absence of a lack of liquidity is understandable. As a rule, when the monetary stimulus of one Central Bank is unlimited, and the second, on the contrary, has its limits, the currency of the latter grows in value. This is exactly the situation we are seeing in the pair USD / JPY.

Interest in the yen is fueled by a busy economic calendar for the United States. In the week of April 3, data will be released on business activity in the manufacturing and non-manufacturing sectors from ISM, on employment in the private sector from ADP, on applications for unemployment benefits, as well as a report on the US labor market for March. Initially, experts issued pessimistic forecasts about a decrease in non-farm payrolls by 200 thousand and an increase in unemployment to 4%, but then the estimates were slightly improved, since the report would not take into account the full month. Most likely, a reduction in employment by 60-100 thousand will not force the S&P 500 to fall, and USD / JPY to grow. In this regard, the increase in the quotes of the pair with the subsequent rebound from the resistance by 108.8 and 109.25 makes sense to use for sales.

Technically, the pair is still squeezed in the trading range 105-114 within the current "Splash and Shelf" pattern, which is not expected to be exited in the short term.

USD / JPY weekly chart